The price of the Base-based meme coin Brett ($BRETT) surged by 36% in the past 24 hours after being listed on the leading South Korean cryptocurrency exchange Upbit on Tuesday.

At press time, the token is trading at $0.10 and appears positioned for further gains.

Brett Rally is Supported by Strong Buying Pressure

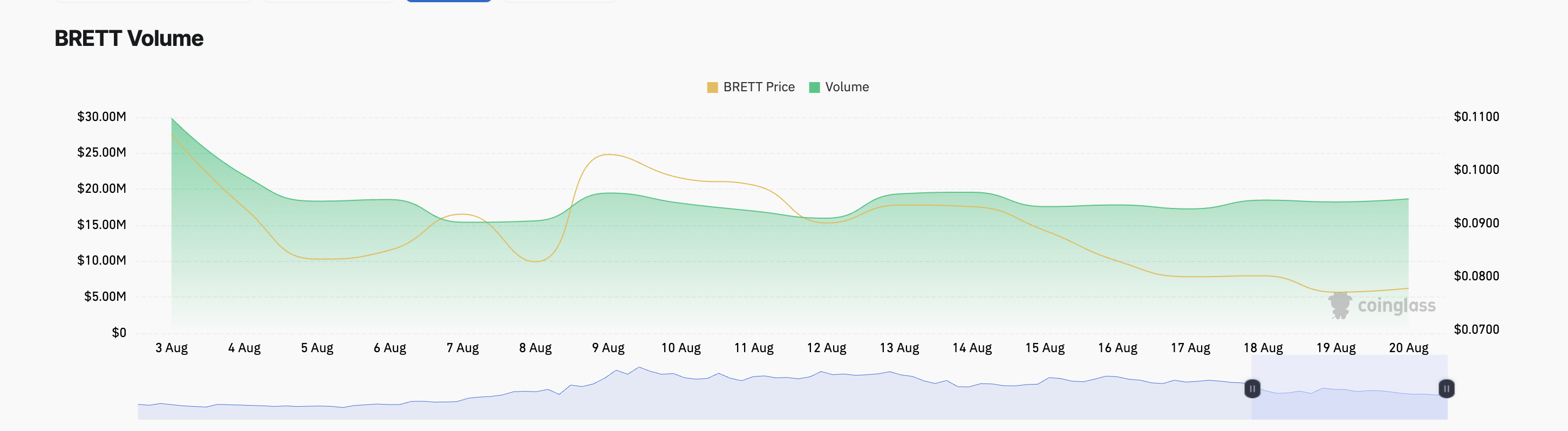

$BRETT’s 36% price rally has been accompanied by a surge in trading volume, reaching $66 million as of this writing — a 193% increase in the past 24 hours.

When both price and trading volume spike together, it typically signals strong market activity and genuine interest in the asset. This suggests that the price rally is supported by market demand rather than speculative trading alone.

Further confirming the increased demand for $BRETT, its Relative Strength Index (RSI) is trending upward and is close to breaking above the neutral 50 line. As of this writing, the RSI stands at 49.39, indicating growing bullish momentum.

This indicator measures an asset’s oversold and overbought conditions. As $BRETT’s RSI trends upward toward the 50 line, it indicates that the meme coin’s price is gaining momentum and that selling pressure is easing.

If the RSI successfully crosses above 50 and maintains its upward trend, it reinforces the bullish signal, indicating increasing buying pressure.

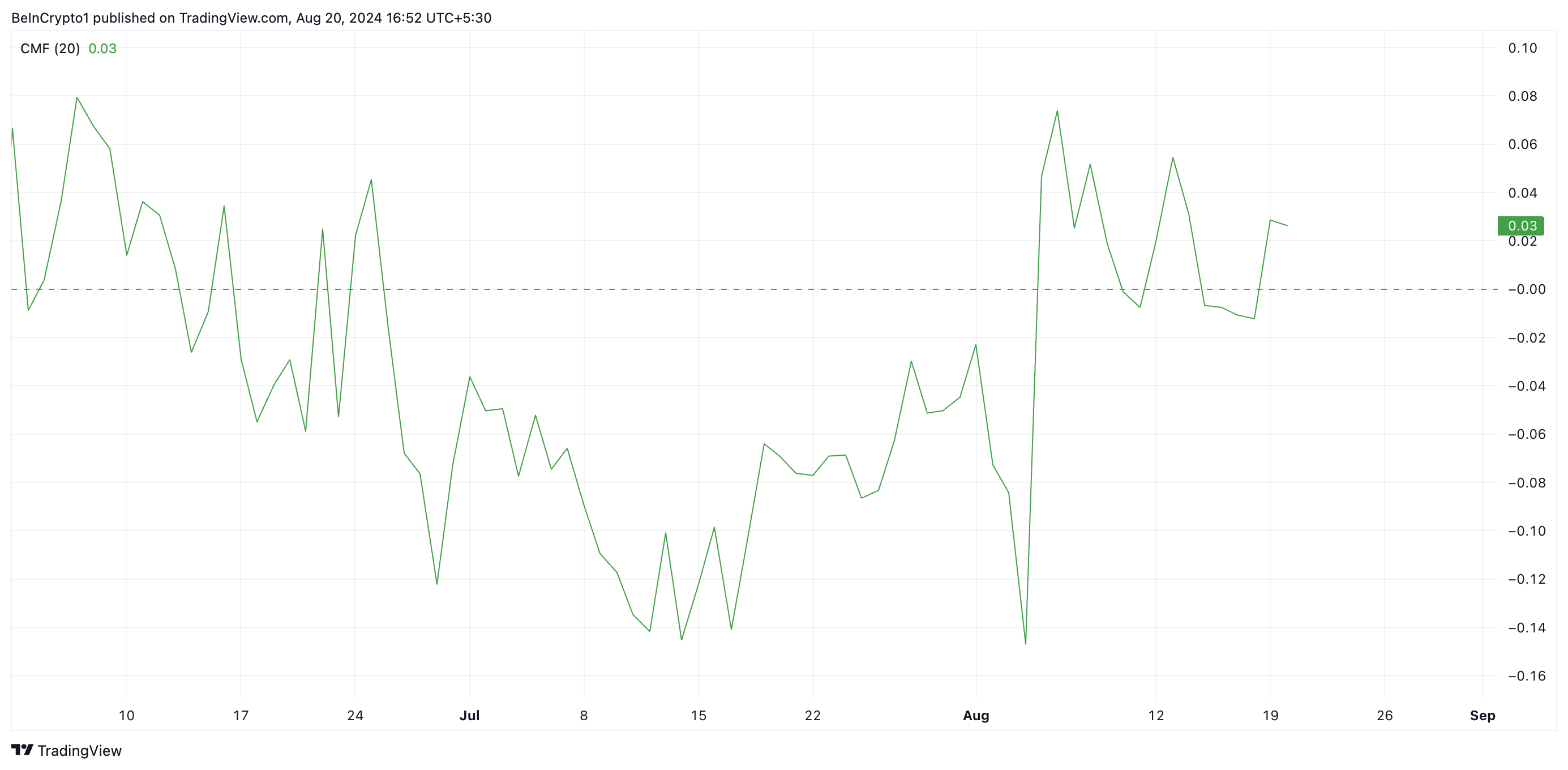

Additionally, the token’s Chaikin Money Flow (CMF) is currently above the center line at 0.04. The CMF tracks the flow of money into and out of an asset, and a value above zero suggests market strength, indicating a liquidity inflow.

Read more: 7 Best Base Chain Meme Coins to Watch in June 2024

Increasing price along with a rising CMF suggests that strong buy volume is supporting the uptrend. This indicates that the rally is backed by significant market participation, making the uptrend more likely to be sustained.

$BRETT Price Prediction: Derivatives Traders Seek to Gain From Surge

The trend is similar in $BRETT’s derivatives market, where trading volume has surged by 282% in the past 24 hours.

Additionally, the meme coin’s open interest has jumped by 112%, reaching $37 million during the review period. Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that remain unsettled.

A spike in open interest indicates that more traders are opening new positions, which is generally seen as a bullish signal. If $BRETT’s demand gains momentum, its next price target is $0.11.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, any uptick in profit-taking activity will cause $BRETT to shed some of its recent gains. If selling pressure intensifies, its price may drop to $0.90

beincrypto.com

beincrypto.com