This week, the meme coins market has witnessed a noticeable decline in activity, with the sector’s capitalization dropping 5% over the past five days.

Many meme assets have seen their value fall during this time, with several prominent tokens suffering double-digit losses.

Dogwifhat ($WIF) Records Losses as Short Traders Take Over

$WIF has experienced the steepest decline among the top five meme assets by market capitalization this past week. Trading at $1.48 at press time, the altcoin’s value has dropped by 20% during this period. On Thursday, the meme coin hit a weekly low of $1.45 before rebounding slightly.

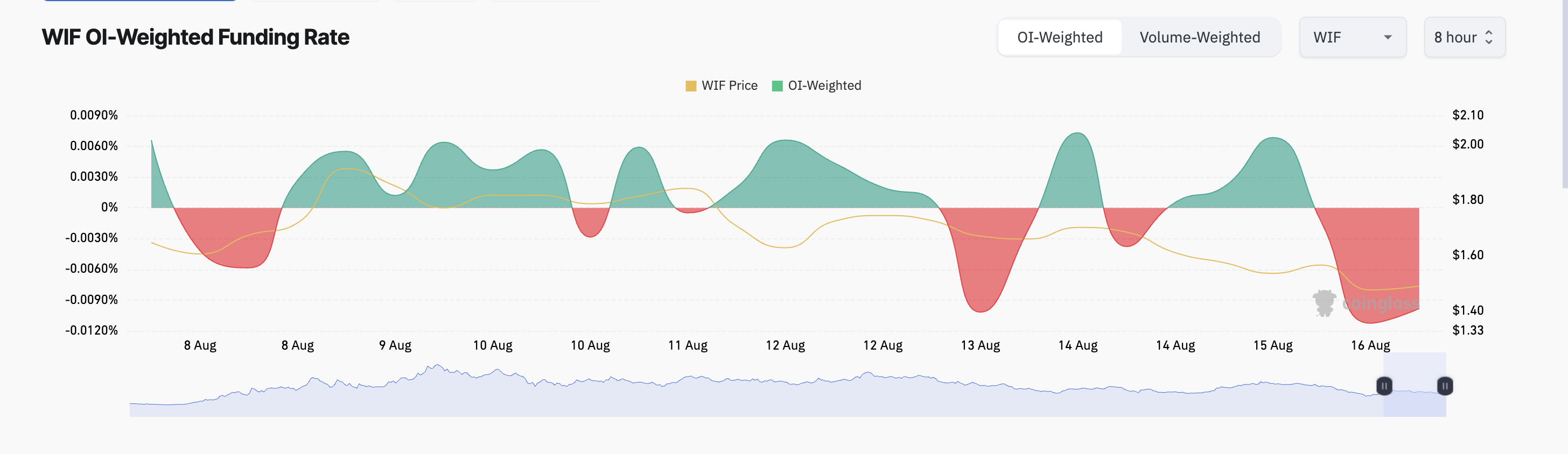

$WIF’s downtrend has fueled a rise in demand for short positions in its derivatives market. Coinglass data shows that $WIF’s funding rates have remained mostly negative throughout the week, currently sitting at -0.0098%.

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are negative, more traders are betting on a price decline than those buying and hoping for a rally.

In the spot market, demand for $WIF has also declined significantly. Its Relative Strength Index (RSI) is trending downward at 38.22, indicating that selling pressure is currently stronger than token accumulation.

Read more: How To Buy Dogwifhat ($WIF) and Everything Else To Know

If this downtrend continues, $WIF’s value could drop further to $1.07. However, a shift in market sentiment and a spike in demand could push its price up to $1.96.

Pepe ($PEPE) Risks 23% Fall as Selling Pressure Mounts

The frog-themed coin Pepe is currently trading at $0.0000075, with its value down by 14%. This week, $PEPE’s Accumulation/Distribution (A/D) Line has been in a consistent downtrend. At 780.42 trillion at press time, it has dropped by 5% over the past seven days.

The A/D Line tracks money flow into or out of an asset, indicating whether it is being accumulated or distributed. A declining A/D Line signals that selling pressure is outweighing buying activity — a bearish indicator that suggests further price drops.

Adding to this outlook is $PEPE’s decreasing Chaikin Money Flow (CMF). Currently at -0.18 and below zero, the CMF is also trending downward. A falling price paired with a declining CMF confirms rising selling pressure, indicating that more traders are offloading $PEPE than accumulating it.

Read more: Pepe ($PEPE) Price Prediction 2024/2025/2030

If $PEPE’s buying pressure remains low, its price may fall 23% to trade at $0.0000058. This bearish projection would be invalidated if the meme coin saw a demand spike, pushing its price to $0.0000085.

Bonk ($BONK) Poised for a “Death Cross”

A one-day chart analysis of $BONK reveals the potential formation of a “death cross,” where the 50-day simple moving average (SMA) (blue line) is nearing a cross below the 200-day SMA (yellow line).

A “death cross” occurs when the 50-day SMA dips below the 200-day SMA, signaling a bearish trend. This suggests that $BONK’s short-term rally is weakening and may be shifting toward a downtrend. Traders often view this pattern as a sell signal, prompting them to exit long positions and consider taking short positions.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

At press time, $BONK trades at $0.000018, having declined 11% this week. If selling pressure mounts as the “death cross” forms, its price will drop to $0.0000015. However, if the moving averages change course due to any rally in demand, it may push $BONK’s price up to $0.000022.

beincrypto.com

beincrypto.com