Litecoin’s struggles since falling from highs of $110 in March have now pushed nearly three-quarters of the holder addresses into a loss.

This week, the $LTC price extended its negative trajectory by falling below $65.

With Litecoin constrained below a downtrend line, will more addresses turn negative or are bulls likely to recoup some of the losses?

74% of Litecoin holders in loss

According to data from IntoTheBlock, about 74% of addresses holding Litecoin ($LTC) are at a loss at the current prices.

The market analytics and intelligence platform shows that over 6.11 million addresses with $LTC acquired the cryptocurrency at average prices higher than $64.33 at the time of writing.

It leaves 1.5 million addresses, accounting for about 18% of holders in profit. Meanwhile, just over 614K addresses, or 7.4% of the holders are at breakeven prices.

The “In the Money Out of the Money” metric is a crucial measure of potential sentiment based on unrealized profits or losses.

Having addresses in clusters helps provide insight in terms of possible demand or supply walls. Analysts look at the buying zones to anticipate support or resistance zones.

Will Litecoin miners sell more?

$LTC could also face new downside pressure if miners continue to sell.

The miner capitulation scenario has hindered Bitcoin bulls too, with the struggle catalysed by the reduced revenue and broader market weakness that had BTC shrinking since hitting its all-time highs in March.

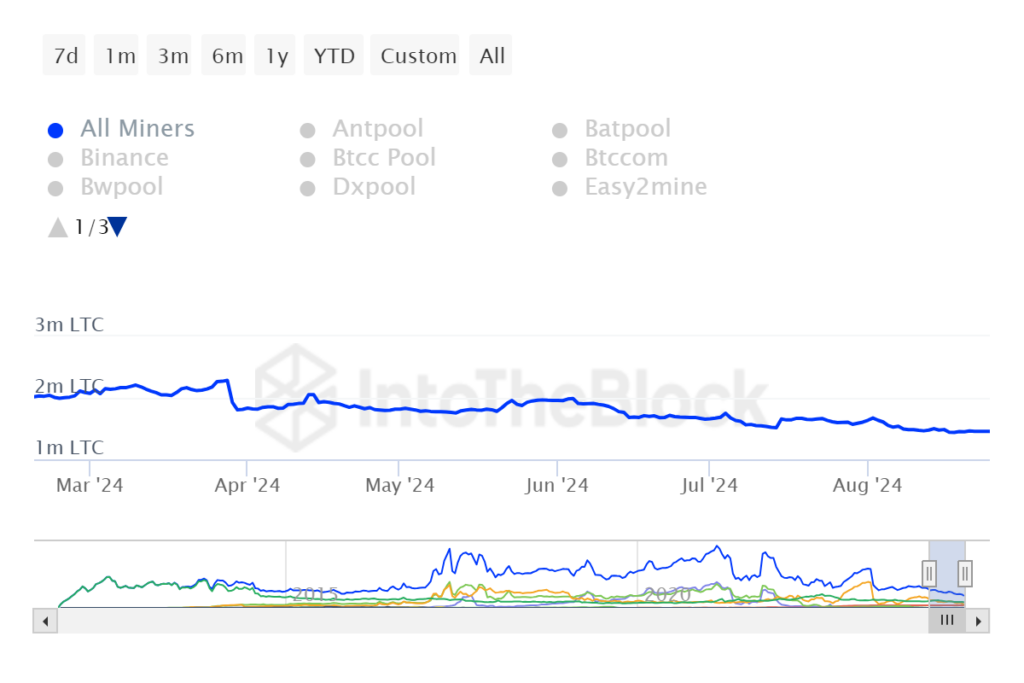

Data from IntoTheBlock also shows a notable decline in $LTC miner holdings.

Per the analytics platform’s miner balances metric, top Litecoin mining pools and entities have recently witnessed their total holdings fall from around 2.28 million $LTC on March 28, 2024, to about 1.46 million as of August 26, 2024.

This implies a miner sell-off of over 820,000 $LTC, worth more than $52 million at current prices.

Litecoin price analysis

In Litecoin’s case, the main support area lies in the $46-$58 range. If the market experiences a bullish flip, buyers may face resistance between $72 and $80.

The 50-day SMA and the descending channel’s resistance trendline are key levels to watch.

According to IntoTheBlock data, over 900K addresses purchased 10.8 million $LTC in this range, with the average price at $76.41.

The next supply wall may be around $79.85 to $90.02 where more than 1.6 million addresses acquired more than 12.24 million $LTC at the average price of $84.89.

Litecoin could struggle further at these levels given the potential for holders to seek profits.

The post Litecoin falls below key level as addresses in loss hit 74% appeared first on Invezz

invezz.com

invezz.com