Curve DAO ends the correction phase with a high-momentum bull cycle. The increased demand projects the next target level at $0.50.

As Bitcoin hangs near the $60K mark, the altcoin market finds a boost in the DeFi space. In the last four hours, the crypto market witnesses a surge in short liquidations worth $8.31 million. In comparison, the $1.55 million worth of lost long positions reflects a relatively stronger position.

As the market’s bullish strength increases, DeFi tokens are gaining momentum. So, will the breakout rally in the Curve DAO token hit $0.50 in the recovering market? Let’s find out.

Curve DAO Channel Breakout

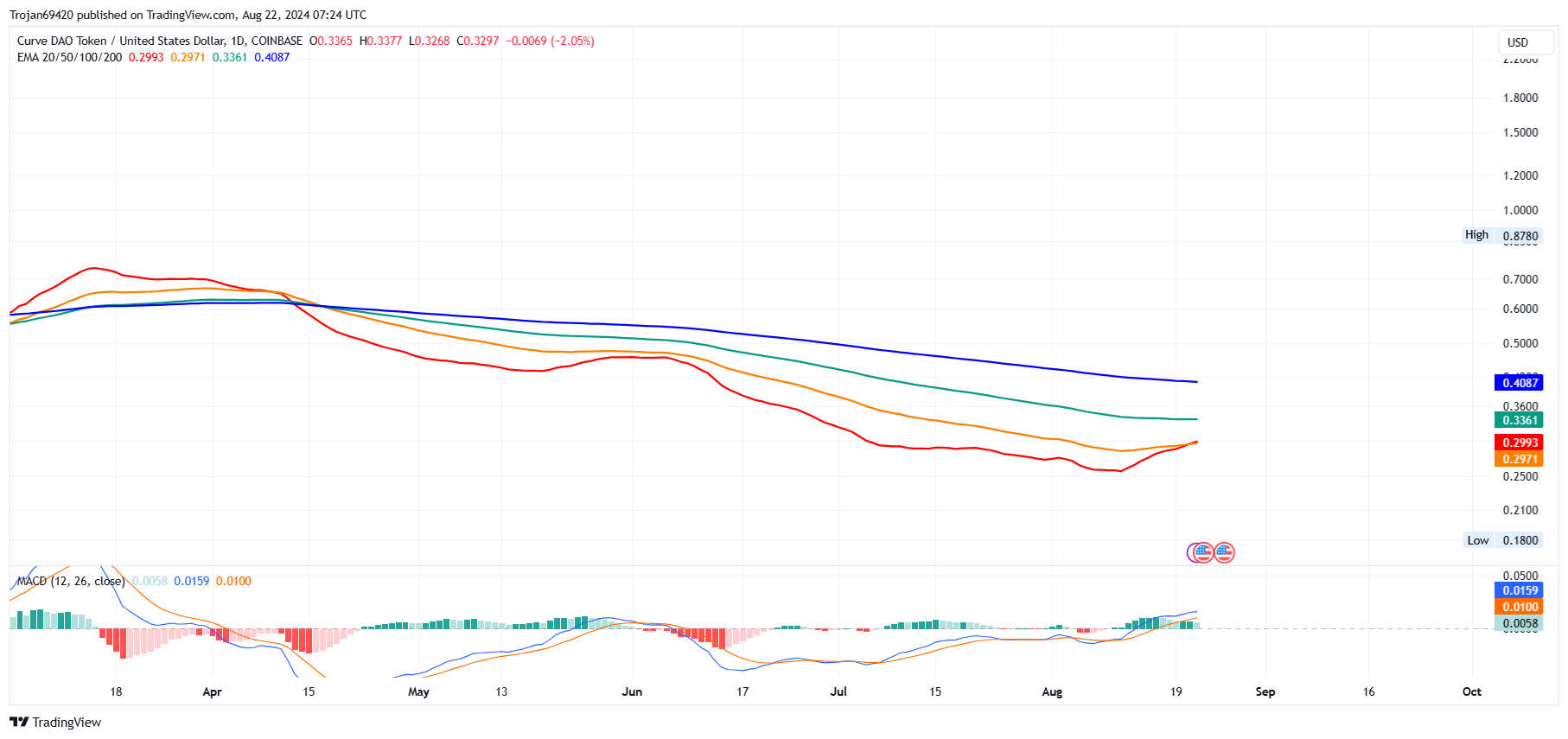

In the daily chart, Curve Dao shows a bullish cycle in a falling channel pattern, resulting in a breakout rally. The downfall in the bearish channel accounted for a 75% drop in Curve Dao’s market value within six months.

However, the third reversal from the support trendline, making a momentary V-shape pattern, breaks above the overhead trendline. Since the retest of the support trendline at $0.18, the $CRV token price has increased by 82% in the last 17 days.

Currently, the Curve Dao token trades at $0.3281 with an intraday pullback of 2.53%, teasing an evening star pattern.

Based on the Fibonacci levels, the uptrend in Curve Dao has surpassed the 23.60% Fibonacci level at $0.29. A closer look at the price action shows a post-retest rally gaining momentum.

The technical indicators in the Curve Dao price chart show a positive crossover in the 20D and 50D EMA. However, the rest of the crucial EMAs (50, 100, 200) maintain a bearish alignment. Further, the MACD indicator shows a bullish trend in the MACD and signal lines.

Tactical Approach by DWF Labs During Market Turmoil

DWF Labs recently moved 2 million $CRVs, worth roughly $683K, to Binance. Last year, during a liquidity crisis, they acquired 12.5 million $CRV ($5 million) in an over-the-counter deal at $0.4 directly from Curve’s founder, Michael Egorov.

DWF Labs now holds a 10.5 million $CRV, valued at about $3.5 million, ranking as its third-largest holding. However, given the current price of $CRV, it currently faces an estimated loss of $824K, or 16.5%.

Will Curve DAO Token Hit $0.50?

Considering the bullish trend gains momentum, the uptrend puts pressure on the 38.20% Fibonacci glass ceiling at $0.3592. A breakout rally above the ceiling will increase the chances of a rounding bottom reversal with a neckline at $0.50 or the 61.80% Fib level.

thecryptobasic.com

thecryptobasic.com