- Several AI tokens lead the crypto market with heavy gains following a 60% rise in $FET.

- Nvidia's earnings are considered an indicator of the global health of the Artificial Intelligence sector.

- Analysts expect a Q2 revenue of $28.7 billion and earnings per share of $0.65.

Several AI tokens, including $FET, $RENDER and $NEAR Protocol ($NEAR), have posted huge gains as the market anticipates Nvidia's (NVDA) Q2 earnings on August 28.

These AI tokens have potential for further rise if Nvidia posts positive earnings

Artificial intelligence (AI) tokens were among the largest gainers in the crypto market in the past week following anticipation of Nvidia's Q2 earnings on Wednesday.

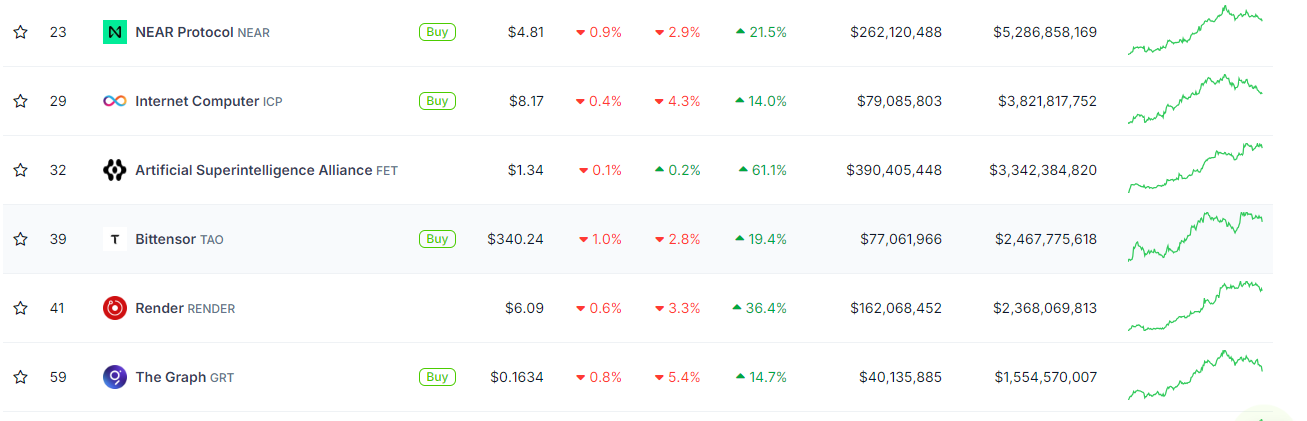

In the 7-day time frame, Artificial Superintelligence Alliance ($FET) leads the sector with gains of over 61%. $RENDER is just a little behind, posting an increase of 36%.

$NEAR Protocol ($NEAR), Internet Computer (ICP), Bittensor (TAO), The Graph (GRT) and Akash Network (AKT) also saw notable gains, rising 21%, 14%, 19%, 14% and 26%, respectively.

Top AI tokens

While most of these tokens currently trade in the red, their outlook could change in the coming days if Nvidia's Q2 earnings come out positive. However, they could flip bearish if the Q2 earnings underperform expectations, as short-term holders may decide to book profits. Historically, AI tokens have often rallied whenever NVDA posted significant gains or provided positive updates.

Following the company's rise to trillion-dollar status since AI went mainstream, many investors see its financial performance as an indicator of the global AI industry's health, including crypto AI tokens. Market analysts predict that Nvidia will report Q2 revenue of approximately $28.7 billion — a year-on-year (YoY) increase of 112% — and adjusted earnings per share (EPS) of about $0.65 — reflecting a 139% YoY growth.

If the earnings come as or higher than expected and history repeats, investors can expect a rally in AI tokens after the Q2 report on Wednesday.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

fxstreet.com

fxstreet.com