Crypto is anti-credentialist. A cypherpunk sandbox for coding anything and everything, backed by an open-source ethos that encourages forking and other forms of entrepreneurial riffing.

But there’s also a massive cohort of cryptocurrencies and blockchains being built by teams led or advised by professors, either former or current.

Hedera, Bittensor, Stellar, Arbitrum, Algorand, Chainlink and Avalanche all have either tapped academics at one-time or employed professors among their senior leadership.

Other projects have enlisted professors as advisors, including Aptos, Filecoin, Ondo and Theta Network and even MakerDAO for a time a few years back.

But just how big are professor coins?

For the sake of neatness, we can probably label projects with professors in advisory roles “honorary” professor coins, while the fully-fledged moniker can be reserved for coins with professors in decision making roles.

Out of the top 150 or so cryptocurrencies by market cap, there are 20 professor coins and another 10 honorary coins.

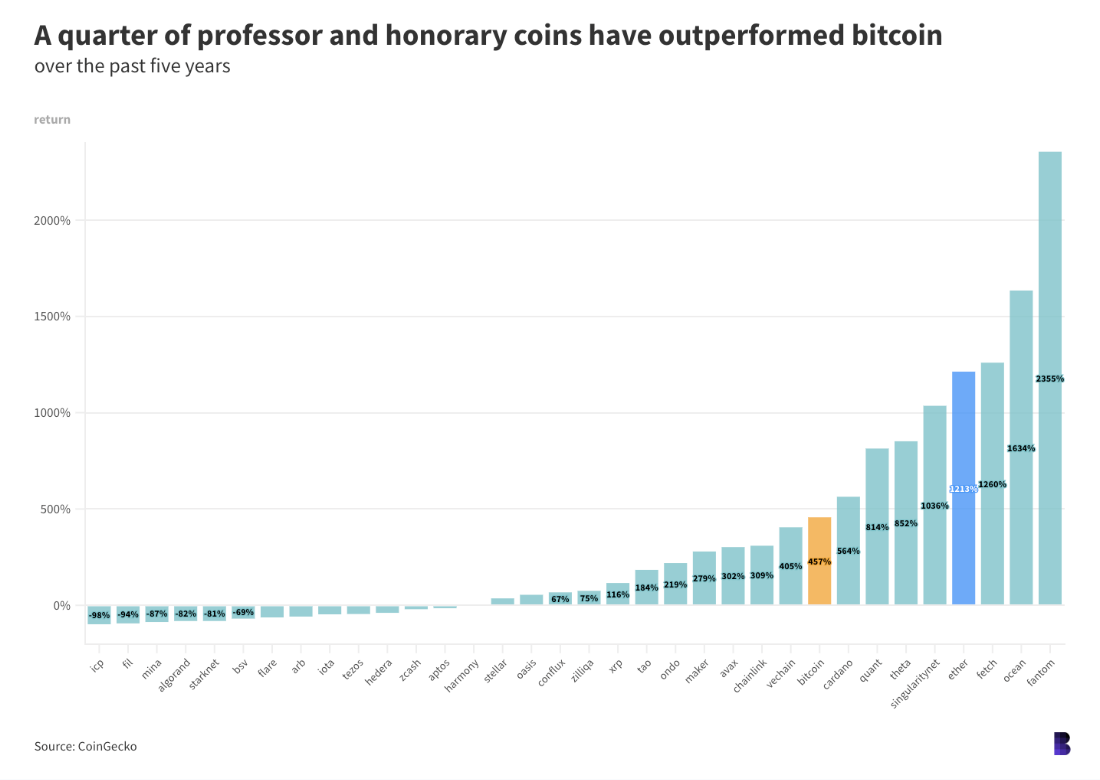

Lumping both camps together, only eight had beaten bitcoin over the past five years, as of earlier this week: FTM, THETA, QNT, ADA, KAS, and the three AI-related tokens that just merged into one, FET, OCEAN and AGIX.

Not to mention two-fifths of the analyzed professor coins are in the red over the same period, with ICP, FIL, MINA, ALGO, STRK losing more than 80% of their value.

Only four professor or honorary coins have eclipsed ether in the past five years.

A PhD in memecoins

Memecoins are on the opposite end of the crypto spectrum, and they’ve transcended every crypto market cycle going back to dogecoin’s launch in 2013.

There are hundreds, and even tens of thousands, of attempted pump and dumps every week. Some are successful but the overwhelming majority are not.

The cheaper networks — including BNB Chain, Solana, Base and more recently Bitcoin through Ordinals — can then be thought of as graveyards for all sorts of tokens and memecoins that never made it, or if they did, it was only for a brief while.

There are plenty of memecoins who do make it. Eighteen memecoins have a market cap of $250 million or more right now, the lower end of which are about the same as more serious projects including Arkham, Dymension, Manta and 1inch.

Another 180 or so have a market cap of $5 million or more and would likely be worth much less if any decent number of tokens were all sold at once.

Still, tracking the top 50 or so memecoins by market cap over the past seven years shows that they indeed are slowly eating crypto. But they’ve recently hit a ceiling.

The chart below plots the dominance of memecoins and professor coins against total capitalization of the crypto market. While it doesn’t include all tokens, it does, however, cover about 95% of the total memecoin market value.

Some caveats: market dominance usually refers to how much of the market is made up of a particular asset — bitcoin’s dominance right now is 57%, as it contributes that amount to the total crypto market capitalization.

In this case, bitcoin and ether were removed from that calculation. Memecoins, including ones that double as native tokens for their own standalone networks, are rarely intended to compete with either cryptocurrency, so it’s instead more interesting to gauge the relative dominance of memecoins against the rest of the crypto market.

The blue line meanwhile follows the market dominance of memecoins that aren’t dogecoin and shiba inu.

Notice that memecoin dominance has trended upwards ever since 2021. Elon Musk’s participation in the crypto zeitgeist was at its peak at the time, and he really liked to shill dogecoin.

Overall memecoin dominance, not including bitcoin and ether, is currently 6.5%. Without DOGE and SHIB it’s closer to 2.65%. Using the same metrics, professor coins have almost 12%.

Dominance topped out at almost 10% in May 2021 and stopped just short of that at the end of May this year.

Most telling is that the blue line reached its all-time high around the same time, and had been trending upwards even as the purple line retraced between November 2022 (FTX’s collapse) and February this year.

All told, it shows that newer memecoins, at least the ones that survive, are indeed finding solid footing within the context of the wider crypto market.

Crypto is many things and one of them is pure peer-to-peer financial anarchy. And that’s the hook that piques the interest of many newcomers to the space.

If the core of crypto and blockchain — pseudonymity, untraceability and censorship resistance — has at all been eroded by waves of regulation over the years, memecoin markets are carrying the torch. And perhaps professor coins are giving them cover.

A modified version of this article first appeared in the daily Empire newsletter. Subscribe here so you don’t miss tomorrow’s edition.

blockworks.co

blockworks.co