Things are getting quiet — really quiet — raising concerns about whether this is still a bull market for the highly volatile crypto ecosystem. While this answer lies in Bitcoin (BTC) performance and altcoin prices, historical data and recent developments can predict the point at which the cycle is.

In this analysis, BeInCrypto examines crucial on-chain metrics that suggest the bull market started about two years ago and could have reached 50% completion.

History Shows the Cycle Is Way Beyond Bears

The year 2022 was a particularly difficult time for the crypto market, which had previously thrived in 2021. The industry saw major firms like FTX, Celsius, and Three Arrows Capital (3AC) collapse, triggering widespread bankruptcies and causing significant declines in cryptocurrency prices.

By November 21, 2022, Bitcoin (BTC) had plunged to $15,409, Ethereum (ETH) was trading at $1,065, BNB at $248.60, and Solana (SOL) had dropped to $7.70. These levels were the lowest these assets had seen in nearly two years.

Given this downturn, it seems that November 2022 marked the bottom of the bear market. The strong price recovery in early 2023 supports the idea that January was the start of a new bull cycle. Historically, crypto market cycles span roughly three years (1,047 to 1,278 days). Based on this timeframe, the current cycle is around 640 days in, indicating that the bull market is approximately halfway through.

Notably, the Bitcoin halving, which typically drives massive price increases, occurred earlier this year. Interestingly, Bitcoin reached a new all-time high even before the halving, driven largely by the approval of spot ETFs. Despite the recent corrections and periods of consolidation, on-chain metrics suggest that BTC has not yet reached the peak of this cycle. This leaves room for potential further growth as the bull market progresses.

As seen above, the post-halving rally began in the fourth quarter (Q4) of each halving year. Thus, if we go by that recurrence, then a substantial upswing could start around October. Interestingly, CryptoQuant’s CEO, Ki Young Ju, also seems to agree with the sentiment.

“In the last Bitcoin halving cycle, the bull rally began in Q4. Whales won’t let Q4 be boring with a flat YoY performance,” Young Ju highlighted on X.

Bitcoin, ETH, and Altcoin Prices Still Have Room to Grow

Historically, Bitcoin’s price has at least doubled during each halving year. In 2012, BTC’s price surged by 2.52x, followed by a 2.26x increase in 2016, and a 4.05x jump in 2020. At the start of 2024, Bitcoin was trading around $42,208. Even after reaching $73,750 in March, the data suggests the bull cycle is not yet over.

To match past halving performances, Bitcoin’s price would need to rise further, targeting between $80,000 and $85,000 before this cycle peaks. The historical trends indicate room for more growth in 2024.

Now, to other things — starting with ETH. During the 2021 bull run, the second most valuable cryptocurrency gave BTC a run for its money, outperforming it for an extended period.

Despite the spot Ethereum ETF approval, ETH hasn’t mirrored its performance from three years ago. On June 20, Ethereum’s dominance was 18.80%. As of now, it has dropped to 15%, signaling that the altcoin has yet to replicate its impressive 2021 run.

Bitcoin dominance, on the other hand, is over 57%. Furthermore, ETH’s underwhelming performance has also been attributed to the delay in this cycle’s altcoin season.

It is worth noting that the cryptocurrency’s rally was one of the major factors that drove many other altcoins to incredible peaks last time. But recently, BNB appears to be the only top altcoin from the last cycle that had surpassed its previous all-time high.

Meme Coins, Celebs Already Tasted the Bull Market

While altcoins continue to underperform, two notable events suggest that this bull market might be halfway through. The first one is the incredible returns from meme coins. Last time, several meme coins on Ethereum and the Binance Smart Chain produced many out-of-the-blue millionaires.

This time, the blockchains offering such seem to be Solana and, most recently, Justin Sun-led Tron. Second on the list is the involvement of celebrities. In 2021, stars like Logan Paul, Paris Hilton, and Snoop Dogg, among others, bought into the NFT hype.

Meanwhile, the NFT craze appears to be over, but celebrities have also been involved with the market. People like Andrew Tate and Iggy Azalea have launched DADDY and MOTHER meme coins, respectively.

Another metric to consider for gauging the crypto bull market is retail investor interest. Whenever retail investor interest declines, it suggests the bull market is ongoing but hasn’t peaked.

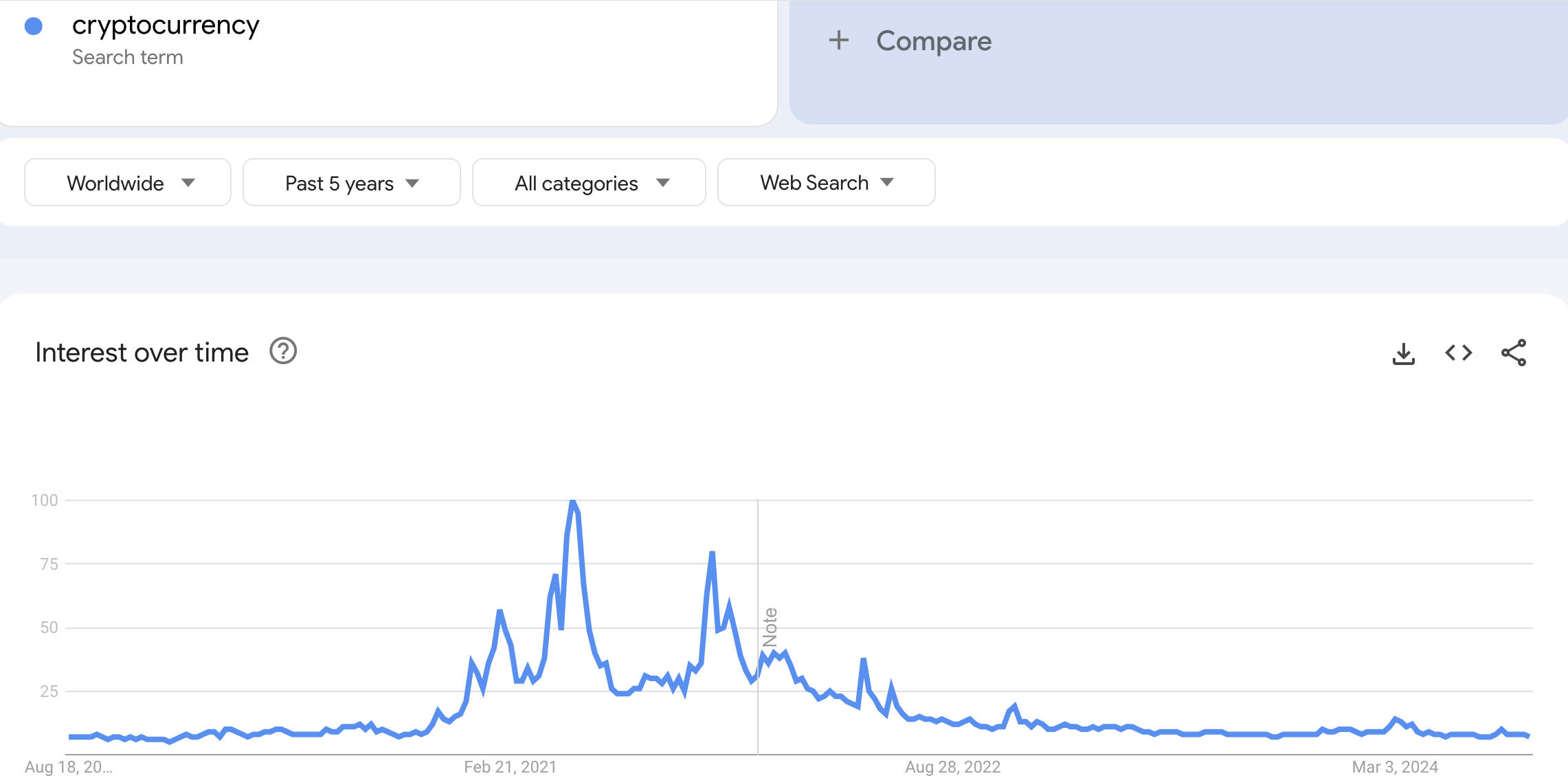

Google Trends data shows searches for “cryptocurrency” hit their highest level in 2021, scoring a perfect 100. However, searches have been consistently lower this year, signaling reduced retail activity.

A bull market typically sees a surge in retail investors as they drive the demand. The current dip in interest suggests that this cycle hasn’t reached its peak yet. The lack of widespread retail FOMO points to more potential upside as the cycle matures.

Long-Term Data Shows the Uptrend Might Kick Off Again

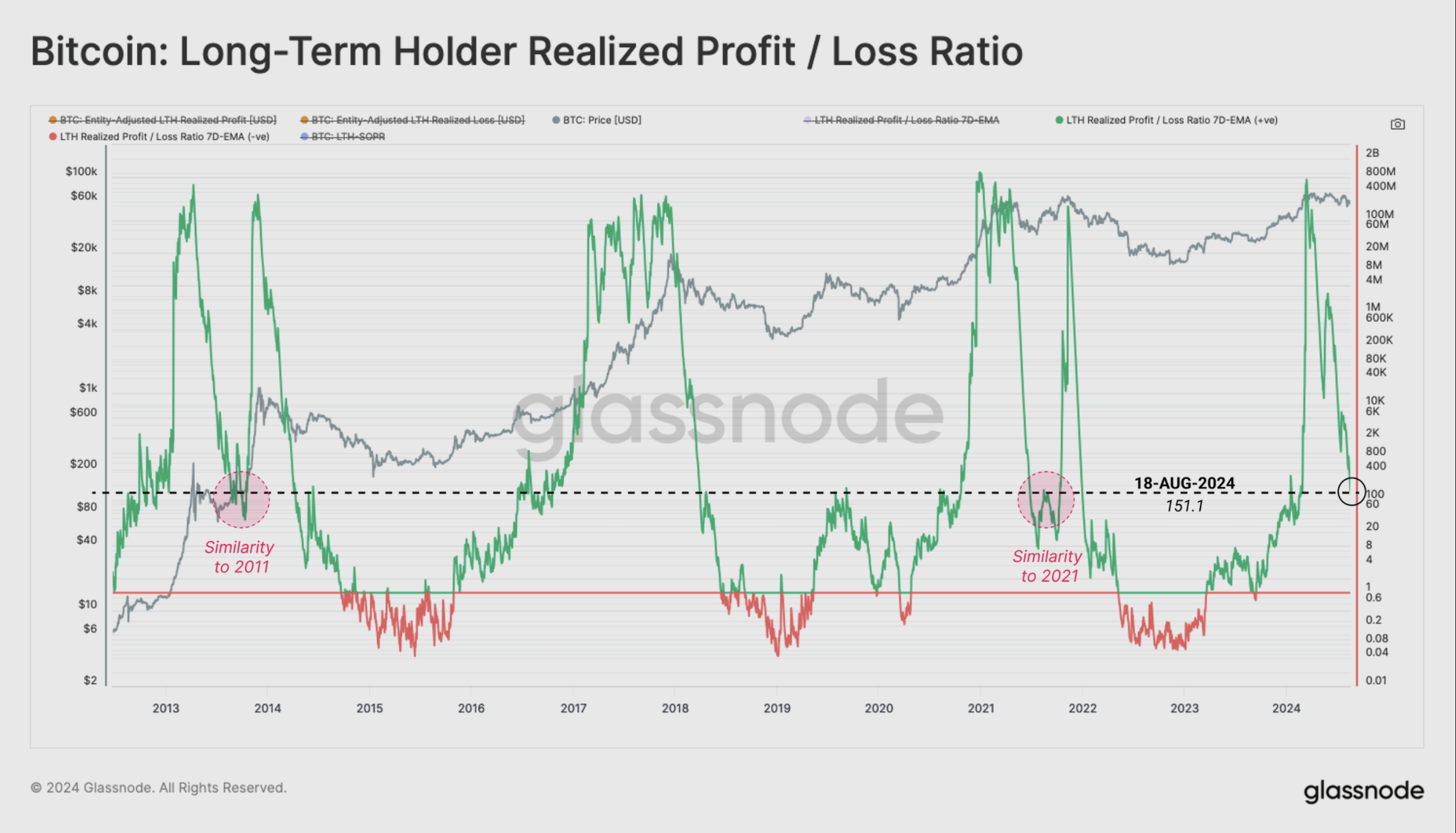

Additionally, Glassnode-provided Long-Term Holder Realized Profit/Loss Ratio comes into play. As the name suggests, this metric tracks the behavior of long-term holders, telling if they are booking profits or enduring losses.

As of this writing, this metric has declined from its peak in March, indicating that holders have reduced profit-taking activity. This fall is similar to the 2021 cycle when Bitcoin’s price went down before restarting another uptrend.

Therefore, if past performances impact future trends, then BTC, as well as other cryptos, might reach new highs. The on-chain analytic platform also agrees in its report dated August 20.

“Notably, during the March 2024 ATH, this metric reached a similar altitude to prior market tops. In both the 2013 and 2021 cycles, the metric declined to similar levels prior to resuming an uptrend in price,” Glassnode stated.

In summary, while some investors remain skeptical about the current market conditions, several indicators point to this still being a bull market despite recent volatility. The analysis suggests that prices may continue to rise, pushing Bitcoin, Ethereum, and other altcoins to new highs and fueling further momentum in this cycle.

However, caution is still advised. Heightened volatility and periodic drawdowns can lead to sudden price shifts. If realized losses persist and dominate the market, the current cycle could transition into a bear phase.

beincrypto.com

beincrypto.com