Tron’s ($TRX) price is in an uptrend, but the broader market picture is a mix of demand and profit-taking.

Whales are the perpetrators of the latter condition as their move could shortstop the ongoing rise in price.

Tron Whales Choose to Sell

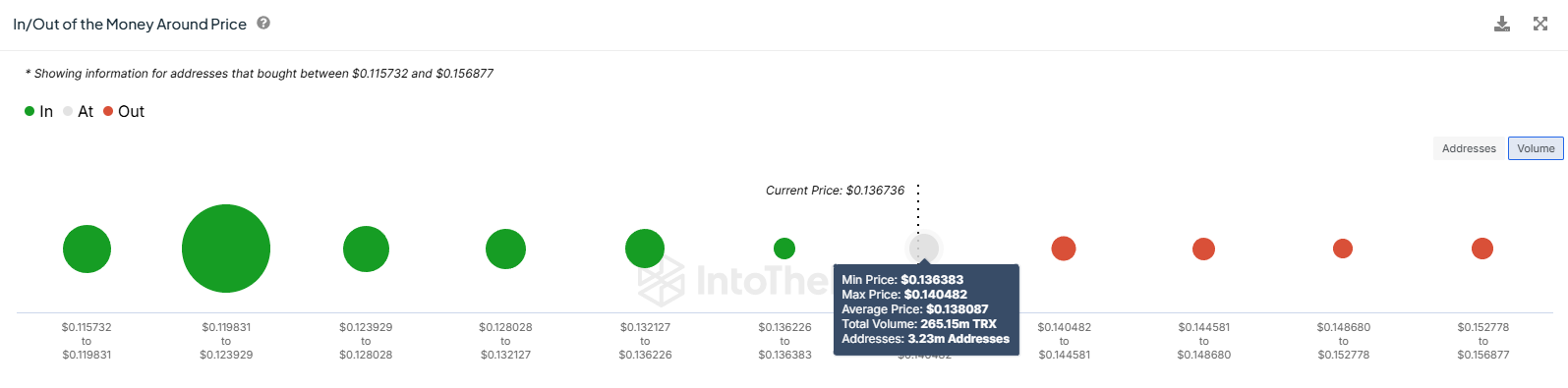

Tron’s price could fail to breach and close above the resistance at $0.137, most likely due to whales’ selling. These investors are highly influential, and their accumulation can lead to rallies, whereas selling may trigger a decline.

In the last 72 hours alone, addresses holding between $1 million to $10 million worth of $TRX have sold off over $23 million of their holdings. Their total supply now stands at $601 million, down from $624 million.

Read More: What Is TRON ($TRX) and How Does It Work?

This rapid selling was profit-taking as $TRX has been noting an uptrend.

This could prove to be harmful to the token and its investors, who have been on a streak of profits for the last couple of days. Tron’s price is already on track to breach $0.137, and doing so would enable a rise to $0.144.

According to the Global In/Out of the Money (GIOM) indicator, Tron investors bought over 336 million $TRX in this range. The supply is collectively worth over $45 million and would become profitable once the year-to-date high is reached.

$TRX Price Prediction: A New High Ahead

Tron’s price, at $0.136, has been the result of the recent 7.6% rally. While investors expect a breach of $0.137, the chances are bleak. If the altcoin does not close above this resistance and flip it into support, it could fall back down.

The whales’ selling could further intensify this bearishness, sending $TRX down to the 61.8% Fibonacci Retracement level. This line is also known as the bull market support floor and could prevent any further drawdown.

Read More: TRON ($TRX) Price Prediction 2024/2025/2030

But if demand dominates the impact of whales’ actions, it could rise beyond $0.137. Coinciding with the 78.6% Fib line, a bounce off this level could send Tron’s price to $0.144, the year-to-date high. Testing and potentially breaching it would invalidate the bearish thesis and establish a new 2024 high.

beincrypto.com

beincrypto.com