Binance Coin ($BNB) has been trading within an ascending triangle pattern since August 6, following a sharp drop to a five-month low of $463.97 during the market decline on August 5.

Currently priced at $522.63, $BNB has experienced a 16% price increase since that dip.

Binance Coin Attempts to Break Resistance

An ascending triangle pattern forms when an asset’s price moves within a range defined by a flat horizontal resistance line above and a rising support line below. This pattern signals bullish momentum, suggesting that buyers are gaining strength and pushing the price higher, while sellers maintain steady resistance.

Since $BNB started trading within this pattern, it has encountered resistance at $524, a level it now aims to break. If $BNB breaks above this resistance, it would indicate that buying pressure has surpassed selling activity, potentially leading to a continued uptrend.

Supporting this outlook are readings from $BNB’s technical indicators. The Parabolic Stop and Reverse (SAR) indicator, for instance, shows a strong bullish bias, as the dots currently lie below $BNB’s price.

The Parabolic SAR indicator tracks an asset’s price direction and identifies possible reversal points. When its dots appear below the asset’s price, it indicates an uptrend, suggesting that the asset’s price has been rising and that the growth could continue.

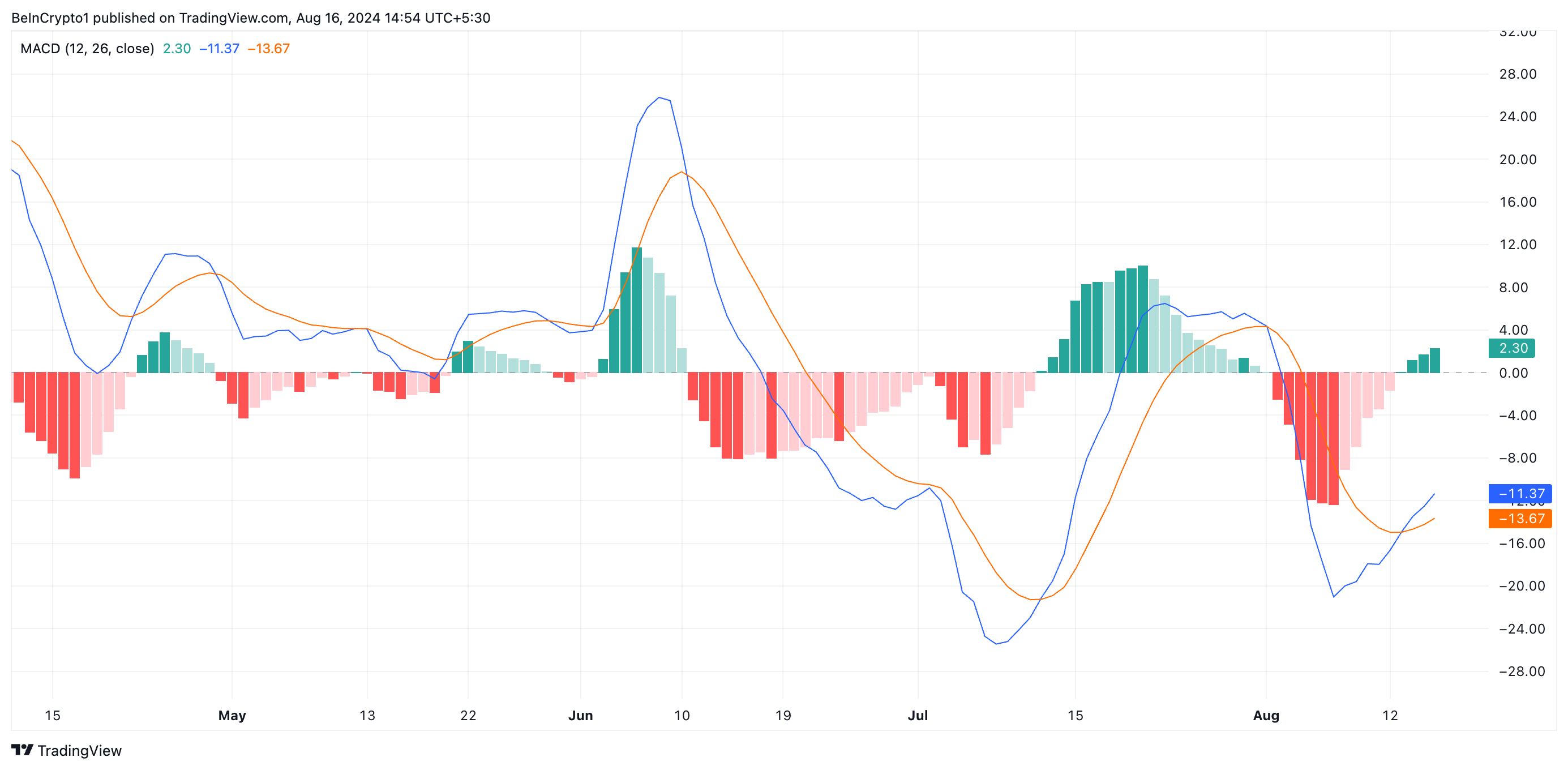

Additionally, $BNB’s Moving Average Convergence Divergence (MACD) indicator reflects stronger buying pressure than selling activity. Currently, the MACD line (blue) is positioned above the signal line (orange), further confirming bullish momentum.

This means that $BNB’s shorter-term moving average is rising faster than its longer-term moving average. Traders view this as a bullish signal to go long and exit short positions.

$BNB Price Prediction: a Rally to $561 or a Drop to $476

If buying pressure remains strong enough to push $BNB above the horizontal resistance at $524, its price could climb to $561.09, a key target within the ascending triangle pattern. This would signal that buyers have decisively overcome selling pressure, allowing the uptrend to continue.

However, a decline in demand at this resistance level could cause $BNB’s price to slip below $500, potentially triggering further selling. If bearish momentum intensifies, $BNB could face a deeper pullback to $476.32, a critical support level where buyers might attempt to regain control.

beincrypto.com

beincrypto.com