The price of Maker (MKR), the governance token of the MakerDAO protocol, has increased by 7.47% in the last 24 hours. This increase appeared after Grayscale revealed the launch of the MakerDAO Investment Trust on Tuesday.

Following the disclosure, Maker is experiencing other positive changes, which this analysis will discuss.

New Investment Vehicle Drives Frenzy for MakerDAO

On August 13, leading crypto asset manager Grayscale announced that it had launched a MakerDAO Trust. This launch is the second consecutive one in a few days after last week’s investment in two other altcoins.

According to the firm, the trust will provide investors with exposure to MKR. In addition, investors will be able to access the on-chain credit protocol and Real-World Assets (RWAs) that the MakerDAO ecosystem offers.

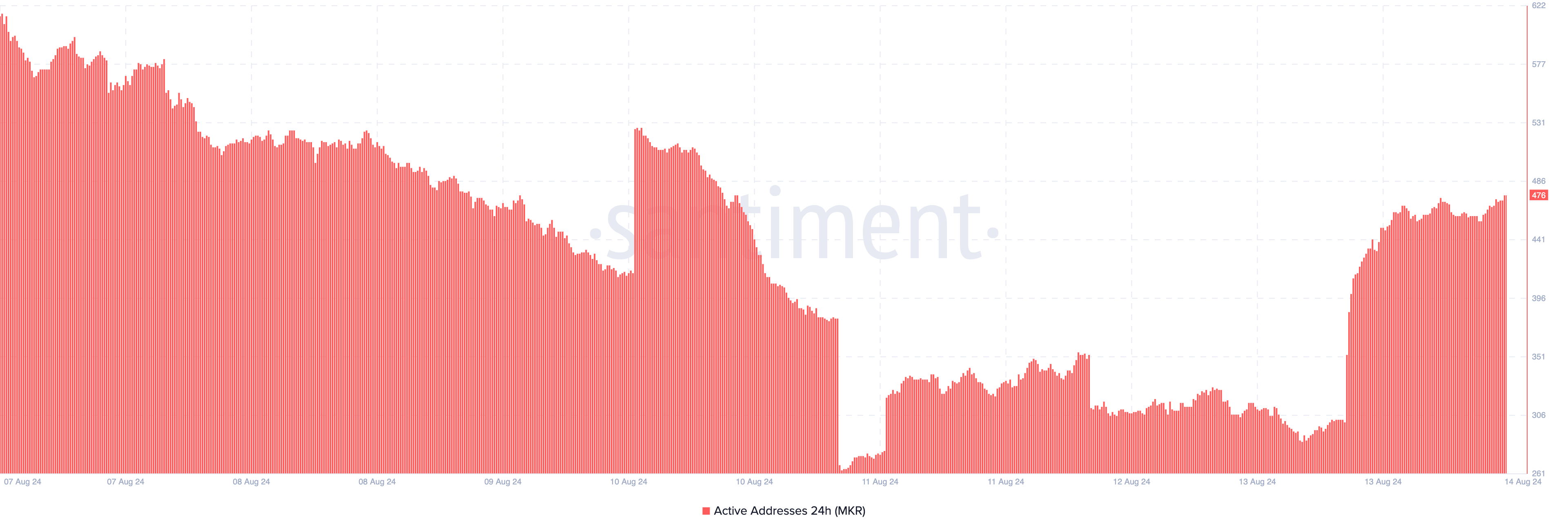

However, MKR’s price is not the only metric affected by the development. On-chain data from Santiment shows a notable increase in active addresses on the network.

Read More: What Are Tokenized Real-World Assets (RWA)?

Active addresses measure the level of user engagement on a blockchain. If the metric increases, users are increasingly involved in sending and receiving tokens on a network. However, a decrease implies a lack of buying and selling among cryptocurrency holders.

Therefore, it appears that MKR’s price increase is not just related to Grayscale investment but also broader market interest. If sustained or improved, MKR’s price may benefit from it as the hike continues

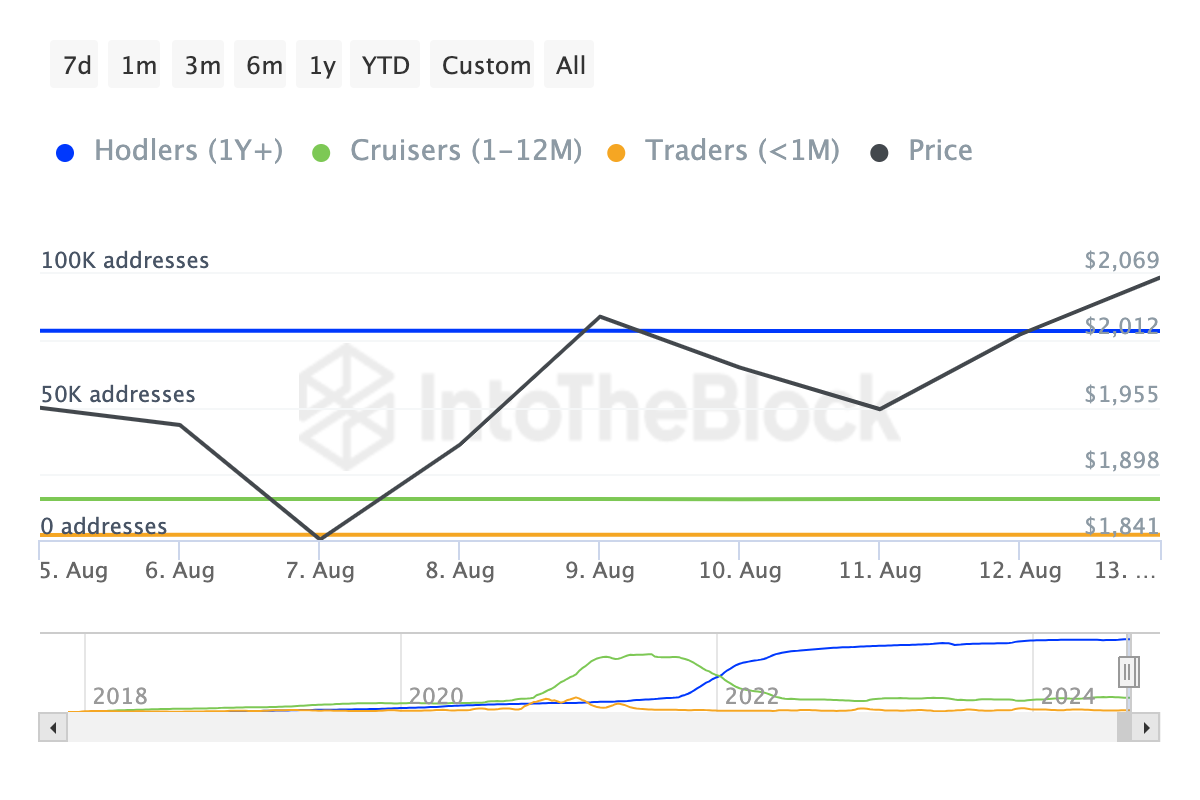

Beyond this, data from IntoTheBlock reveals an increase in the number of short-term holders. Specifically, a look at the Addresses by Time Held shows a double-digit increase in the number of addresses that bought the token within the last 30 days.

Typically, a rise in accumulation within this period indicates confidence in a cryptocurrency’s short-term potential. A decrease will, however, suggest the opposite.

Therefore, the rise also represents an increase in buying pressure. Like the impact of the active addresses above, an increase in this figure could be bullish for MKR.

MKR Price Prediction: $2,500 May Be Next

Before MKR’s price recently rebounded to $2,127, the token experienced a 38% decline, dropping as low as $1,716. According to the Relative Strength Index (RSI), at that point, MKR was oversold.

The RSI measures momentum using the speed and size of price changes. A reading of 70.00 or above means an asset is overbought, while an RSI reading of 30.00 or below indicates that it is oversold.

On August 7, the indicator’s rating was 26.33. But a rise to 44.07 at press time suggests buyers are back and accumulating. If sustained, this could drive the price higher. To validate the bullish bias, the RSI must surpass the neutral line at 50.00.

Once this happens, MKR can surpass the resistance situated at $2,184.82. If this happens, the next level for the token to reach may be between $2,354.73 and $2,537.86.

Read More: Maker (MKR) Price Prediction 2023/2025/2030

However, invalidation may occur if activity on MakerDAO’s network drops. It could also occur if bulls retreat from buying the MKR dip. If this is the case, the price may retrace to $1991.46.

beincrypto.com

beincrypto.com