Avalanche ($AVAX) has continued to display resilience, experiencing an impressive 5% surge over the past week.

This upward trend follows a significant market downturn on August 5, which led to the liquidation of over $1 billion in leveraged positions. $AVAX, now trading around $22, previously experienced resistance at this level but shows no nearby on-chain obstacles.

Current market conditions suggest $AVAX’s future movement depends on broader sentiment, with optimism potentially driving the price towards $30.

Key Price Levels

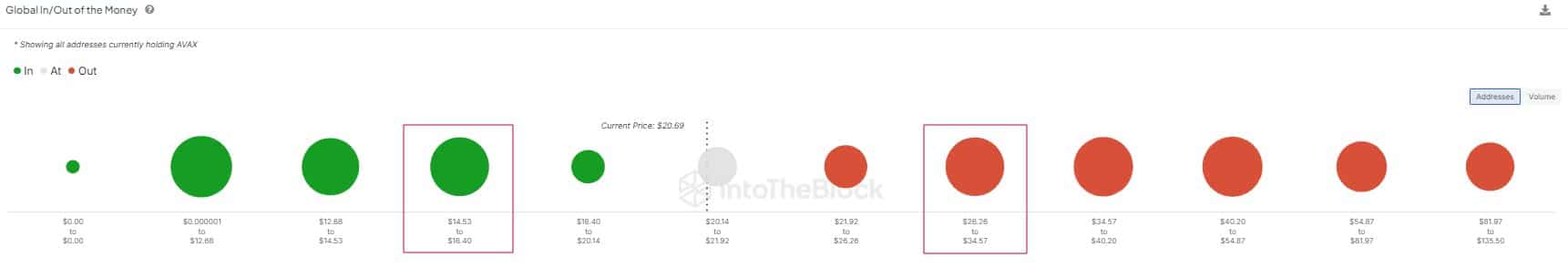

Notably, data from IntoTheBlock offers insights into $AVAX holders’ positions. Address activity highlights the importance of specific price ranges. For instance, a cluster of addresses at the $14.53 to $18.40 range remains in profit, suggesting strong accumulation at these levels.

Another significant accumulation exists between $18.40 and $20.14, where many addresses are marginally in profit.

This suggests that this range may act as a support level in the event of a price decline. Interestingly, the next price range of $21.92 to $26.26 sees more addresses at a loss, indicating that it could serve as resistance as those holders may exit at breakeven.

Possible Targets

However, higher price levels, such as $26.26 to $34.57, reveal even more addresses at a loss, indicating substantial accumulation during that period. These levels could further resist upward movement, as holders look to minimize losses.

Nonetheless, prices above $34.57 see fewer addresses involved, indicating less trading activity at higher levels, which could lessen the resistance during a more extended rally.

The analyst’s assertion that $AVAX could climb to $30 if market sentiment remains positive is plausible, given the chart shows significant resistance clusters between $26.26 and $34.57.

However, if sentiment worsens, the potential for a drop to $16 also seems likely based on the support levels visualized in the chart.

Open Interest Increases

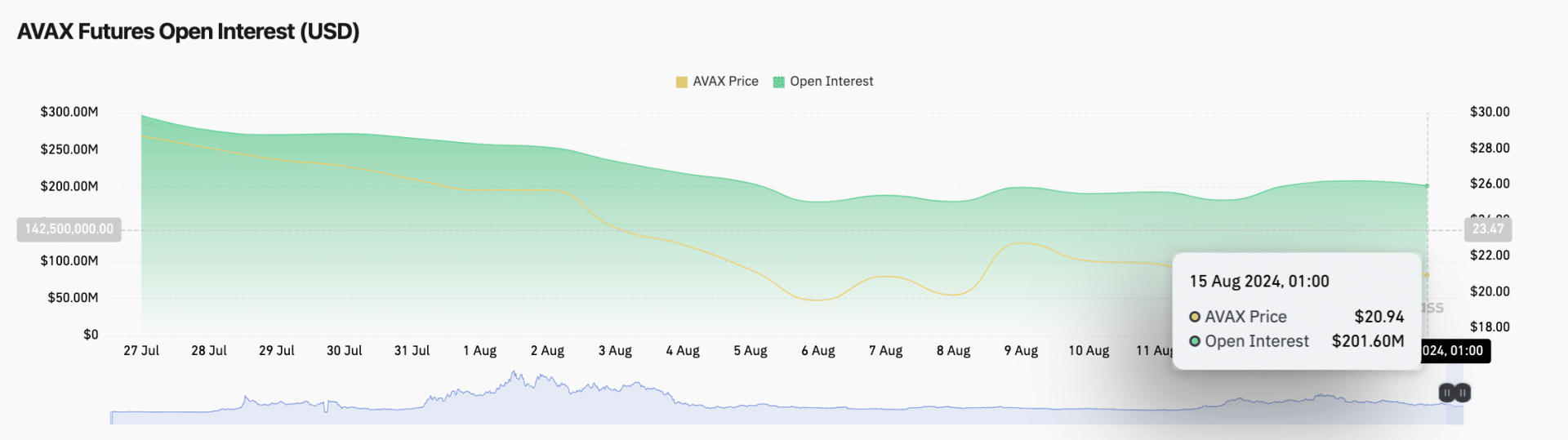

Elsewhere, a rise in $AVAX’s Open Interest suggests renewed confidence in the asset. Following the release of the U.S. Bureau of Labor Statistics’ inflation data on August 14, Open Interest in $AVAX jumped from $182 million to $201.6 million by August 15.

The 10.77% increase in Open Interestduring a period of price consolidation, suggests that a significant price move may be imminent.

Two key factors are driving this: growing trader confidence and the possibility of a short squeeze. If bears fail to push $AVAX below critical support levels, bulls may regain control and drive prices higher.

thecryptobasic.com

thecryptobasic.com