Will $AAVE surpass the 78.60% Fibonacci level neckline at $128 for a sprint to $200 this week?

Amidst the recovering market, traders are expecting a bullish week ahead. Among the high-performing altcoins, $AAVE stands prominently, with a breakout rally gaining momentum.

With the support of improving on-chain data, the altcoin is ready for a moonshot. So, should you consider buying $AAVE this week?

$AAVE at 78.60% Fib Level Hits a Crossroads

In the daily chart, $AAVE’s price action reveals a consolidation breakout, signaling the start of a new bullish cycle. Over the past ten days, $AAVE has experienced a 43% surge, driven by a series of 8 bullish daily candles over the past 9 days, reflecting increasing demand.

Notably, a morning star pattern formed at $110, with three consecutive bullish candles resulting in a 16.54% rise since the last bearish candle.

Currently, $AAVE is challenging the 78.60% Fibonacci level at $128.89 and is trading at $129.22, with an intraday gain of 9.33%, hinting at a potential breakout. For the uptrend to continue strongly, buyers need to sustain the closing price above $128.

The rising demand is also reflected in technical indicators, with the MACD showing a surge in positive histograms and a potential golden crossover between the 50-day and 200-day SMAs.

$AAVE Expansion Fuels Upside Potential

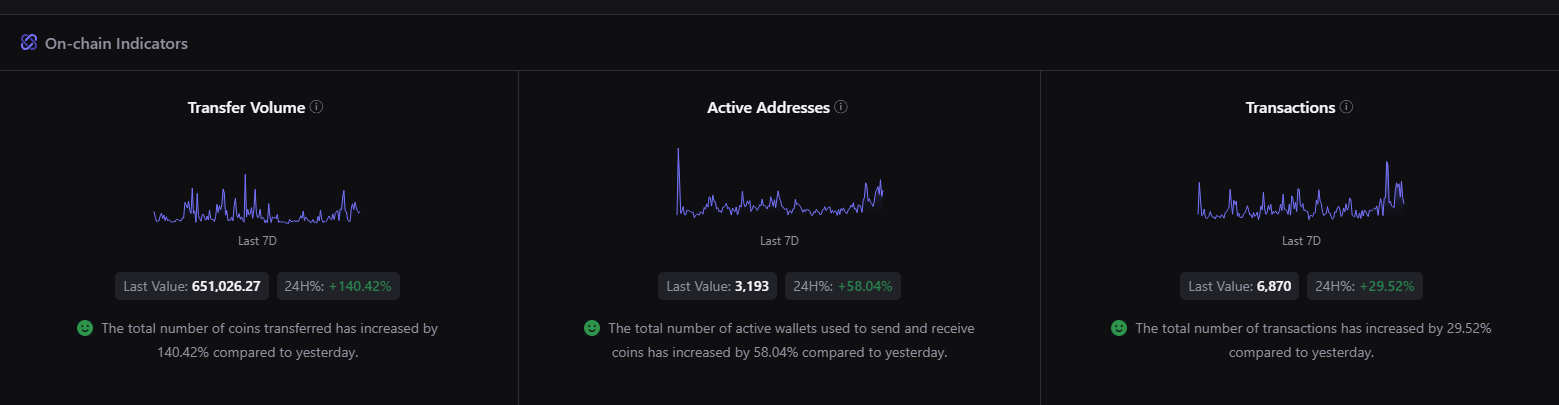

The on-chain data for $AAVE shows a significant uptick in network activity. In support of the high-momentum bull run, $AAVE witnessed a 140.42% increase in transfer volume. Furthermore, a 58.04% rise in active addresses and a 29.52% growth in transactions are seen over the last 24 hours.

The surge in the on-chain data bolsters the bullish trends in the $AAVE price. Further, the conditions are favorable for uptrend continuation, increasing breakout run chances.

Will $AAVE Surpass $150?

A successful breakout above $128 would likely target the $142 level, which peaked in March 2024. Based on Fibonacci levels, the next bullish target could be $182, corresponding to the 1.618% Fibonacci level.

Conversely, a minor pullback to $120 or $110 remains possible.

thecryptobasic.com

thecryptobasic.com