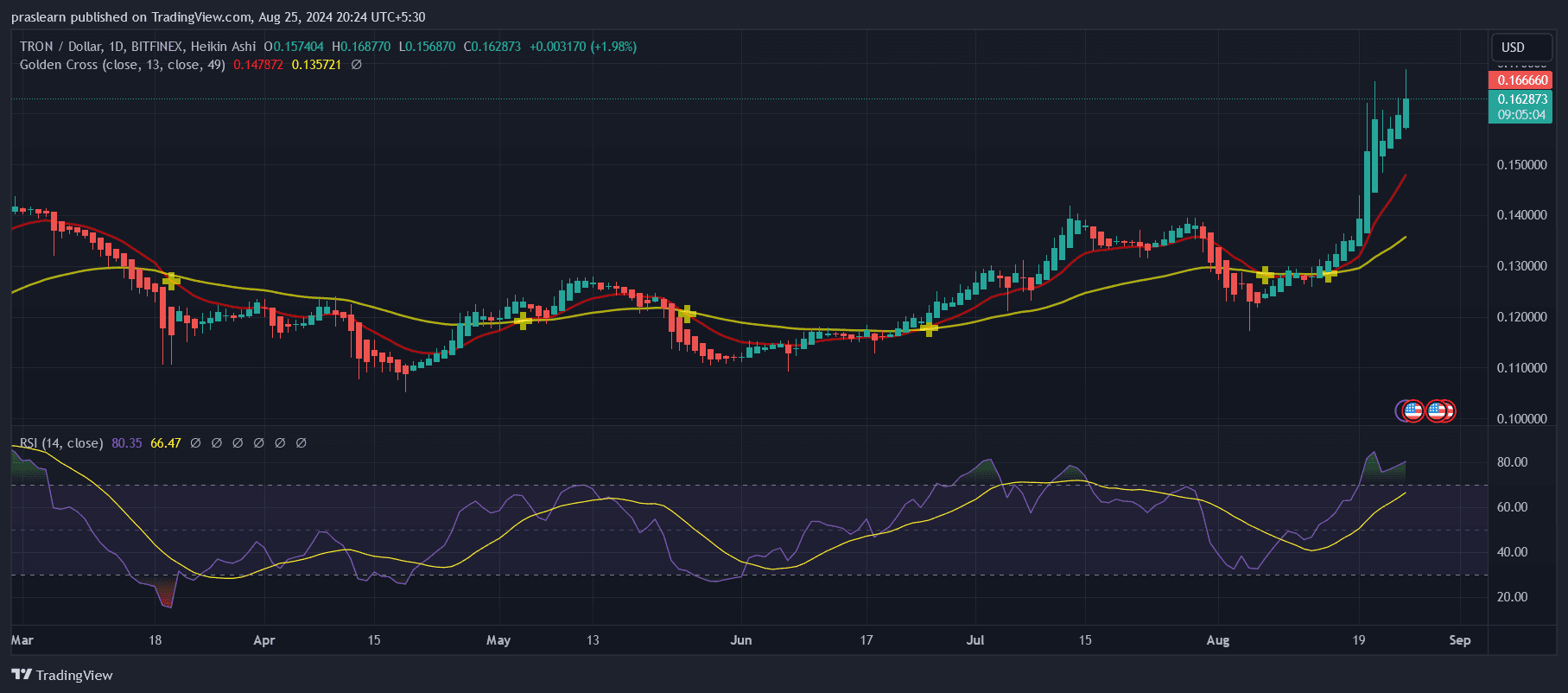

Tron (TRX) has been making headlines with a significant price jump, reaching $0.16—the highest it's been since May 2021. Over the past week, TRX has surged by 30%, sparking excitement and interest among investors and traders. In this Tron price prediction article, we'll explore what's behind this impressive rally and what it could mean for TRX's future.

How has the Tron (TRX) Price Moved Recently?

Today, TRON (TRX) is priced at $0.165908, with a 24-hour trading volume of $1.68 billion and a market cap of $15.32 billion, giving it a market dominance of 0.68%. Over the past 24 hours, the TRX price has risen by 4.17%.

TRON reached its peak price of $0.302062 on January 5, 2018, while its lowest recorded price was $0.001091 on September 15, 2017. Since its all-time high, the lowest TRX price was $0.00735 (cycle low), and the highest since that low was $0.179725 (cycle high). The current market sentiment for TRON is bullish, with the Fear & Greed Index at 54 (Neutral).

TRON's circulating supply stands at 92.35 billion TRX, out of a maximum supply of 99.28 billion TRX.

Why is Tron (TRX) Price Up?

Tron (TRX) has experienced a notable price increase due to a mix of favorable legal developments and rising market activity. One of the key drivers is the recent legal win for Justin Sun, Tron’s founder, in his ongoing battle with the U.S. Securities and Exchange Commission (SEC).

The SEC had been pursuing a lawsuit against Sun, accusing him of conducting an unregistered securities offering through the sale of TRX. However, on August 19th, a New York Federal Judge rejected the SEC’s request for an accelerated legal process. This decision provides Sun and his legal team more time to prepare their defense, easing some of the regulatory concerns surrounding Tron.

As a result, investors are gaining confidence, with many choosing to hold onto or even increase their TRX holdings, anticipating that the most severe regulatory consequences may be avoided.

Additionally, the launch of SunPump, a new meme coin platform on the Tron network, has contributed to the upward trend in TRX’s price. This platform has triggered a substantial rise in on-chain transactions, with network activity on the Tron blockchain increasing by 124%. Transaction volumes ranging from $100 to $10,000 have reached $100 million, while those between $1,000 and $10,000 have climbed past $50 million.

This surge in activity reflects growing user interest and engagement with the Tron network, which directly boosts demand for TRX tokens as they are used to pay transaction fees. Together, these factors indicate a strong and optimistic outlook for TRX, with the potential for continued price growth as positive sentiment and user adoption expand.

Tron Price Prediction: How High Can the Tron (TRX) Price Go?

Tron (TRX) has shown remarkable resilience and growth over the past year, with its price surging by 112%, outpacing 60% of the top 100 crypto assets. This strong performance is further validated by TRX trading above its 200-day simple moving average, indicating a sustained upward trend.

The positive momentum is also evident in TRX’s consistent performance, with 19 green days in the last 30 days, equating to a 63% success rate, which highlights a healthy and growing interest from the market.

Given these indicators, TRX is well-positioned for further price appreciation. The recent legal victory against the SEC has alleviated some of the regulatory pressure, bolstering investor confidence. Moreover, the launch of the SunPump platform has driven significant on-chain activity, directly increasing demand for TRX tokens.

However, while TRX has demonstrated strong growth, it's essential to consider its performance relative to Bitcoin, which remains the dominant force in the crypto market.

TRX has been outperformed by Bitcoin, suggesting that while TRX is poised for gains, its upward trajectory may be more measured compared to Bitcoin’s broader market influence.

Looking ahead, if TRX can maintain its current momentum, supported by high liquidity and continued network activity, it could push towards new price highs. While predicting exact price levels is challenging, the current bullish indicators suggest that TRX could potentially test resistance levels closer to its previous all-time highs, especially if broader market conditions remain favorable and if it continues to outperform other major assets.

cryptoticker.io

cryptoticker.io