Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Temp check

This week has lasted years — and it feels like we’ve gone through a few different cycles.

But alas, we’re still in the same one and last weekend is becoming just another blip on the radar. According to CoinGecko, the global crypto market is up 5% in the last day to $2.2 trillion.

Bitcoin remains pretty correlated with the equity markets, which are also shrugging off last weekend’s selloff so far. To be fair, the correlation isn’t new, and we’ll probably continue to see it until the election, GSR co-CEO Rich Rosenblum tells me.

Ledn’s John Glover said earlier this week that “when shit hits the fan, all correlations go to one,” which essentially means that this trend may be here for a while as bitcoin reacts like a risk asset. It’s fairly safe to say, given the action not only this week but throughout the last year, that bitcoin isn’t reacting like it should if it were really digital gold, so perhaps we can (finally) drop that discussion.

Now that we can look back at the data to better digest what happened, JPMorgan analysts noted that there was some retail action clearly present earlier this week.

“Retail investors appear to have also played a role in the correction as spot bitcoin ETFs saw so far in August their largest monthly outflow since inception,” the analysts wrote.

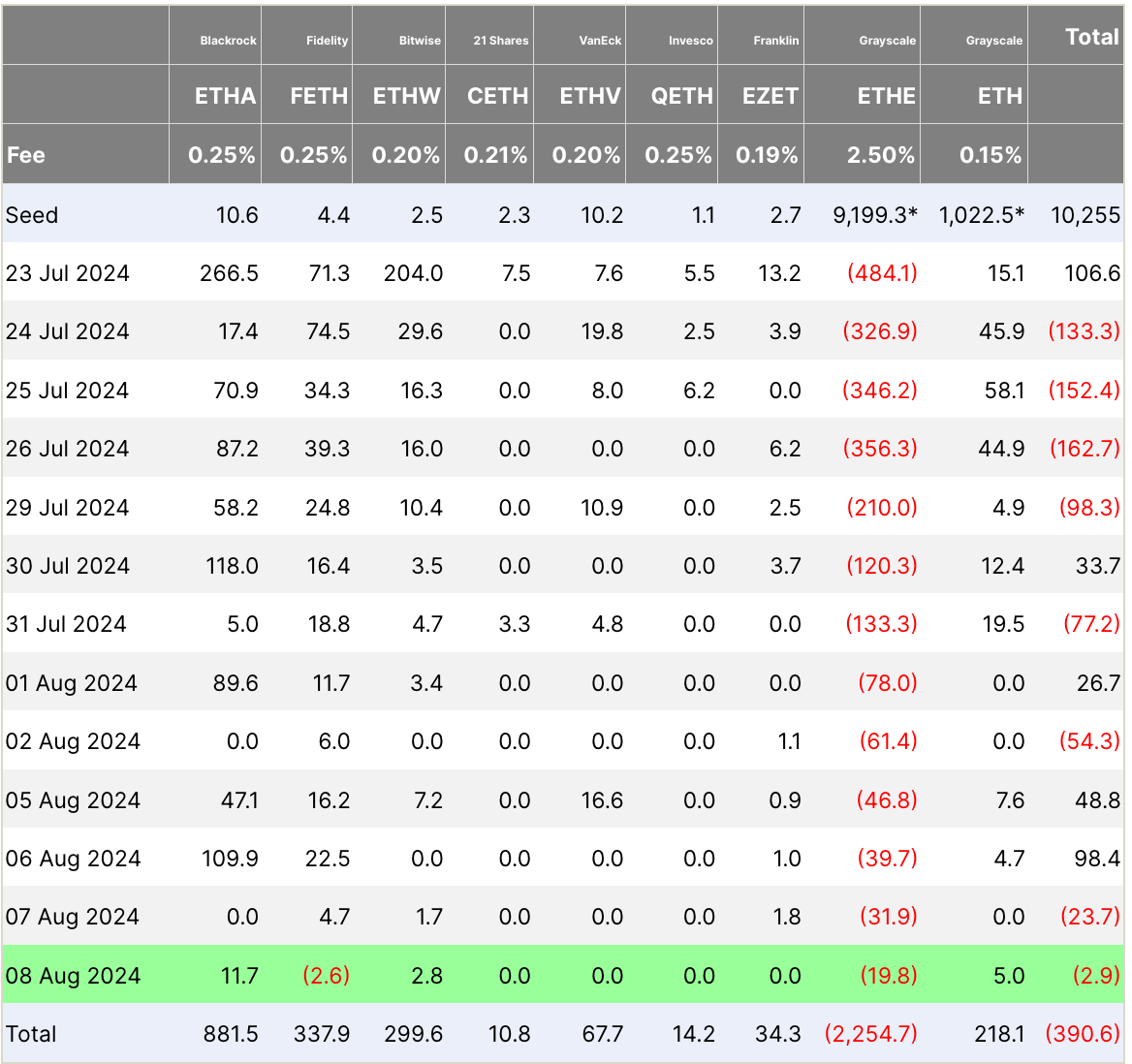

But, while bitcoin ETFs were experiencing negative flows, the ETH ETFs saw multiple days of inflows — $48 million and $98 million on Monday and Tuesday of this week.

Notably, those flows turned negative as we wrap up the week. Meanwhile, Farside data shows inflows to the bitcoin ETFs on Wednesday and Thursday of this week — $45 million and $194 million respectively.

Unsurprisingly, JPMorgan analysts — led by Nikolaos Panigirtzoglou — noted that they’re still “cautious” on crypto as the market rebounds from last week.

However, they reckoned that there are still reasons for institutional investors to “remain optimistic.” These include the political environment, the winding down of the FTX bankruptcy, Mt. Gox (hopefully) being behind us and Morgan Stanley recently allowing the recommendation of bitcoin ETFs from wealth advisors to clients.

A separate note, penned by Kenneth Worthington and his team at JPMorgan, argued that the continued trend of TradFi asset managers engaging in tokenization “strengthens the use case” for crypto.

Now that we’ve covered the daily dose of positivity, I wanted to dig into a few bits and bobs of interesting data from Worthington’s team to better understand some of the market action we saw last month.

“July offered some reprieve to the mostly negative crypto environment we saw for much of [second quarter]. Volumes improved slightly in July, but market cap trends were mixed across tokens and crypto products,” analysts led by Kenneth Worthington wrote earlier this week.

On a positive note, volumes were up in July for the first time since the first quarter of this year. Analysts noted a 9% bump month over month in average daily volume, per TradingView data. CCdata confirmed that there was a 7% jump in spot volumes.

It admittedly felt like a bit of a quieter month, but the data shows that ADV was up compared to June, and was up more than 130% compared to July of last year.

Pairing this data with the earnings from Robinhood earlier this week, which showed that rising trading volume bumped its crypto revenue 161% in the second quarter.

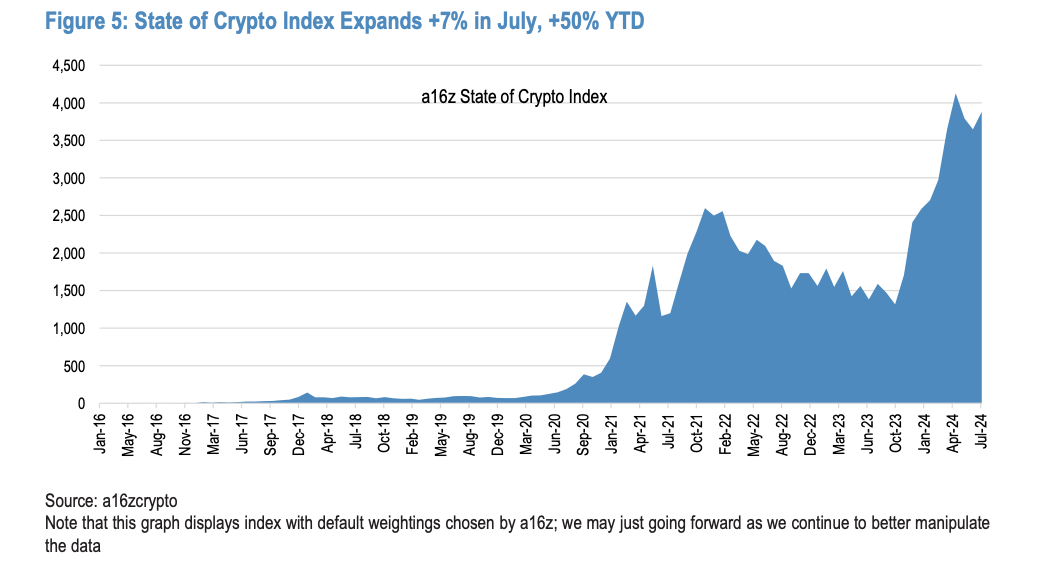

Then you have Andreessen Horowitz’s State of Crypto Index popping up 7% last month, despite a 4% decline in June.

Right now, we’re bumping along whether you look backward or forwards. This doesn’t mean that we’re out of the woods, recall that August is a slower month in general for crypto, but it does show that adoption is still underway.

Perhaps we should bring back the term “cautiously optimistic” and stick with that — over the short-term, at least.

— Katherine Ross

Data Center

- BTC and ETH are still rounding out their recoveries, today up 6% and 7.5% apiece (BTC: $60,540; ETH: $2,630).

- SUI, TIA and HNT lead the front-page with 30%, 23% and 20%, respectively.

- XRP has given up some of its gains since the Ripple ruling earlier this week, down 4% to $0.5847.

- $153.8 million in shorts have been wiped out on CEXs in the past day to $74.9 million in longs.

- Solana is the number-one chain for DEX volumes right now, processing $1.63 billion over the past 24 hours to Ethereum’s $1.57 billion.

Bit by Bitcoin

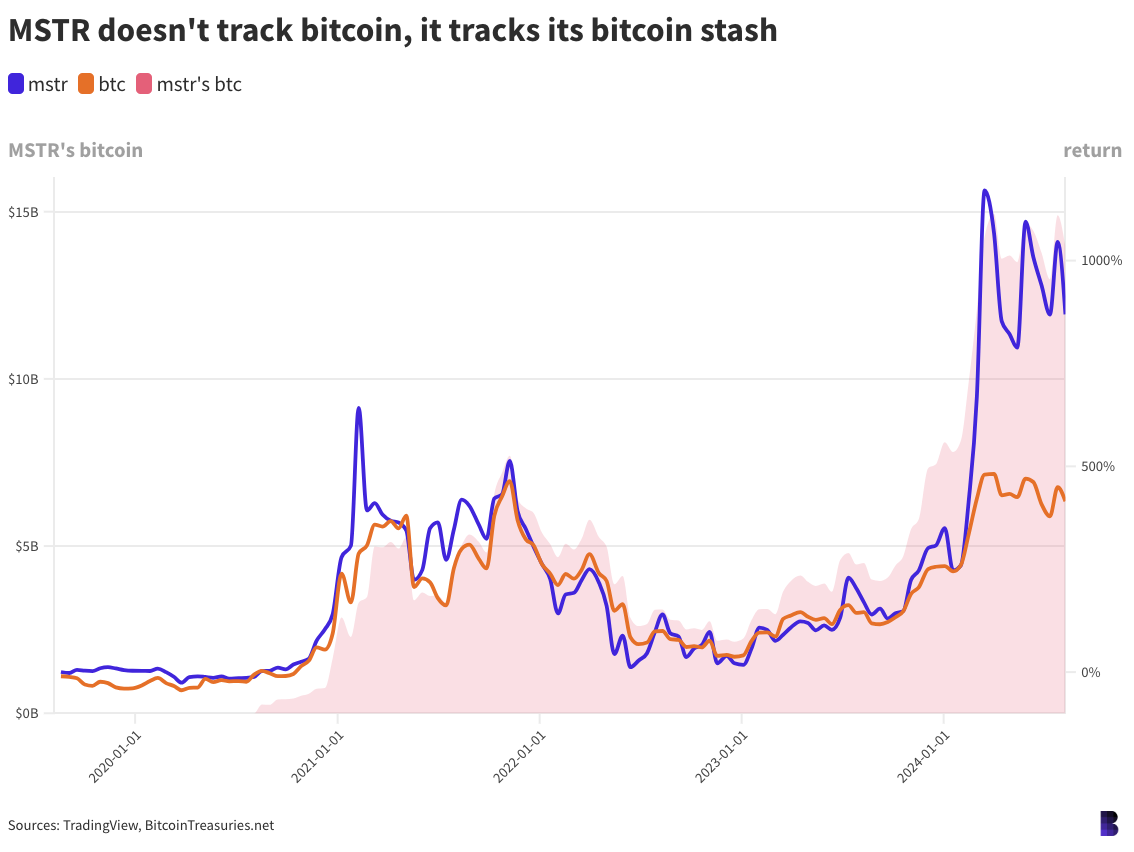

MicroStrategy is defying gravity.

The stock pumped three times as hard as bitcoin at the start of the year and hasn’t yet come down.

MSTR rallied up to 180% between January and the end of March, around bitcoin’s all-time high. Bitcoin had meanwhile managed 60%.

February’s earnings release, for Q4 2023, appears to be the catalyst. The data intelligence firm turned bitcoin hoarder posted a 136% increase in net income, 138% boost in net profit margin and 78% rise in operating income year-on-year, but still missed quarterly revenue expectations.

MicroStrategy’s earnings so far this year haven’t really been all that great. But it has been buying a lot of bitcoin — spending about $2.42 billion on 37,350 BTC ($2.26 billion) — which the market still seems to appreciate.

MSTR is down on its bitcoin purchases to date, but zooming out, it’s still way up. In total, it’s paid $8.35 billion to acquire 226,500 BTC over the past four years.

That same stash is now worth $13.74 billion, putting the firm almost 65% ahead, equal to almost $5.4 billion. On the other hand, MicroStrategy reported $3.905 billion debt on its balance sheet at the end of June, putting a damper on those gains.

Perhaps it’s those kinds of figures that have let markets look past lackluster earnings this year. Two-thirds returns on its bitcoin purchases in four years is impressive, but it’s also what the S&P 500 has done across the same period.

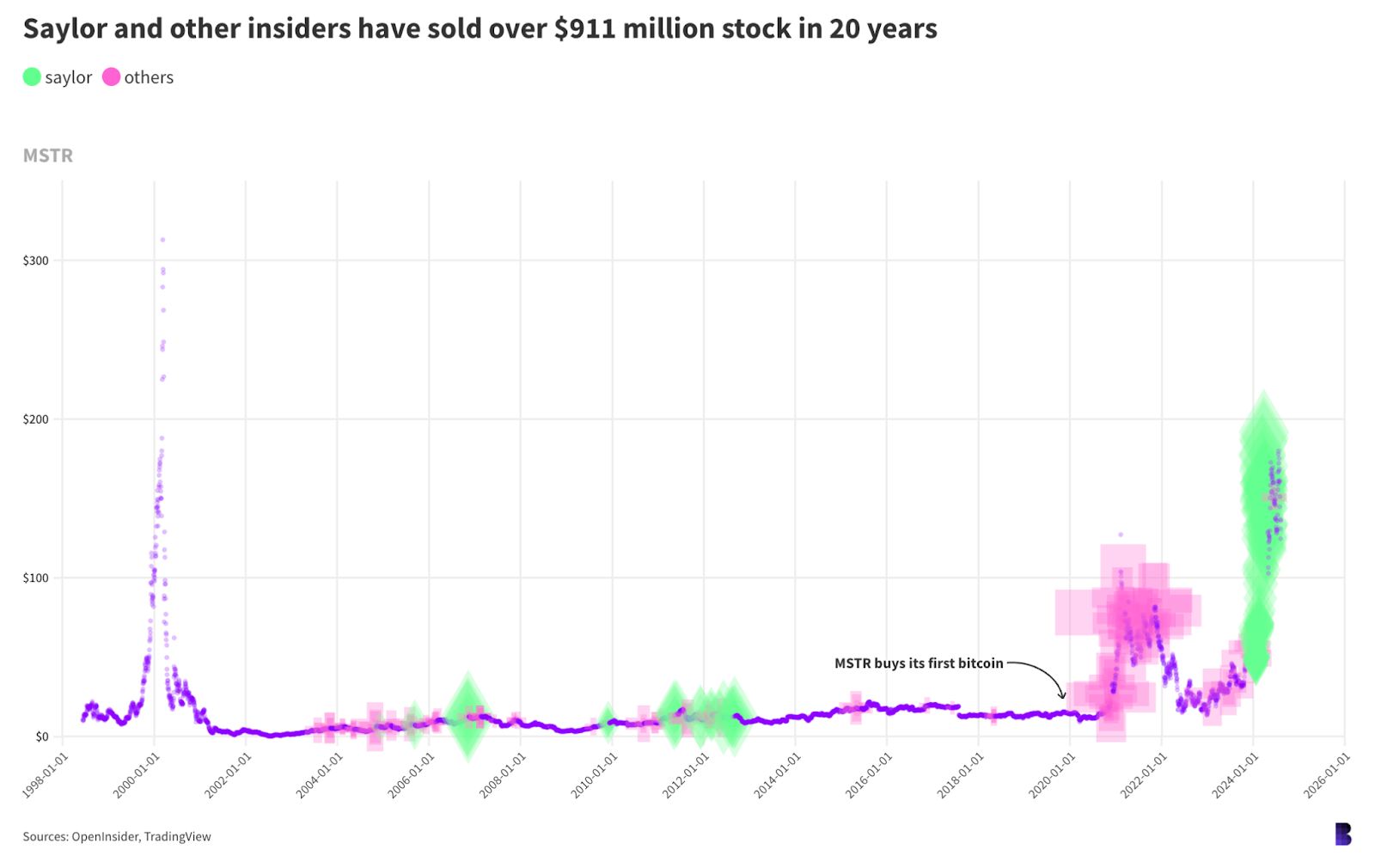

Still, few shareholders would be happier than founder Michael Saylor and the rest of the exec team. Saylor has led other insiders in selling hundreds of millions of dollars in stock, almost all of it going to the founder.

The others mostly got theirs during the last bull market while MSTR was busy collecting its first billion in bitcoin at the time.

Between October 2020 and November 2021, bitcoin rose from $11,000 to nearly $69,000. MSTR rallied from $165 to almost $900 alongside it, while company executives other than Saylor offloaded nearly $215 million in company shares.

If sold today, those same sales would’ve netted $588 million. Saylor, meanwhile, benefitted from waiting until this bull market to cash in his own chips — MicroStrategy’s share price was at times double what it was when the other company insiders were busy selling.

In total, Saylor sold 400,000 shares in daily trades spread between January and the end of April, a few days after the halving.

He generated $410.8 million in the first four months of the year as MSTR tripled bitcoin’s performance — nearly half of all cash generated by MicroStrategy insider stock sales since before the dot-com bubble.

That’s built different, with a capital ₿.

— David Canellis

The Works

- Cboe re-filed its application to list bitcoin ETF options on Thursday.

- In a letter to the CFTC, Coinbase said the proposed rule on event contracts contains a “vague definition of ‘gaming,” which would overstep its authority.

- Tether plans to hit a headcount of 200 people over the next year, Bloomberg reported.

- Bitcoin miner Ionic Digital is postponing its IPO after its CEO stepped down.

- Executives from Coinbase, Kraken and Ripple attended a conference call with White House advisers Thursday.

The Riff

Q: How do we know when retail returns?

Lately, there’s been signals.

Scottie Pippen invoking Satoshi Nakamoto to shill a memecoin was one.

Donald Trump Jr. denying that the Restore the Republic memecoin had anything to do with their “Trump project” was another.

Both tie into the spate of minor celebrity memecoin pump and dumps from a few months back.

But while celebrities were celebrated in the 2021 cycle for joining in NFT mania, this time around, the reception hasn’t been so positive, with the exception of anything that the Trumps actually do with crypto.

So, perhaps the real signal for retail’s return might be the maturing of these kinds of interactions.

Let’s call it: Retail comes back when Shaquille O’Neal starts mining bitcoin, validating Ethereum, or voting on the next Uniswap proposal.

— David Canellis

I use a couple of different metrics to gauge where retail could be.

Robinhood’s earnings are probably one of the best signals, I think, given that you can track the trends pretty clearly. The bummer is that it’s all hindsight.

ETF flows are another, and one that I noted JPMorgan sometimes uses, but I don’t know that I’d rely on them. It is interesting to see which firms load up on the ETFs though.

Social media chatter’s probably the best bet for a more in the moment look at where we stand.

I don’t know that we’ll see the same level of involvement as we did pre-FTX, and if we do, it’ll certainly take years. Anecdotally, my friends and family (outside of the cryptosphere) aren’t as aware of major crypto moves and only really express concern to me when the equity markets are tumbling.

So perhaps that’s a good gauge: We’ll know retail’s back when it becomes a topic at the holiday dinner table.

If we stay on our current path I can see it now: Crypto coming November to a dinner table near you!

— Katherine Ross

blockworks.co

blockworks.co