Towards the end of July, Avalanche ($AVAX) price broke above $33. As of this writing, the token has lost $13 from that value, and if care is not taken, it could drop much more.

However, this isn’t just a rumor; there are reasons to believe this bias is accurate unless something changes.

On-Chain Data Flashes Big Avalanche Warning

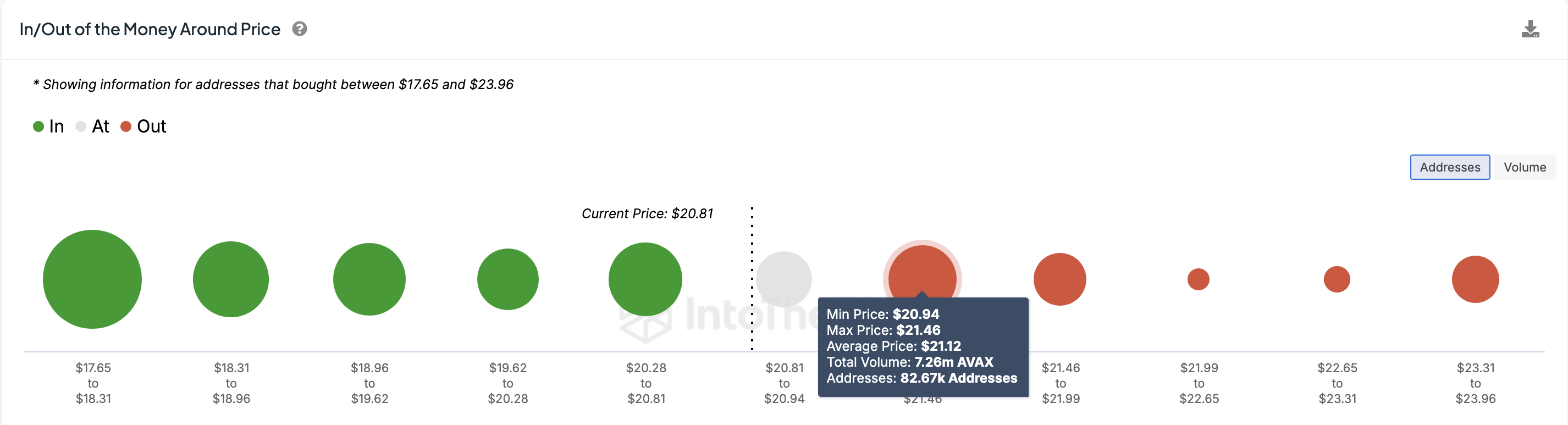

The ln/Out of Money Around Price (IOMAP) is the leading indicator driving this prediction. This on-chain metric displays the number of addresses holding a token in profits, breaking even, and those losing at a certain price.

With this data, traders can identify specific price levels at which a cryptocurrency can move. Typically, the higher the addresses at a price range, the stronger the support or resistance it provides.

However, it is important to note that a higher number of addresses out of money will act as resistance, while a higher one in money will offer support. For Avalanche, 82,670 addresses purchased 7.26 million tokens at an average price of $21.12. This cohort is out of money and holding at unrealized losses.

Read more: 11 Best Avalanche ($AVAX) Wallets to Consider in 2024

Meanwhile, 70,930 addresses bought 1.02 million $AVAX, or around 19.95, and are in the money. The difference between those two sides shows that the cryptocurrency could face resistance from potential selling pressure.

If $AVAX lacks a relatively high level of buying pressure, the price could be rejected if it approaches $21. If this happens, the next level for the token could be around $19.62.

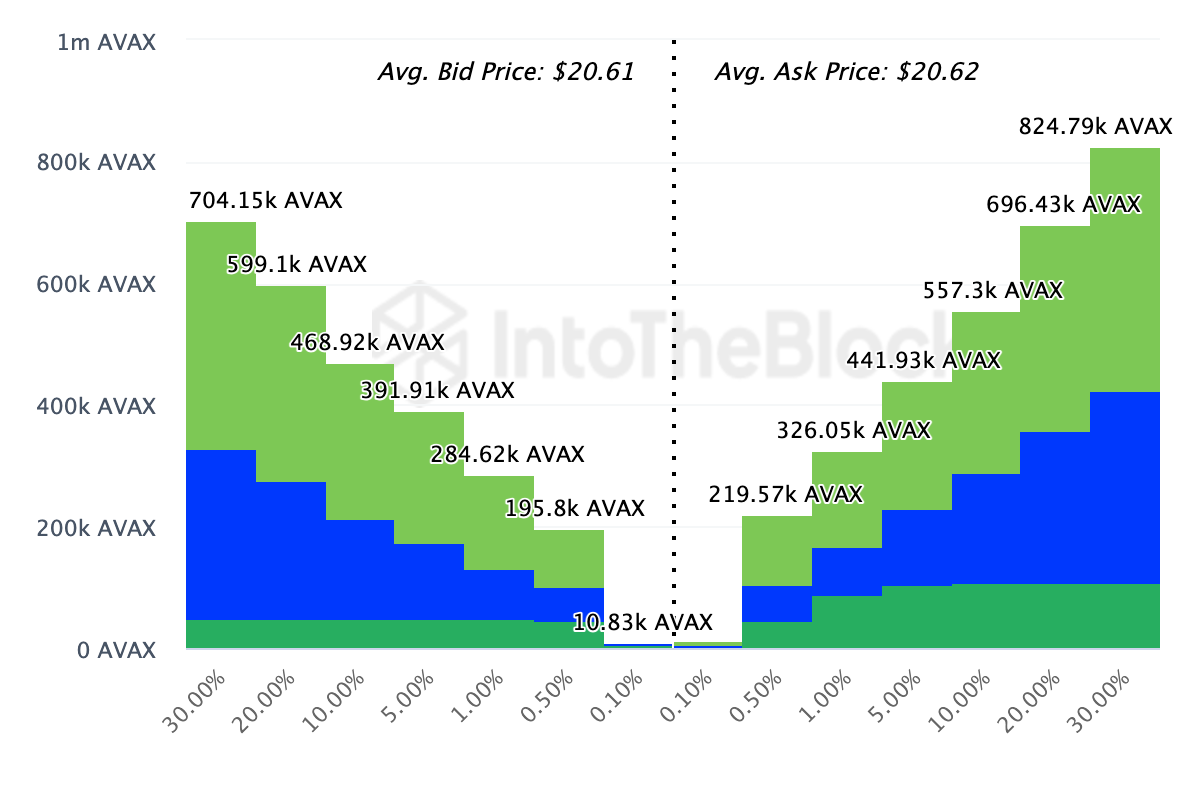

Further, information obtained from the order books of the top 20 exchanges supports this position. Using the Exchange-Onchain Market Depth, BeInCrypto observes that more tokes are lined up on the ask (sell) side compared to the bid (buy) side between $20.61 and 20.62.

A higher number of cryptos being prepared to be sold than those to be bought indicates potential selling pressure if buyers do not match the selling volume.

$AVAX Price Prediction: It’s Either $19 or $17

Judging by its recent price performance, $AVAX has been underperforming compared to the broader altcoin market. For instance, the cryptocurrency faced a 40% correction between July 22 and August 6.

It also trades below the 20-day EMA (blue). EMA is an acronym for Exponential Moving Average and is a technical indicator measuring trend direction. Usually, if the price trades above the EMA, the trend is bullish.

Thus, $AVAX’s current position below the EMA suggests a bearish trend. If this trend persists and bulls fail to defend the token, the next price level for $AVAX may be around $19.56. If the cryptocurrency struggles to hold on to this region, the price could slide to $17.03.

Read More: How To Buy Avalanche ($AVAX) and Everything You Need To Know

However, if buying pressure increases, $AVAX may bounce to $23.07. With further intensification, the cryptocurrency’s value could surpass the EMA at $24.25 and reach $26.64.

beincrypto.com

beincrypto.com