Notcoin (NOT), the Telegram-based tap-to-earn project, has seen a decline in whale activity as the altcoin’s price plummets.

Over the past month, NOT large holders have distributed more than they have accumulated due to the altcoin’s double-digit price drop during that period.

Notcoin Whales Flee the Market

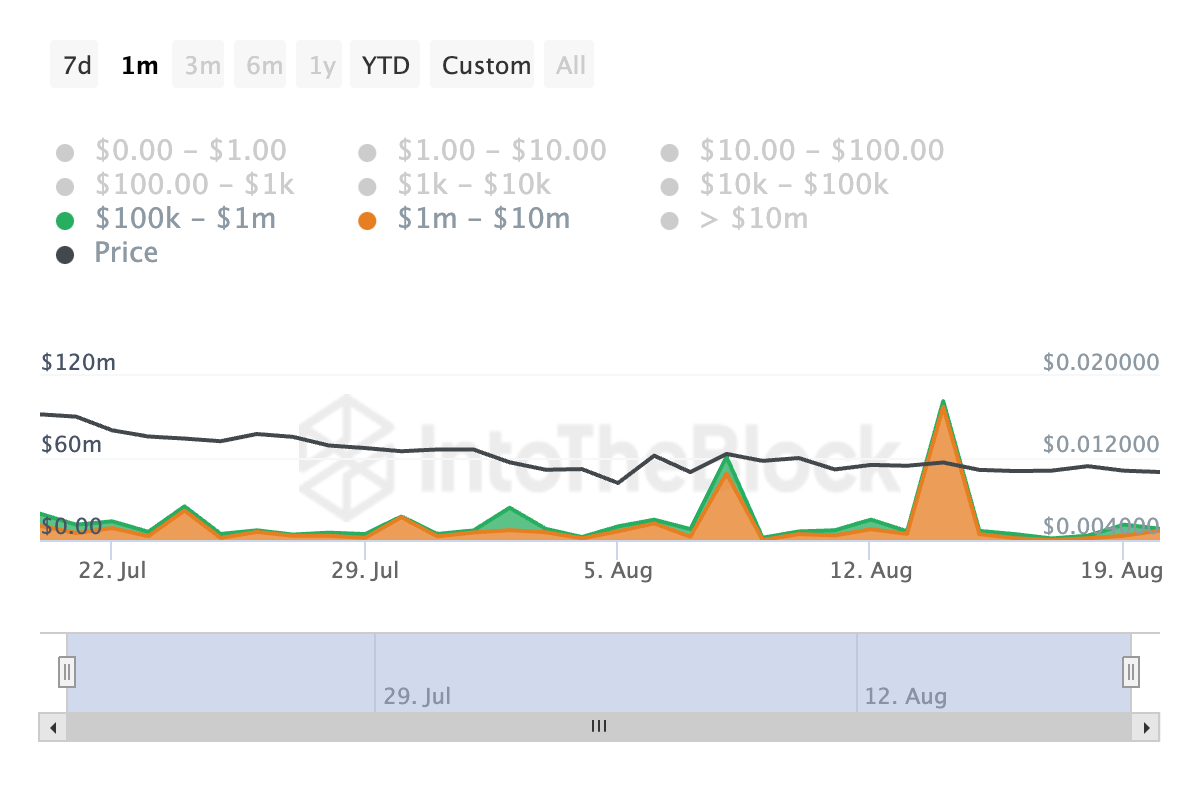

On-chain data indicates a sharp decline in the daily volume of large NOT transactions. According to IntoTheBlock, the volume of NOT transactions valued between $100,000 and $1 million has dropped by 74% over the past month.

Meanwhile, transactions worth between $1 million and $10 million have seen a 21% decline in daily volume during the same period.

A decline in large transaction counts is typically seen as a bearish signal, as it negatively affects the overall perception of the asset. When retail investors notice whale investors reducing their trading activity, confidence in the asset tends to weaken. This often triggers increased selling pressure, leading to sustained price declines.

Confirming the surge in whale selling pressure, NOT’s large holders’ netflow has dropped by 98% over the past 30 days.

Read more: How To Buy Notcoin (NOT) and Everything You Need To Know

Large holders are wallet addresses that hold over 0.1% of an asset’s circulating supply. The large holders’ netflow measures the difference between the coins that whales buy and the amount they sell over a specific period.

When this metric declines, it indicates that an asset’s whales are selling their holdings. This is a bearish signal, suggesting potential selling pressure and an increased risk of a price decline.

NOT Price Prediction: Altcoin Trends Sideways

NOT has been trading within a horizontal channel since August 6, characterized by sideways price movement. This occurs when there’s a relative balance between accumulation and distribution, preventing the asset from trending strongly in either direction.

The technical setup shows that the Relative Strength Index (RSI), a key momentum indicator, has remained flat since August 8. The RSI measures whether an asset is overbought or oversold. NOT’s stable RSI suggests market indecision or consolidation, indicating the asset is neither overbought nor oversold.

Furthermore, NOT’s Average True Range (ATR), which gauges market volatility, has been trending downward since August 8, reinforcing the consolidation phase. A declining ATR indicates reduced market volatility, suggesting the asset is less prone to price swings. As of now, NOT’s ATR is 0.0011.

If NOT breaks out of its narrow range to the upside, it could rally toward $0.13. Conversely, if it falls below the lower boundary of its horizontal channel, the price might drop further to $0.008.

beincrypto.com

beincrypto.com