The dot-com boom was one giant party.

Especially if you worked in technology, that period from 1995-2000 was a glorious time to be alive. Everyone was buying computers, the internet was taking off, and people were becoming overnight millionaires (at least on paper).

Then came the dot-com crash of 2000, and all those paper paychecks went up in smoke. But from the ashes of the dot-com fire arose the next generation of world-changing companies: Amazon, Google, and all the rest.

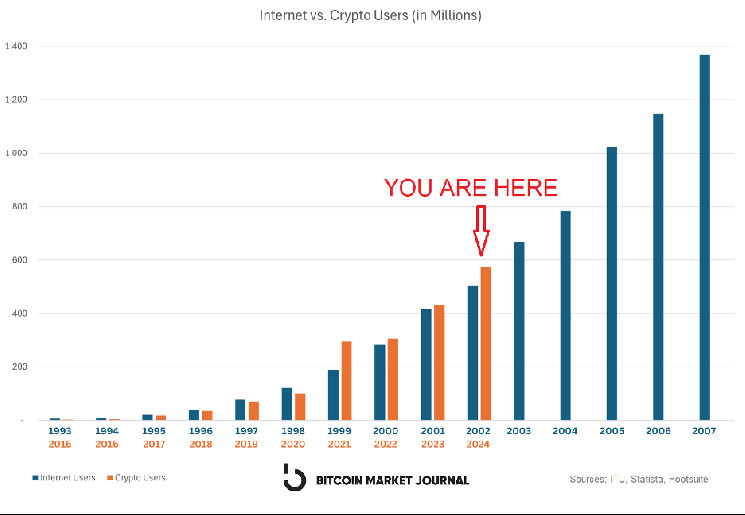

I was recently inspired by a brilliant social post comparing Internet adoption vs. crypto adoption over time. I couldn’t find sources for their numbers, so I spent the morning replicating the chart with reliable data (see above). My findings are slightly different, but the takeaway is similar.

Based on this chart, the crypto industry in 2024 is at a similar stage as the internet industry in 2002.

As someone who’s lived through both, that feels about right. Here’s why.

Users are Growing

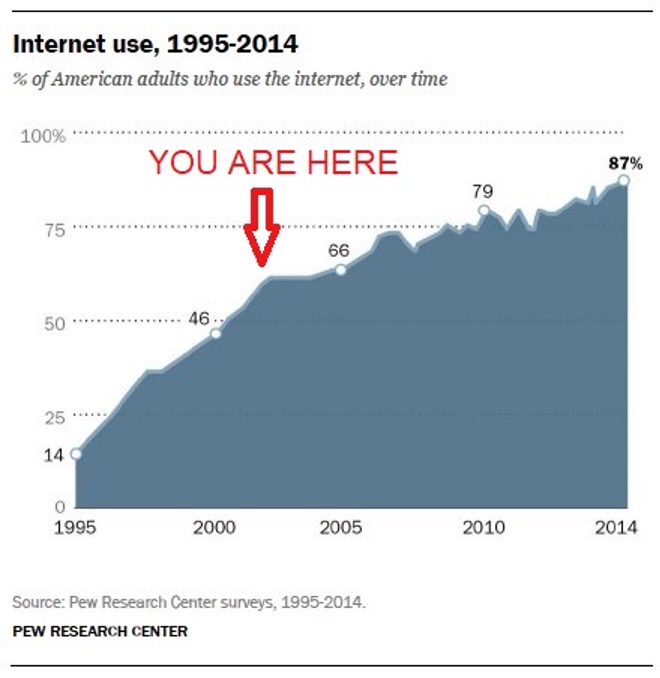

In 2002, the internet was still in the early stages of mass adoption: lots of users, but nowhere near the saturation point. Many people were just coming online, and broadband was still in its infancy (there was a lot of text, not much video). Memes were just becoming a thing.

In 2024, crypto feels like it’s just starting to enter that phase of hypergrowth. The first crypto ETFs have launched in the U.S., opening it up to the masses. It’s going from this geeky thing with confusing wallets and passkeys to user-friendly products that anyone can access.

Markets are Maturing

In 2002, the market was still reeling from the dot-com crash, which shut down many early Internet businesses. All the companies that survived had to tighten their belts and build real, sustainable businesses. This was ultimately good for the industry: it forced us to focus.

In 2024, we’ve been through several crypto booms and busts, but those that have survived have also become real, sustainable businesses: Binance, Coinbase, Circle, Ethereum, Uniswap, and many others. This, too, has been good for the industry: it forced us to focus.

Core Technology is Improving

In 2002, there was so much infrastructure being built: web standards, AJAX, WordPress, e-commerce – and especially broadband, which would enable video, social media, and all kinds of web-based applications. All these core technologies were the foundation of the Web today.

In 2024, we’re working on core technologies like Layer-2 networks to improve speed and lower cost, DeFi applications that mirror our entire financial system on blockchain rails, and tokenization of real-world assets. These are the building blocks of tomorrow’s financial system.

Regulation is Evolving

In 2002, there were profound questions about how to regulate the Internet, especially in regard to privacy, security, and intellectual property. The Telecommunications Act of 1996 was the big one, followed by DMCA (1998), E-Government Act (2002), and CAN-SPAM (2003).

In 2024, we’re finally seeing some movement in the U.S., with FIT 21 as a key milestone. The EU has passed the Markets in Crypto-Assets (MiCA) framework, while countries like Singapore and Switzerland are positioning themselves as crypto-friendly hubs. (China still hates crypto.)

Businesses are Growing Up

In 2002, the successful internet companies transitioned from speculative business models to real revenue generation, pioneering new playbooks like e-commerce (Amazon), online advertising (Google), and digital payments (PayPal).

In 2024, the crypto industry is evolving from speculative trading and ICOs into real business models: digital exchanges (Coinbase, Binance), crypto fund management (Fidelity, BlackRock), hosting dapps (Ethereum, Solana), and much more.

The Giants are Emerging

In 2002, it’s hard to remember that many investors had written off the Internet. But that would have been a tremendous mistake, as a few Internet companies began to grow into giants that would soon dominate the world (Google, Amazon, eBay).

In 2024, we’re at the same inflection point, as a new class of “crypto giants” are beginning to grow in power. We’ve covered them above, and we cover them every week in our newsletter. Investing in these crypto companies in 2024, we believe, is like investing in the Internet in 2002.

How Big Will Crypto Grow?

What’s most exciting about these chart is how the Internet grew after 2002.

If crypto continues to follow the same growth curve as the Internet, we’ve got a “long boom” of sustained growth ahead of us, which bodes well for our long-term, buy-and-hold approach.

The Internet boom was about everyone getting online. Crypto is about everyone getting on-chain.

The Internet connected the world to a global information system; crypto is connecting the world to a global financial system.

The Internet disrupted traditional media; crypto is disrupting traditional finance.

There’s so much noise in crypto markets that it can be helpful to occasionally take a breath, take a step back, and see how far we’ve come.

But how far will we go? If Internet history is any guide, the party is only getting started.

* Caveat: Crypto users may be overstated, since it’s really tracking wallets, and a user can have more than one wallet. As always, the future may look different than the past. Invest carefully.

bitcoinmarketjournal.com

bitcoinmarketjournal.com