This week, the Kaspa ($KAS) price reversed sharply from the 200-day EMA mark and lifted over 18% of gains. It defied the selloff and re-entered the bullish channel.

With the crypto market bouncing back this week, Bitcoin and other altcoins saw a price recovery. Despite the price recovery, a lack of follow-on buying interest was noted. The token was struggling near the 50-day EMA cluster.

Since the beginning of 2024, the token has formed crystal clear higher high swings. It witnessed a sustained uptrend inside a rising channel.

However, the token has exited the channel due to sharp volatile activity. It has traded below the trendline mark of $0.1800.

With a long tail price rejection from the 200-day EMA near $0.1250, a strong support zone, the Kaspa buyers assert dominance over the neckline and bounce back.

Kaspa $KAS Price at Press Time

At press time, the Kaspa was trading at $0.1656 with an intraday surge of 4.06%, reflecting a minor pullback. It has a monthly return ratio of -2.30% and 243.20% yearly, reflecting a long-term bullish trend.

Per the CoinMarket Cap Data, the token was ranked at 32 with a market cap of $4.02 Billion.

Has Kaspa’s Price Retracement Ended?

Retracing over 20% from its All-Time-High ($ATH) mark of $0.2075, Kaspa found concrete support around the 200-day EMA mark. It pulled back in the last sessions.

Last week was too volatile for Kaspa. It made an $ATH but failed to extend the bullish momentum and faced significant profit booking. Kaspa retested the 61.8% Fib retracement level.

Still, the Relative Strength Index (RSI) curve was floating in the oversold trajectory, and a crossover is still pending. Similarly, the MACD indicator projected the red bars and conveyed a bearish stance.

@Bleeding_Crypto tweeted his bullish view on the Kaspa token.

$KAS By request. Here are my thoughts on $KAS

— Bleeding Crypto (@Bleeding_Crypto) August 7, 2024

I’m bullish….. pic.twitter.com/ZafDirN5hb

After the price retracement from its peak, the $KAS token price suffered from declining volume participation and lower buying interest.

The decline in the investors’ confidence is due to fear across the market. This led the price to hover close to the 50-day EMA mark.

Kaspa Weighted Sentiment Highlighted a Positive Shift

Following the price rebound, the weighted sentiment data noted an upmove. It lifted to the positive region at the 0.575 mark, highlighting an improved investor outlook for $KAS.

Meanwhile, the social dominance curve was projecting the lower investors’ chatter and a declining media buzz on social media platforms.

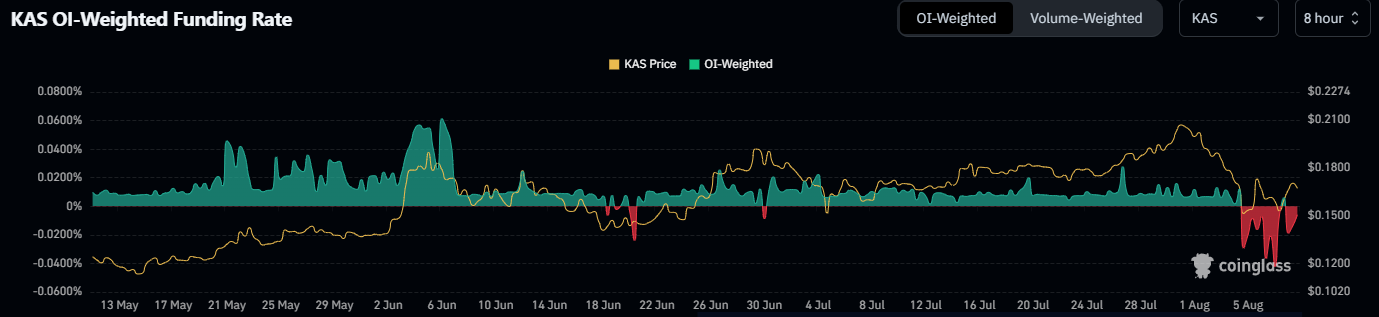

Funding Rates Looked Negative

The token’s funding rate plotted negatively, noting around -0.0059%. This represented that sellers had to pay a fee to buyers, which was a sign of bearishness.

The Open Interest (OI) data and negative funding rates still looked flat. It noted a change of only 0.90% on the short side. Surprisingly, the short liquidations noted a downtick, whereas the long liquidations saw a positive spike.

The token has witnessed an upward price shift, negative funding rates, a lack of OI, and volume metrics. It meant that the $KAS token was not ready for a strong upmove.

If the Kaspa token succeeds in breaking the 50-day EMA mark, it could ascend toward the resistance mark of $0.1860. The $0.2000 mark would follow this.

Conversely, if it fails, it may see a decline and retest the immediate support zone of $0.1400. It would be followed by $0.1270 ahead.

thecoinrepublic.com

thecoinrepublic.com