Cardano (ADA) has caught the interest of many as its price edges closer to $1. With September around the corner, there's growing curiosity about whether ADA will finally reach this milestone. In this article, we’ll break down the main factors influencing ADA’s price and explore if hitting $1 is a real possibility. Let's take a look at this Cardano Price Prediction article in more detail.

How has the Cardano (ADA) Price Moved Recently?

Cardano is currently priced at $0.351945, with a 24-hour trading volume of $470.73 million, a market cap of $12.56 billion, and a market dominance of 0.60%. Over the past 24 hours, ADA’s price has risen by 2.25%.

Cardano hit its peak price of $3.10 on September 2, 2021, marking its all-time high. Its lowest recorded price was $0.017354 on October 1, 2017. Since reaching its all-time high, the lowest ADA has dropped to is $0.234392, while the highest recovery point was $0.806108. Currently, the sentiment around Cardano’s price prediction is neutral, and the Fear & Greed Index stands at 26, indicating fear in the market.

Cardano has a circulating supply of 35.69 billion ADA out of a maximum supply of 45 billion ADA. The yearly supply inflation rate is 5.53%, which means 1.87 billion ADA were added in the last year.

Cardano Price is Rising– Is ADA on the Path to a Comeback?

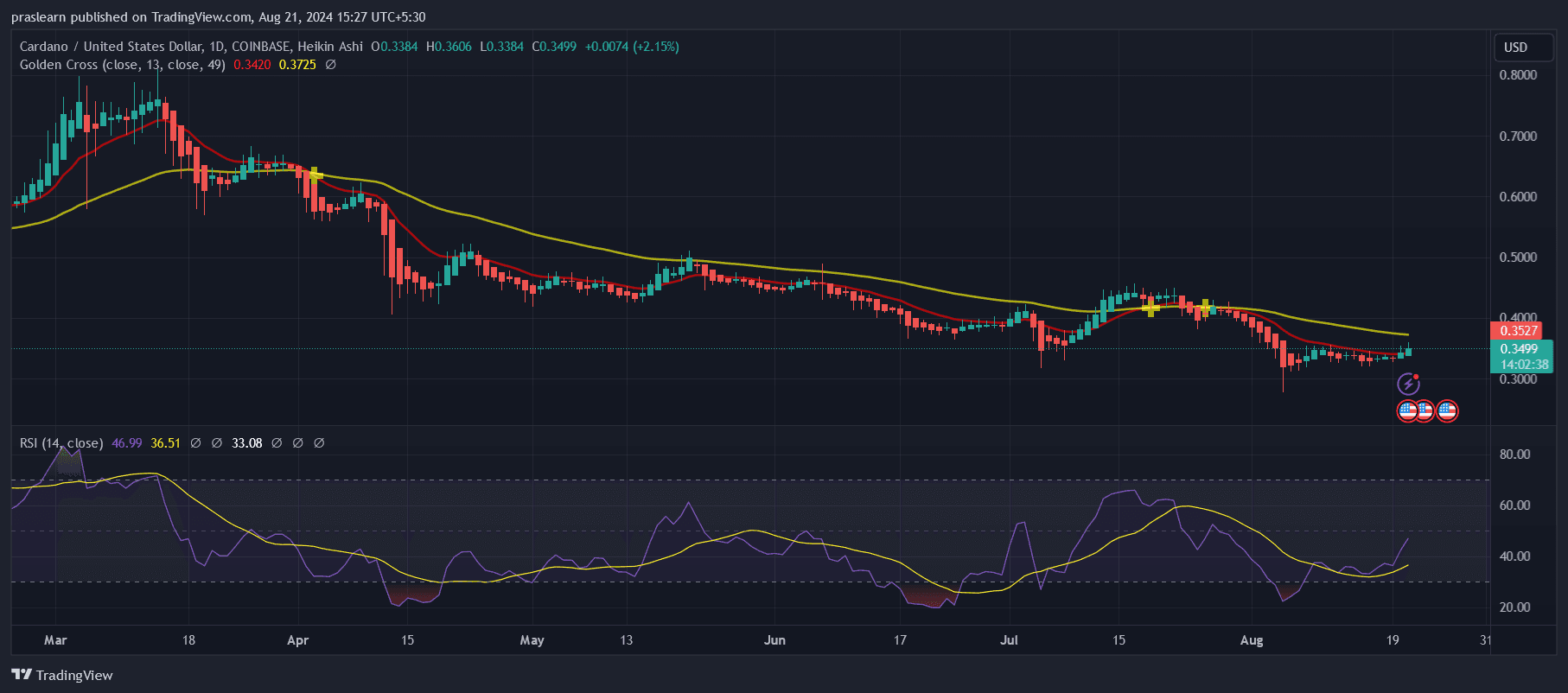

Cardano’s recent price movement suggests a potential rebound, driven by a combination of technical and sentiment indicators. The ADA price has increased by 3.2% over the last 24 hours, now trading at $0.3519. This rise brings it closer to a pivotal juncture in its price trajectory.

A key factor contributing to this bullish outlook is the performance of Cardano's Hydra, which has outpaced Bitcoin's Lightning Network in recent evaluations. This success, showcased at the RareEvo blockchain event, has heightened interest and optimism within the crypto community. As a result, traders are leveraging the positive sentiment to book profits, fueling the recent price uptick.

Investor behavior also supports the notion of a potential comeback. According to Coinglass, there was a significant net outflow of $5.73 million worth of ADA on August 20, marking the largest withdrawal since the market downturn on August 5. This withdrawal trend indicates a shift towards holding ADA, as investors anticipate higher future prices rather than liquidating their holdings.

Additionally, the 5% increase in Cardano’s open interest over the past 24 hours reinforces the bullish sentiment. This rise in futures contracts suggests that traders are predominantly opening long positions, reflecting confidence in ADA's upward potential.

So, the combination of improved technical metrics, strong investor sentiment, and growing market activity points to a likely continuation of Cardano’s price recovery. If current trends persist, ADA could be on the path to a more significant rebound in the near term.

Will ADA Hit $1 September?

Predicting whether ADA will hit $1 by September requires a thorough analysis of its recent performance and market conditions. Over the past year, Cardano’s price has increased by 35%, reflecting a solid upward trend despite recent volatility. However, it remains significantly down—by 89%—from its all-time high, indicating considerable room for recovery.

Currently, ADA is trading below its 200-day simple moving average, a key technical indicator that suggests the asset is in a longer-term downtrend. This could imply resistance around the $1 level, making it a challenging target to reach in the near term. Additionally, with only 12 green days in the last 30 days (40%), the recent trading pattern indicates a lack of sustained bullish momentum.

Despite these challenges, ADA benefits from high liquidity due to its substantial market cap, positioning it favorably for potential gains. It has outperformed 61% of the top 100 crypto assets over the past year, though it has lagged behind Bitcoin and Ethereum. This relative performance could be a positive sign if broader market conditions improve.

The yearly inflation rate of 5.53%, translating to the creation of 1.87 billion ADA in the past year, suggests that supply dynamics are relatively stable, which might not add significant downward pressure in the short term.

While the factors indicate potential hurdles, Cardano’s liquidity, relative performance, and the recent price increase offer a foundation for optimism. However, given the current technical indicators and recent trading patterns, hitting $1 by September will require a substantial and sustained upward shift in market sentiment and trading activity.

cryptoticker.io

cryptoticker.io