Cardano’s (ADA) price is failing in its attempts to note recovery largely due to the broader market cues.

This is because ADA investors are demanding a price rise, saving the altcoin from selling.

Cardano Investors Saved From Bearish Pressure

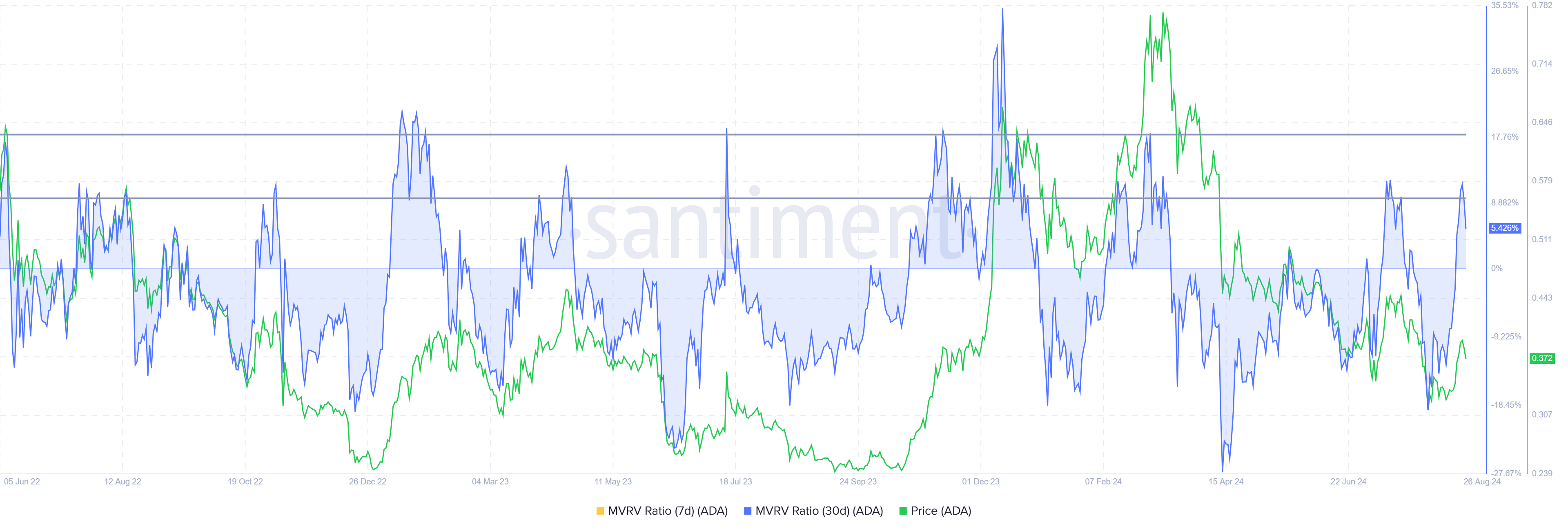

Cardano’s price has declined over the last 24 hours after failing to breach the resistance at $0.40. The reason behind this is slight selling observed after the third-generation crypto asset entered the danger zone of the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, Cardano’s 30-day MVRV stands at 5.4%, but 48 hours ago, it was at 11.4%, indicating profitability and possible selling pressure.

Historically, ADA tends to correct when the MVRV is between 8% and 18%, often called the danger zone. The same thing happened two days ago, which led to a correction in Cardano’s price.

However, the altcoin deflected heavy selling pressure thanks to positive investor demand. Cardano’s positive funding rate indicates investors are warranting a price increase. This metric reflects traders’ willingness to pay a premium in the derivatives market.

Since the long contracts are dominating the short contracts, it signals optimism regarding the cryptocurrency’s future performance.

ADA Price Prediction: Drop and Bounce Back

Cardano’s price has been following the same pattern since late February. This macro downtrend leads to ADA noting a decline followed by a sharp recovery and then observing a decline.

This pattern suggests that ADA’s failed breach of $0.40 will result in a drop to the support floor of $0.34 from the trading price of $0.37. The altcoin has already lost the support of $0.37, making its drop to the support floor likely.

However, if the investors’ demand overpowers the macro bearishness, ADA could recover. Breaching $0.40 will open up the altcoin to a run up to $0.44, beyond which the bearish thesis will be invalidated.

beincrypto.com

beincrypto.com