Cardano Posts 3-Day Consolidation at $0.33

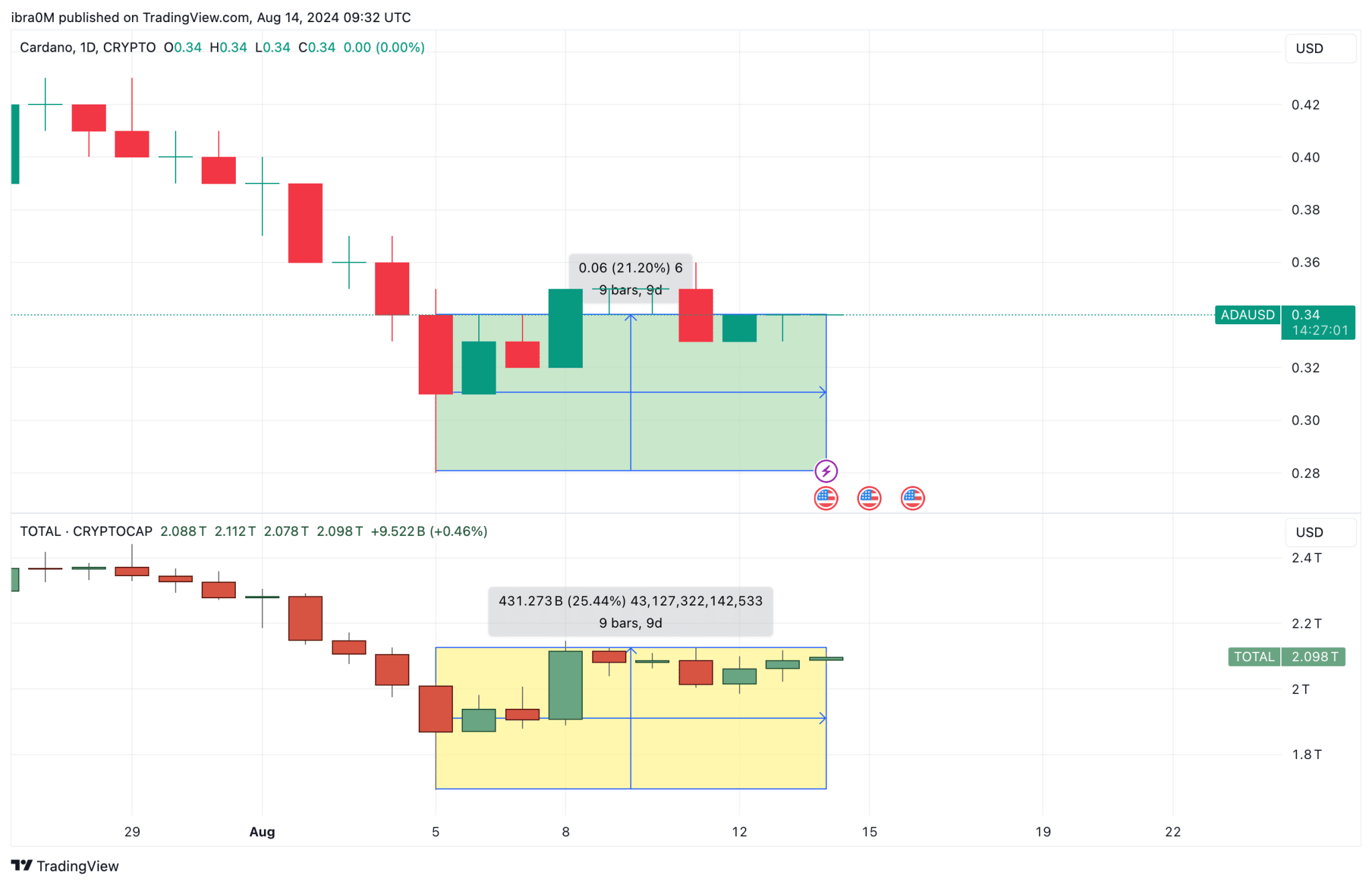

ADA, the native coin of the Cardano blockchain, has underperformed the broader cryptocurrency market over the past week. The global cryptocurrency market cap surged by over 25.44%, adding more than $431 billion since August 5, fueled by bullish news such as Solana ETFs being approved in Brazil and Russia legalizing crypto mining.

Despite these market-wide gains, Cardano’s price action has been lackluster. ADA’s price rose modestly from $0.28 to $0.33, achieving just a 21% gain. Over the past three days, ADA’s price has stagnated around the $0.33 level, yet recent data suggests that demand for ADA is on the rise.

ADA Witnessing Market Demand Surge

After three days of price stagnation, growing market demand could soon propel ADA into a significant breakout. On-chain data reveals an influx of buy orders for ADA this week, which could be a precursor to a bullish move.

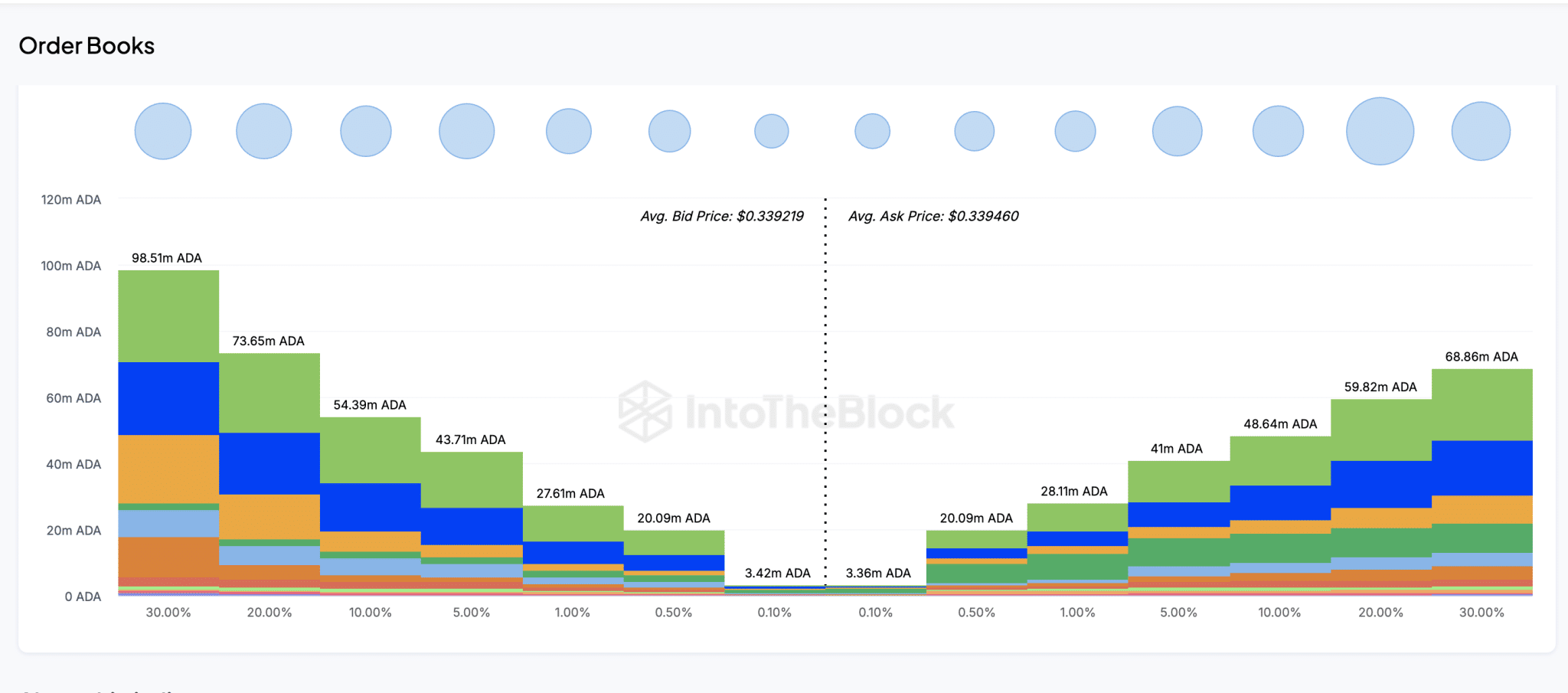

Exchange Order Books, which track buy and sell orders, typically show bullish signals when buy orders outweigh sell orders.

The chart above indicates total buy orders amounting to 198.86 million ADA, compared to 161.42 million ADA in sell orders. This excess demand, valued at approximately $67.5 million at the current average price, underscores the bulls’ growing influence in the market.

Two factors suggest that this could be bullish for ADA in the coming days. First, the sheer volume of buy orders indicates strong market confidence in ADA’s potential upside. Second, the accumulation of ADA at current levels could create a solid support base, making it more difficult for bears to push the price lower.

ADA Price Forecast: $0.35 Target in Sight?

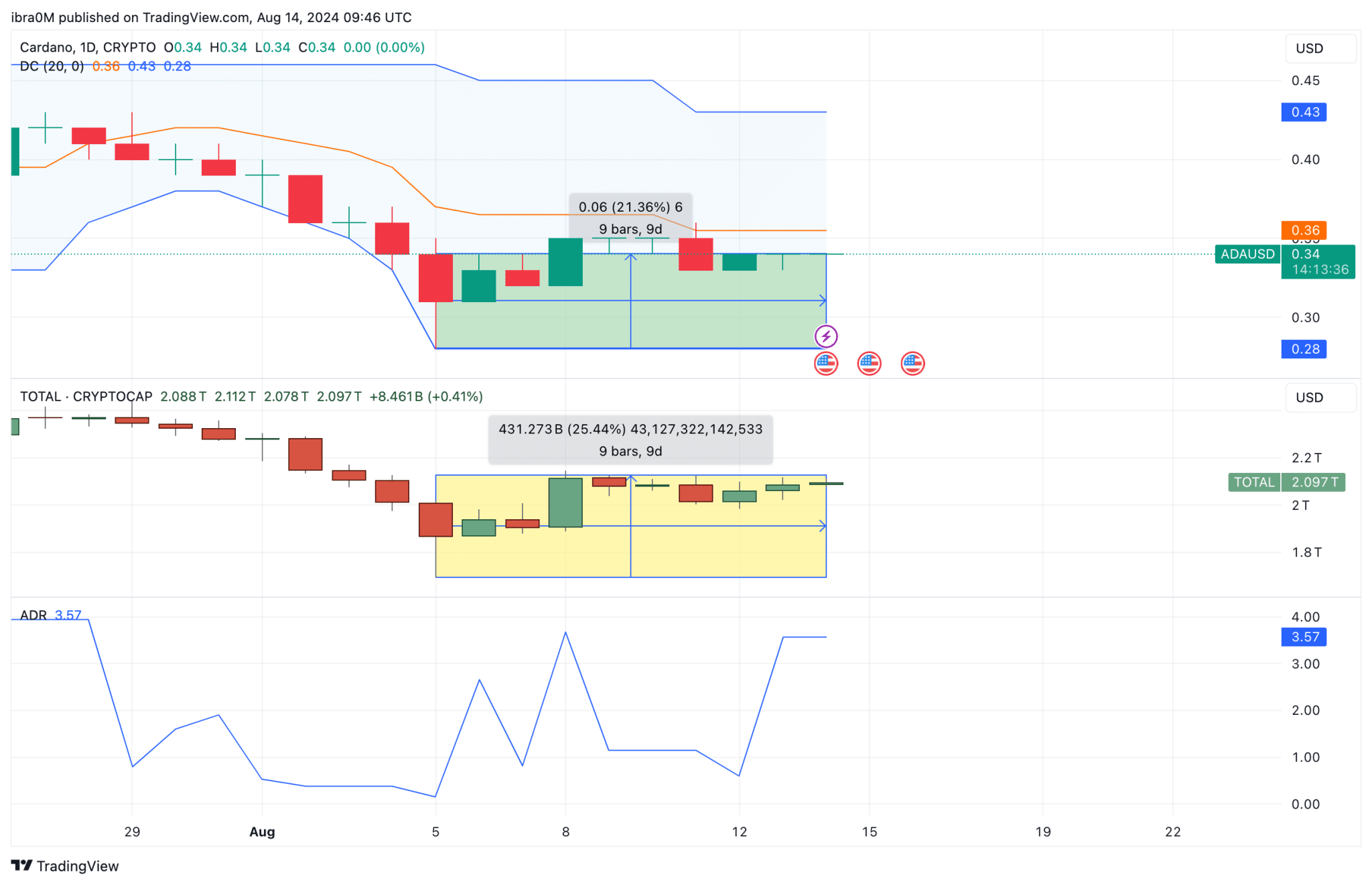

Although Cardano has been consolidating, technical indicators suggest a bullish outlook. The Keltner Channels indicator highlights that ADA is trading near its lower band, which often acts as a support level. If the price can maintain above this lower band, it could rise toward the middle band at $0.35, which serves as the next key resistance level.

A break above $0.35 would likely attract more buying interest, potentially driving ADA toward the upper Keltner band at $0.43. However, should ADA fail to hold its current support at $0.28, a retest of this level could occur before any upward movement.

In conclusion, while ADA’s recent performance has been underwhelming, growing market demand and bullish technical indicators suggest that a breakout to $0.35 is achievable in the near term.

thecryptobasic.com

thecryptobasic.com