Last week, ImmutableX (IMX) Price showed a steady rise in gains; intraday gains were 7% until press time. Meanwhile, the 24-hour volume of the spot was up by35% to $46.397 Million.

The Immutable was the 38th-largest cryptocurrency globally, with a market cap worth $2.081 Billion. The Immutable token’s 78.64% of the maximum supply was floating in the market as of writing.

The total supply of the token further was 2.0 Billion tokens. This further resulted in an FDV of $2.645 Billion from the current price.

Derivatives Data Insights of Immutable (IMX) Price

The Immutable (IMX) derivatives volume increased by 80.51% in the last 24 hours from the press time. This showed a strong increase in asset demand among investors.

Similarly, 6.41% more contracts opened into the IMX market for the recent trend, which resulted in $32.04 Million.

Following the derivatives data, the Immutable witnessed higher short liquidations in the last 24 hours. This resulted in an amount that was liquidated in shorts worth $134.01K, against which the longs of $17.44K amount were liquidated.

Onchain Insights in IMX

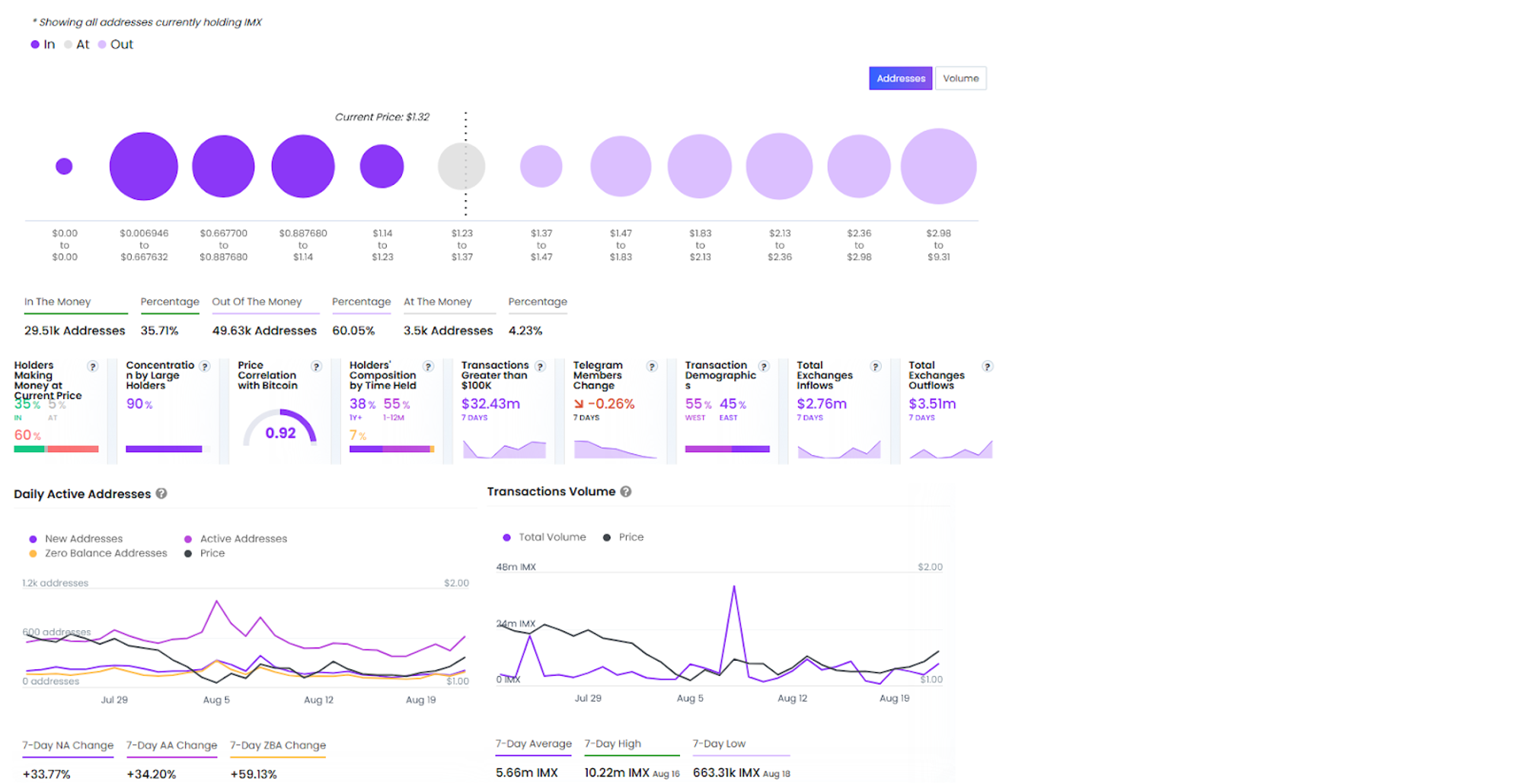

Per the On-chain numbers, the accumulation of IMX has begun, as total exchange outflows, resembling withdrawals to wallets, have surged to $3.51 Million. Meanwhile, the deposit to exchanges based on exchange inflows has slowed down to $2.76 Million in the past 7 days.

With the recent surges in price, holders’ positions improved. In the last few days, the active addresses surged to 616, as of writing, with an increased transaction volume of 9.17 Million IMXs. Investors held on to IMX for an average of 1.2 years.

Additionally, 78.09% of whale holders own 1.56 Billion IMX tokens. Likewise, per the financial data, the 29.51K addresses are in the money or in profit, making 35.71%. While, the losses with earlier downtrend has still an effect, as 60.05% (49.63K addresses) are currently sitting at losses.

Technical Analysis of ImmutableX (IMX) Price

The IMX token has been on a consistent downward trajectory for the past five months, marked by a series of lower lows on the price chart. This extended bearish trend underscores the prevailing influence of sellers in the market.

During this period, IMX formed a falling wedge pattern. While falling wedges are generally seen as bearish patterns, they can also signal a potential reversal if the price breaks out to the upside.

Should the IMX token price break above the falling wedge with notable increases in trading volume, it could signify the start of a bullish reversal. Such a breakout might indicate a shift in market sentiment, potentially leading to a substantial upward movement in the token’s price.

Currently, technical indicators on the IMX token’s daily chart reflect a strong bearish trend. The 50-day and 200-day EMAs have been declining, culminating in a death cross, extending the ongoing downtrend.

The MACD and its signal line have been persistently negative, highlighting continued weakness in the token’s price. Additionally, the RSI has stayed below the 50 level, with the 14-day SMA overlapping it. At the time of writing, the RSI was at 44.51, suggesting a lack of bullish momentum and ongoing bearish sentiment.

Potential support levels for the IMX token are $0.511 and $0.901, while resistance is $1.610 and $2.601.

thecoinrepublic.com

thecoinrepublic.com