Last week, bullish sentiment dominated the cryptocurrency market, leading to notable price increases across several digital assets. However, the tide appears to be turning for Binance Coin (BNB), as new sell signals emerge on its chart, suggesting a potential price decline.

BNB’s Price Set for a Decline?

Data from CoinMarketCap shows that BNB's price increased by over 6% in the past week. However, the last 24 hours have been bearish, with the coin's chart turning red. At the time of writing, BNB is trading at $577.01, boasting a market capitalization exceeding $84.2 billion, which secures its position as the fourth-largest cryptocurrency. This recent price dip was not unexpected.

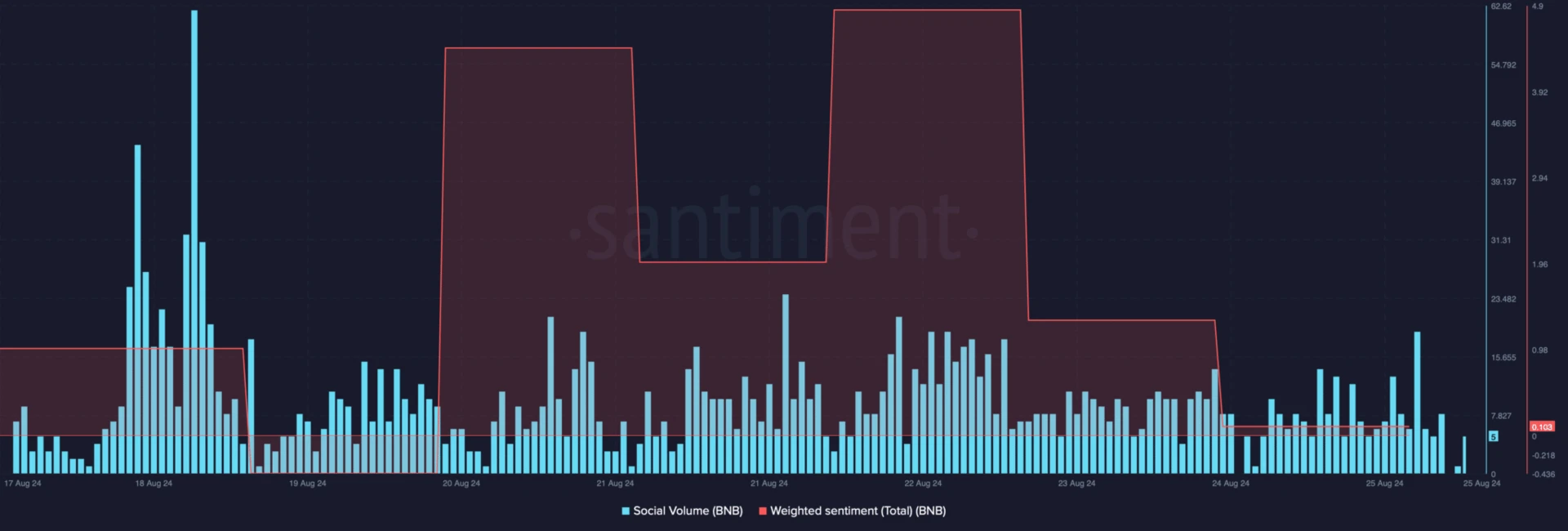

An analysis by Bitcompare, based on Santiment data, indicates that investor confidence in BNB has been waning over the past few days. This is reflected in the decline of its weighted sentiment and a drop in its social volume, pointing to reduced popularity.

In the midst of this downturn, popular crypto analyst Ali shared a tweet suggesting a continued decline in BNB's price. According to the tweet, BNB's TD Sequential indicator has flagged a sell signal.

The TD Sequential presents a sell signal on the $BNB daily chart! pic.twitter.com/68tsJyqD6Q

— Ali (@ali_charts) August 25, 2024

Examining BNB's Current Market Conditions

Bitcompare’s examination of the coin’s fear and greed index showed a reading of 61% at press time, indicating that the market is currently in a “greed” phase. Historically, when this metric reaches such levels, it often precedes a price correction.

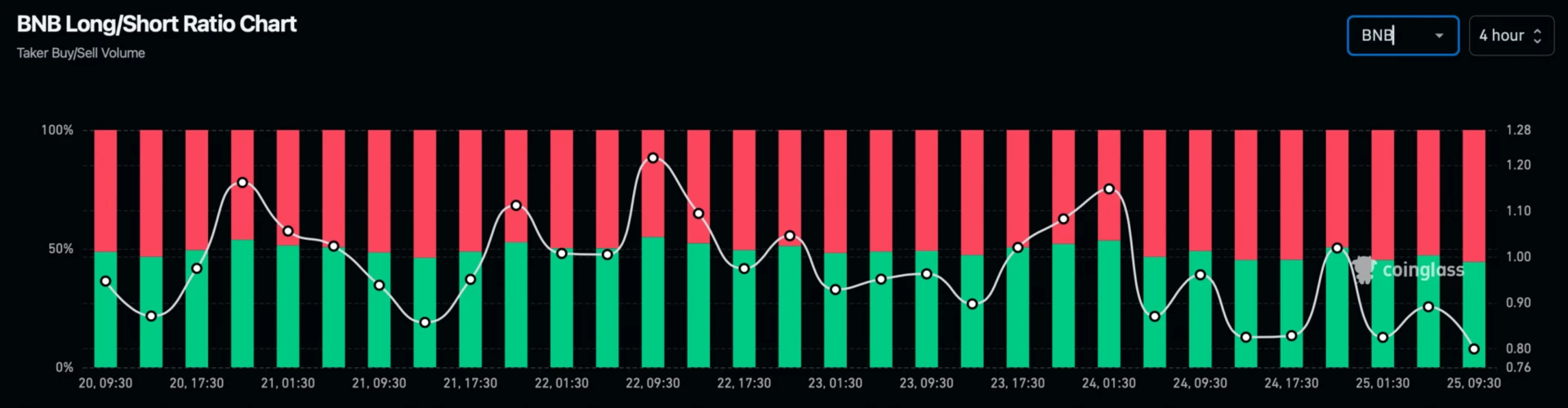

Furthermore, data from Coinglass highlights another bearish indicator. BNB's long/short ratio has shown a sharp decline, meaning there are now more short positions than long ones in the market. This shift suggests a rise in bearish sentiment surrounding the coin.

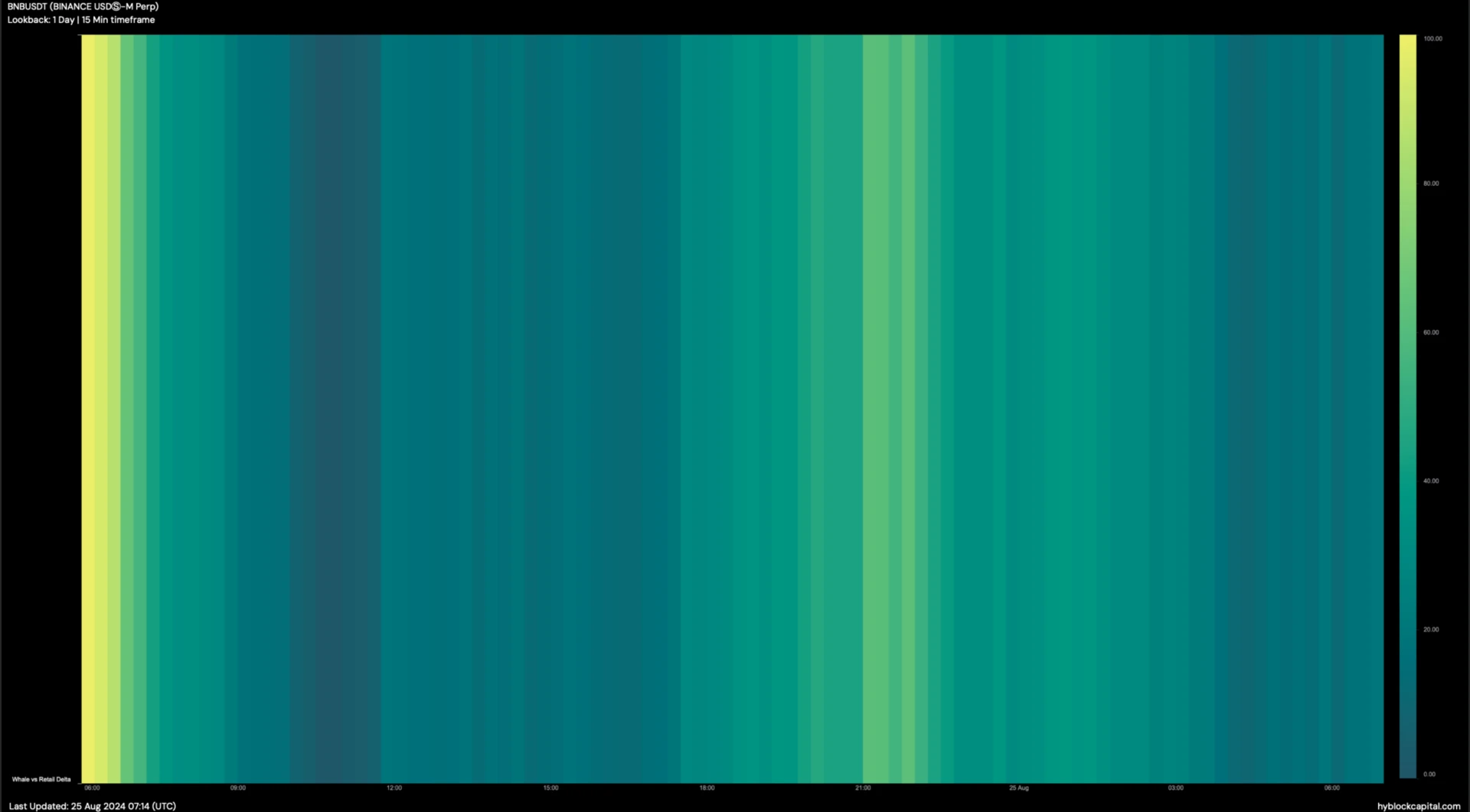

Additional insights from Hyblock Capital reveal that BNB's whale versus retail delta dropped significantly from 61 to 19. This shift suggests that whales, or large holders, are reducing their market exposure. For context, this indicator ranges from -100 to 100, with a value of 0 indicating equal positioning between whales and retail investors.

Chart Analysis Points to Potential Further Decline

A closer inspection of BNB’s daily chart shows that the coin was recently rejected at its resistance level of $602.3. Additionally, the Chaikin Money Flow (CMF) indicator has registered a downturn, further hinting at a potential continued price decline in the coming days. Should this trend persist, it wouldn’t be surprising to see BNB plummet to a target price of $461.