Zilliqa ($ZIL) started the week with a bullish stance after breaking above a descending wedge pattern on Monday. Consequently, the altcoin saw a notable uptrend to trade at $0.01440 during this publication – a nearly 5% jump.

$ZIL to extend upsurges

The altcoin exhibits a bullish outlook after a 3.50% increase over the past day. Further, on-chain data from Coinglass suggests an upside continuation for Zilliqa in the coming sessions.

The rising open interest while the long-to-short ratio stays above one confirms $ZIL’s bullish trajectory.

Zilliqa postponed its upward move yesterday, 21 August, after facing the resistance at $0.0145.

That triggered a slight dip in the altcoin’s current price. However, a closing beyond the hurdle at $0.0145 could catalyze a 20% rally towards the 29 July peak of $0.0175.

Meanwhile, the Awesome Oscillator and the Relative Strength Index sway around their neutral regions of zero and 50, respectively. These indicators should move above the neutral levels to support sustained uptrends for $ZIL.

Coinglass data supports Zilliqa’s bullish stance as the future’s open interest surges. OI shows the total pending derivative contracts awaiting settlement and whether the contract sees increased or reduced cash inflow.

Surged open interest indicates additional funds joining the marketplace and new buyers, which confirms a bullish bias. On the other hand, declined OI signals market liquidation as investors leave the market.

Zilliqa’s open interest stood at $9.67 million at press time, reflecting a massive increase from Monday’s $8.27 million.

That indicates more cash entering the altcoin and buying activities from new participants.

Moreover, the 1. 12 long-to-short ratio supports $ZIL’s optimistic outlook. Any value above one shows most traders expect price surges.

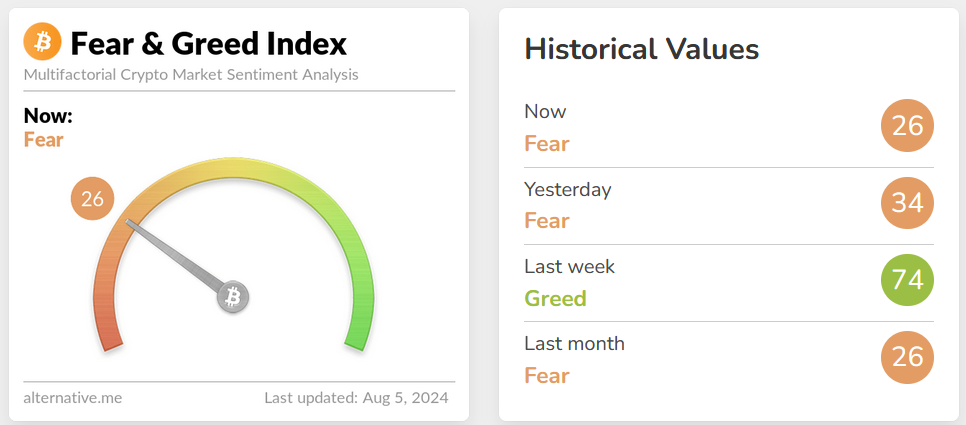

While technical indicators and on-chain data signal bullishness for Zilliqa, broad market sentiments remain vital in shaping $ZIL’s price trajectory.

Current crypto market outlook: Fed minutes boost price actions

The crypto market displayed recoveries on Thursday following the Fed’s dovish stance. The Federal minutes announcement bolstered investor confidence in cryptocurrencies.

The anticipated September rate cut has alleviated the attractiveness of risky assets, pushing Bitcoin past the $61K mark.

Low borrowing costs will likely magnify investments, bolstering cryptocurrency purchases and possibly propelling prices to record highs. Furthermore, analysts expect a monumental altcoin season in the coming few months.

#Altcoins market cap #TOTAL2 continues to accumulate before the big boom like in 2020!

— Rodri ZXZ (@rodrizxz) August 22, 2024

The 2024 – 2025 #altcoin season will be epic! pic.twitter.com/hI20rqTqqw

While the current crypto market outlook supports Zilliqa’s near-term bullish stance, the anticipated broad-based bull run would bolster $ZIL’s long-term performance.

$ZIL price

The token maintains a robust uptrend after the recent downward pattern breakout. $ZIL gained 3.50% in the past day to hover at $$0.01440, and the 10% daily trading volume surge supports continued rallies.

Meanwhile, broad market tendencies would be vital in determining the alt’s trajectory. A sudden bearish influence would nullify the expected Zilliqa surges.

A daily candle closing beneath the 7 August low of $0.0123 could see $ZIL retesting the support at $0.0108 – a 12% dip.

The post Zilliqa ($ZIL) extends gains after a falling wedge breakout; eyes 20% surge appeared first on Invezz

invezz.com

invezz.com