TRX has showcased good price activity recently, where 100% of holders’ addresses were in green. Also, no addresses were making a loss, per the On-chain research website. Similarly, in the past 7 days, the transactions greater than $100K were $4.12 Billion.

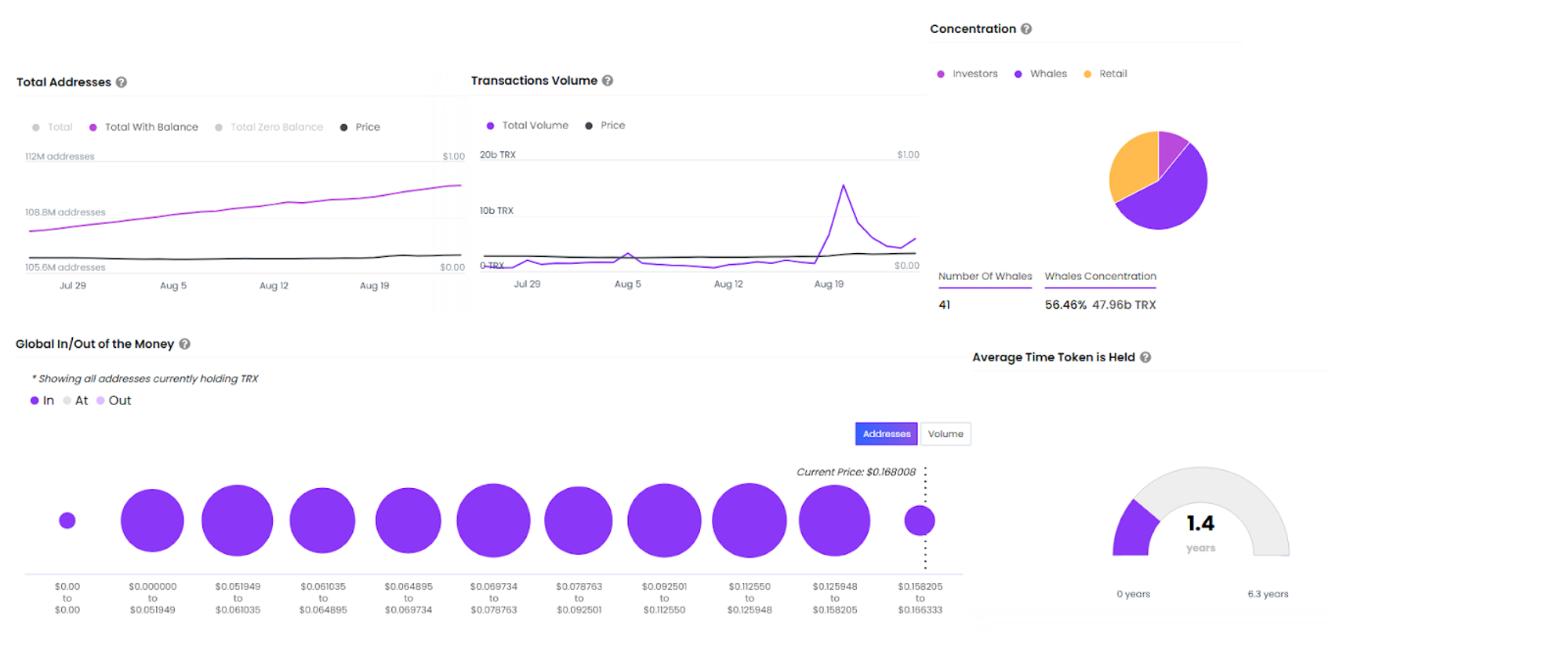

Moreover, the transaction volume surged to 5.87 Billion TRX in mere days. Meanwhile, the total number of addresses with a balance of Tron was 110.65 million.

Additionally, the average time the token was held was 1.4 years before it got transferred from possession. The Whale concentration was higher at 56.46% holding 47.96 Billion TRX.

Per Coincarp, the Rich list highlights that TRX has witnessed amazing user growth and adoption. The ace in the rich list holds 11.06% of the floating supply, and the top 20 holds 22.24% of the supply.

TRX Numbers on the go

The trading volume of spot for the Tron has advanced by 47.22% in the last 24 hours, resulting in a traded value of $927.60 Million. Following the surge, it showed a rise in demand; the market cap also advanced by 4.34% and was valued at $14.590 Billion at press time. This made it the 9th largest cryptocurrency globally.

As per Coincodex, the price sentiment of Tron was bullish and the fear and greed index was at 55. The value of the derivatives traded volume for the Tron advanced by 61.66% in the last 24 hours resulting in $572.24 Million.

Likewise, following the surge in derivatives volume, the open interest of the asset also witnessed an advance of 20.86% resulting in $205.21 Million. Short liquidation in the coin was huge at $410.22K.

Price Action of Tron (TRX)

Since late November 2022, TRX displayed a significant bullish rally. It climbed from a support level of $0.050 within a descending triangle to a peak of $0.1439 by February 2024, marking a 220% gain.

Following this advancement, the price showed signs of exhaustion by March 4th, unable to break through the key supply zone at $0.14389. It eventually entered a narrowing wedge pattern, resembling a symmetrical triangle.

Four notable touches on its boundaries confirm the symmetrical triangle pattern. It gave a breakout, and the pullback was complete after TRX saw a liquidity grab on August 5th, 2024. The upward thrust led to a substantial 43% surge that exceeded the previous peak of $0.1439.

The Tron has already reached the 2021 highs, and continued bullishness could lead to new all-time highs, targeting $0.1798 and $0.2000.

Conversely, maintaining support above $0.1438 is crucial if the price breaks down.

A drop below this support could lead to further declines towards $0.1290 and $0.1181. Technical indicators reveal higher momentum, with the price taking support of the 20-day, 50-day, and 200-day EMAs.

The RSI has reached a notably high level of 73.07, suggesting the possibility of a price pullback or consolidation. The MACD shows a bullish crossover with a histogram at 0.003642 and a MACD line at 0.009979, but caution is advised.

thecoinrepublic.com

thecoinrepublic.com