Cardano price has reached $0.34 today, marking a 21% rebound from the historic lows recorded on Monday, with two key indicators suggesting ADA could be on track for a $0.40 retest in August.

Cardano Scores 21% Rebound as Bull Traders Swoop In

During the crypto market crash, and frenetic liquidations that gripped the crypto markets on Monday, Cardano was one of the worst-hit mega cap altcoins.

Notably, layer-1 Proof of Stake (PoS) coins have recorded reduced demand since the Ethereum ETF’s approval. The prolonged decline in buying interest had weakened ADA’s key support levels, leading to rapid downswings during the market crash.

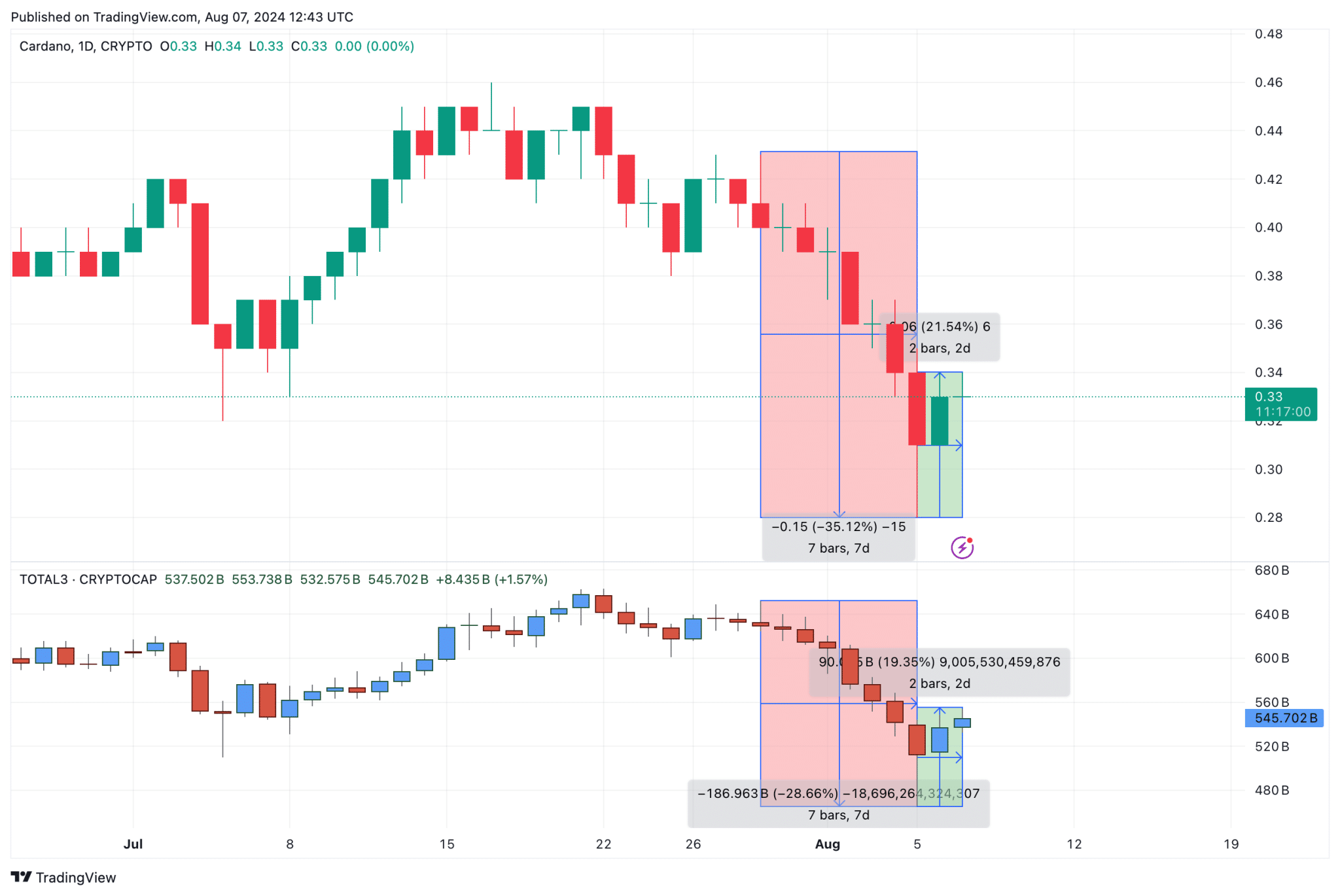

Looking at the chart above we see how ADA price had declined 35.12% between July 29 and August 5. Meanwhile the global altcoin market (TOTAL3) only dropped by, 28.66% during that frenetic 7-day sell-off.

This shows that Cardano’s losses during the crash had exceeded in market average my more than 6%. When a mega cap asset like ADA underperforms the market, it is often interepret as a signal that the asset is now undervalued due to increased volume of leverage trade liquidations.

This often encourages strategic traders to buy-in such undervalued assets, in a bid to capitalize on its rebound potential. The ADA/USD chart above has shown early signal of this phenomenon.

Since the Aug 5 crash, Cardano’s price has now rebounded 21.54% as it reached the $0.34 area at the time of writing on Aug 7. But collectively, the altcoin market has only recorded a 19.3% rebound.

This shows that investors look to ape in on ADA after it fell to a new 2024 low on Aug 5, causing it to outpace the market average as the rebound phase begins.

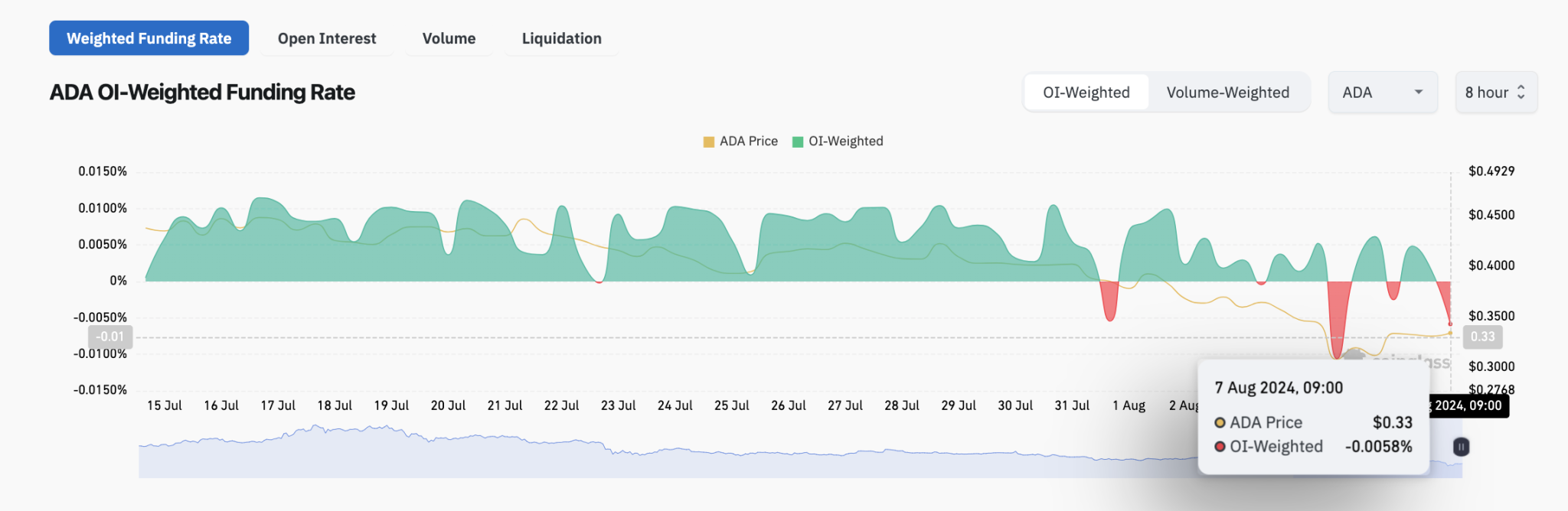

More so, another critical data trend in the ADA/USD derivatives markets also flashes a prolonged bullish rebound signal. The Coinglass Funding rate chart below tracks fees paid between SHORT and LONG position holders to keep leveraged contracts open.

Negative funding rate values signal dominant bearish trades and vice versa.

Looking at the chart above, we see that ADA Funding rate is trending in negative values of -0.006%. This suggests that after the large liquidations on Monday, there’s still significant fear in the market, and ADA is yet to attract a steady flow of new leverage Long positions.

More importantly, ADA’s funding rate trending negative after a 21.54% rebound in the last 48 hours signals more room for additional gains as bull traders gradually return to the derivatives markets in the coming days.

This current market dynamic suggests ADA price could advance further towards the $0.40 area.

ADA Price Forecast: Bulls Eyeing $0.40 Retest

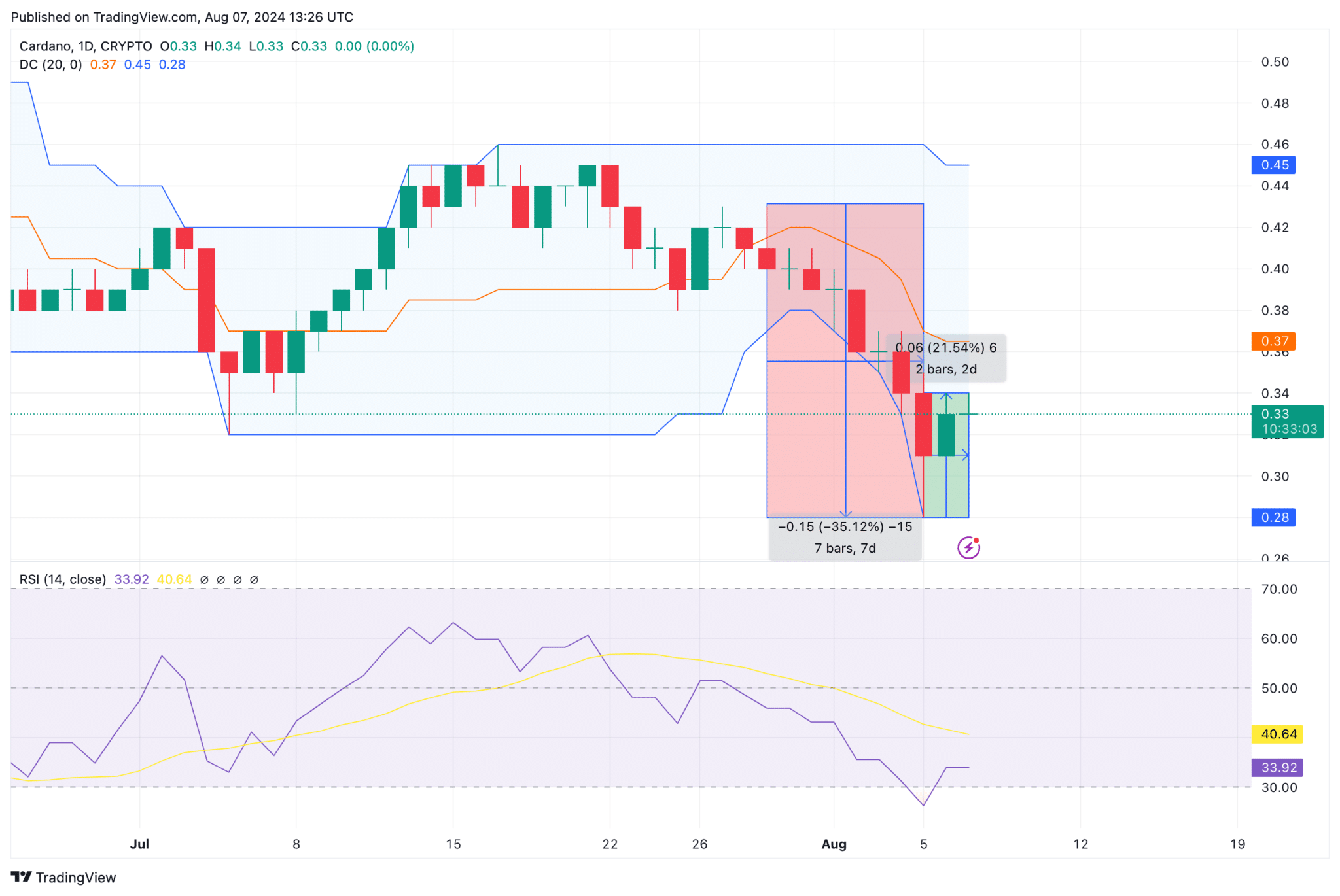

Cardano (ADA) has shown signs of a potential bullish reversal after a steep decline from $0.42 to $0.28 over the past seven days. The daily chart reveals that ADA experienced a 35.12% drop, followed by a minor recovery.

Currently, the price is consolidating around the $0.33 mark, indicating that the bears are losing momentum. The RSI indicator, although still in bearish territory at 33.92, has started to curve upwards, suggesting a potential increase in buying pressure.

The Donchian Channels are reflecting a range between $0.28 and $0.45. The lower boundary at $0.28 has proven to be a strong support level, as ADA rebounded off this point. This support is crucial for the bulls to defend in order to maintain the upward trajectory.

On the upside, the immediate resistance is at $0.37, coinciding with the middle line of the Donchian Channel. A successful break above this level could see ADA retesting the $0.40 psychological barrier.

Moreover, the recent bullish candlesticks formed over the last two days indicate that buyers are stepping in. If the price can close above the $0.37 resistance, it will signal a bullish continuation pattern. Traders should watch for volume confirmation to support this upward move, as a surge in daily market volume alongside a price break can further validate the bullish trend.

A sustained break above $0.37 could propel ADA toward the $0.40 mark, providing an optimistic outlook for the bulls. However, if the $0.28 support fails to hold, ADA may revisit lower levels, potentially testing $0.25.

thecryptobasic.com

thecryptobasic.com