The MANTRA (OM) price has recently seen a downtick and retested the $1 mark. It decreased over 26% from its all-time high (ATH) mark in the last two weeks. Due to the broader market selloff, the token faced profit booking at the highs.

Undoubtedly, OM token has been one of the best-performing crypto assets in 2024, having risen over 5800% in the last ten months. This crypto asset recorded its ATH mark of $1.41 On July 22, 2024.

Despite the significant rebound in the crypto market, Mantra (OM) price still suffered lower volume buying activity at press time. It hovered around the $1 mark. However, the token has tightly held the cluster and consolidated throughout the week.

MANTRA (OM) Price Faces Profit Booking

MANTRA has demonstrated resilience in the face of recent market turbulence and held the $1 mark, the previous resistance. Following a retracement of 30%, OM price just made a higher low formation, and the bulls were eyeing to flip the gains ahead.

When writing, the MANTRA price traded at $1.03 with an intraday surge of 6.98%, depicting bullish sentiment on the chart. However, the trading volume dropped over 34% to $27.06 Million in the past 24 hours, conveying lower investors optimism.

@DaanCrypto, in his tweet, mentioned that OM is one of the crypto assets that remained stable amid the sharp volatility in the market and held the bullish sentiment.

$OM One of the few coins that was able to hold on to its bullish market structure throughout the recent pain in the market.

— Daan Crypto Trades (@DaanCrypto) August 9, 2024

One of the RWA leaders and one I think will continue to do well when the market picks back up.

$0.95 level has been important as can be seen. Would be… pic.twitter.com/ptwbANUqrI

The Relative Strength Index (RSI) curve dropped to the oversold region and directed a negative divergence. That conveyed a further price decline can be seen ahead. Likewise, the CMF indicator represents a negative value of -0.08, reflecting a significant selling pressure.

Total Value Locked (TVL) Noted a Rise

Amidst the uptrend continuation, its Total Value locked (TVL) showed a significant rise from the start of 2024. This significant spike in TVL highlighted that increased capital locked into DeFi protocols.

That also highlighted an increment in liquidity and higher popularity, which might influence the price rise. The OM token had a TVL of $1.86 million with a liquidity of $3.75 Million at the time of writing.

Weighted Sentiment Data Stayed on a Positive Note

The Weighted Sentiment data projects the positive sentiment among the investors, as the value spiked above the zero line to the positive region. It implies that investors and traders have looked confident and will likely accumulate the token price ahead.

Similarly, the social dominance data shot up over 22% to 0.234%, revealing that investors have started chattering for OM and anticipating the upcoming pullback. OM gained media buzz and noted increased activity and discussions on the media platforms.

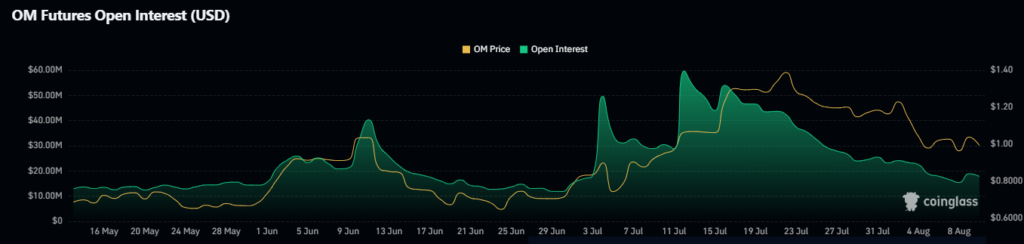

Futures Open Interest (OI) Overview

The Futures Open Interest (OI) data showed a decline of over 3.87% to $16.94 Million in the past 24 hours. Generally, when the price rises and OI decreases, sellers have begun to cover their positions. Thus, it triggers the short covering move.

If the OM price accumulates more gains, it may reach the resistance mark of $1.20, followed by the $1.40 mark ahead.

On the other hand, if the token price sees any retracement ahead, it may retest the immediate support zone of $1, followed by the $0.87 mark in the short term.

thecoinrepublic.com

thecoinrepublic.com