$AAVE ranked 49th as per market cap size. As per the Chainbroker, the fundamentals are highly rated as 8.55 out of 10. $AAVE price action has been a tad bit suspicious though, here’s how.

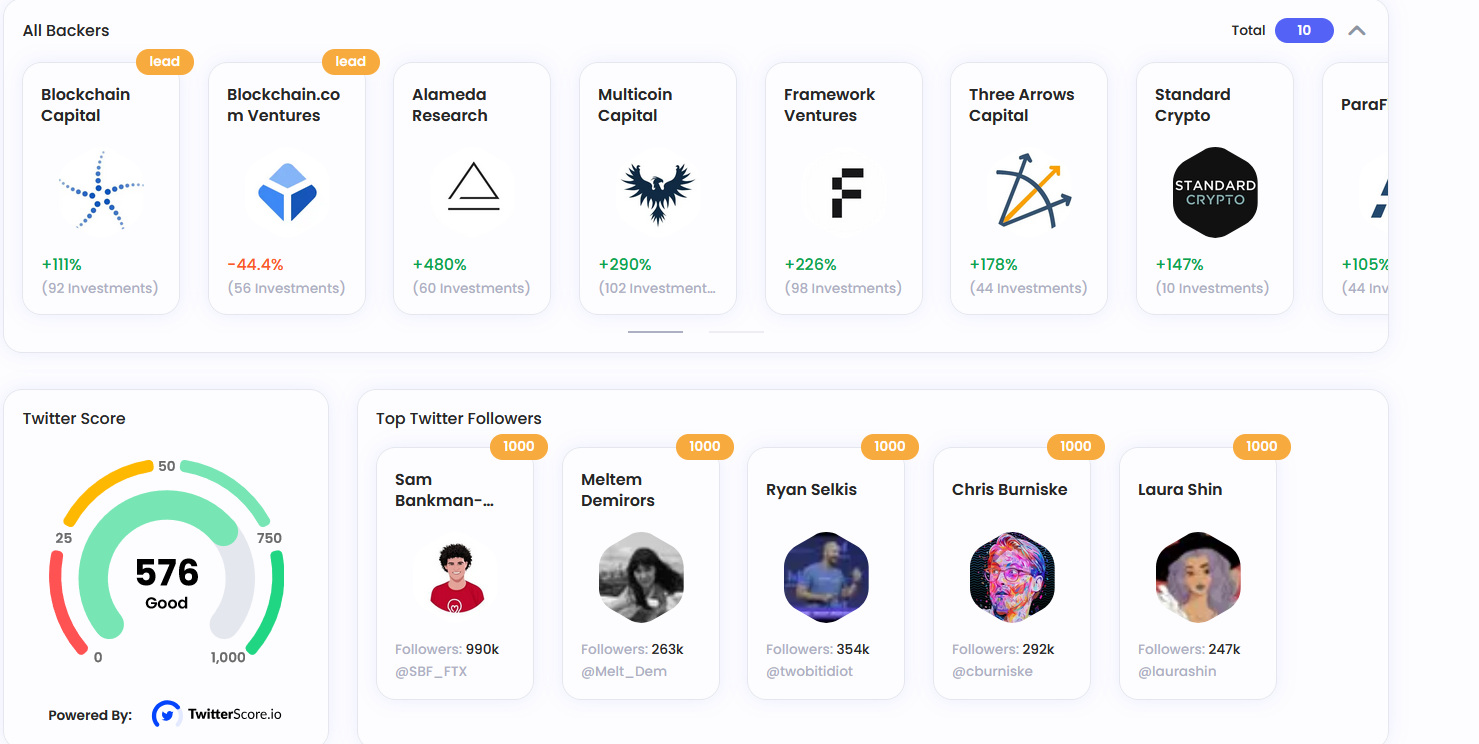

Meanwhile, it has strong backing from various organizations, who have made multifold investments in the asset. The most popular backers are @Blockchain Capital, @ Blockchain.com Ventures, and a few more.

Even the asset happens to be socially active, too, with a Twitter score exceeding 576 and significant followers like @Sam Bankman and others.

What Does $AAVE Price Action Signify?

As of writing, the $AAVE managed to advance 6% but has been facing a tough time beating the 50-day and 200-day EMA bands.

$AAVE price sawmore than 27% with a major spike from the $90 support over the last week.

The investors who have aped larger quantities have been waiting for $AAVE to pierce through the EMA bands for a quick rise in the northward direction.

This support has been tested many times in $AAVE and has proved resilient on the daily chart.

Overall, the scenario looks like one of range-trapped movements. Where its price has shown movement in the $80 to $120 range in the past 12 months (at press time).

On July 5th, the price rose with a liquidity grab after a major decline that led to beneath $70, but bulls regained from there and displayed more than 40% gains in the past 40 days. Where, the $AAVE price last traded at $95.94, with 1.43 Billion market capitalization, and a spot volume inflow of $120.91 Million

What’s The Forecast For $AAVE?

Since the $AAVE price has shown a run from the range’s lower boundary to its higher border, mostly. Then, in the bullish case, the short-term rise could lead towards the upper boundary, delighting traders and cruisers in the asset.

However, the price has been showing a struggle at the upper border, and history has been evidence of it. Based on such a hypothesis, once it clears by piercing it, the bullish arrow could pierce the hurdle, which could lead to capturing the $134.01 and $145.01 price targets.

But, $AAVE Dipping below $80.01 would mean deterioration piercing below the lower border of the range. Where $60 could be a support to watch out for.

Indicators, at the time of writing, showcased mixed signals, while price has been suppressed by both the 50-day and 200-day EMA bands, which has been stopping growth.

Meanwhile, the MACD has formed a bearish cross above the zero line with a histogram negative at -1.50. The RSI was above the median line at 47.69.

thecoinrepublic.com

thecoinrepublic.com