Fundamental analyses are often overlooked in the cryptocurrency market, primarily focused on short or mid-term trades, mostly following technical analyses. However, investment funds like Cyber Capital focus on long-term value investing through in-depth fundamental analyses of the industry’s projects.

Cyber Capital‘s Founder and CIO, Justin Bons, revealed in a thread on X on August 5 what he believes is “the technological Holy Grail of crypto;” and urged the cryptocurrency community to “wake up to this development” that is still fairly unknown.

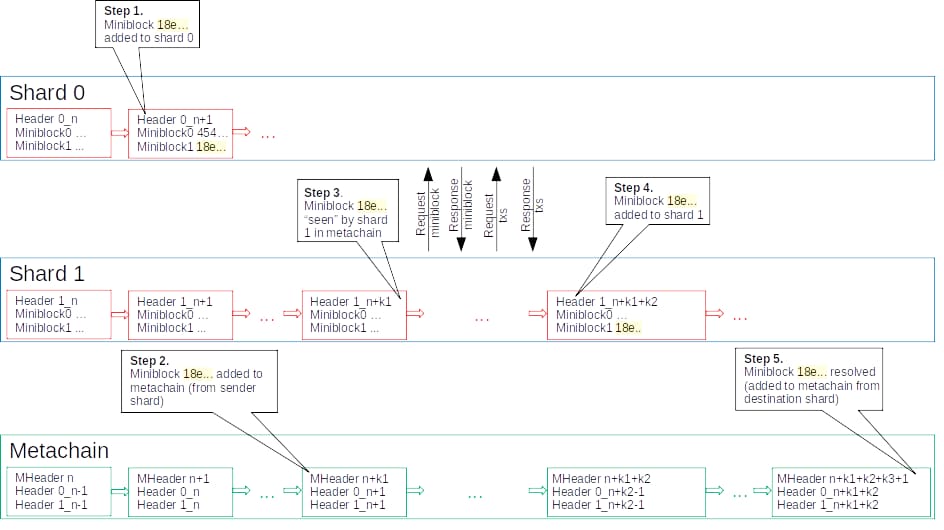

According to Bons, MultiversX ($EGLD) stands out by successfully fully implementing the sharding technology ahead of competing cryptocurrencies. As described, MultiversX is capable of exceeding over 100,000 transactions per second right now, making it one of the most scalable blockchains to date.

Nevertheless, the investing expert explained that $EGLD is not perfect, pointing out its economics and governance design. Bons believes they are not ideal from his perspective, mentioning other projects also working with different sharding architectures.

Overall, the post highlights the benefits of sharding and MultiversX’s particular implementation that could lead the market into a new development that, in his words, the cryptocurrency community should “wake up to.”

Alongside $EGLD, Cyber Capital‘s founder mentioned Radix (XRD), Toncoin (TON), Tezos (XTZ), and Near (NEAR), looking at sharding, although not yet fully implemented and battle-tested like MultiversX. Additionally, Solana (SOL), Aptos (APT), Sei Protocol (SEI), and Sui Network (SUI) are other layer-one blockchains delivering higher scalability.

“The future is bright. It will take time for more people to recognize the true power of these breakthroughs. $EGLD serves as proof that we can, in fact, scale blockchains on-chain through sharding! Technologically, it is far ahead in terms of scaling, making it a key player. This is what makes $EGLD so incredibly important to the entire cryptocurrency movement. Even though $EGLD’s ecosystem & usage is tiny in comparison to major competitors.”

– Justin Bons

$EGLD price analysis and growth potential

As of this writing, MultiversX native token $EGLD trades at $27.13, with nearly 12% in losses year-over-year. It shows a short-term downtrend from March’s local top of $74.71 and a mid-term downtrend from the $545 all-time high (ATH) in 2021.

This market data illustrates a poor price performance and low capitalization of around $740 million.

In this context, the crypto educator and MultiversX enthusiast DBCrypto posted a thread addressing the project’s so-far “unknown” state.

The content creator pointed out the comparatively low initial funding, with two rounds totaling $5.15 million raised. Conversely, most of $EGLD’s competitors have raised over ten times that, he explained, at the expense of retail traders and the community. In June, Justin Bons described the crypto market as being “dominated by predatory VCs,” as Finbold reported, warning of this dynamic.

1/ MultiversX is arguably the most advanced blockchain in the world 🚀

— DBCrypto⚡️ (@DBCrypt0) August 6, 2024

But a common question I have seen lately is:

“If it’s so good how come I haven’t heard much about it?

This is such a great question and one in which I have an answer for!

Read on 🧵 pic.twitter.com/Z0DjIKY74S

All in all, $EGLD must first reverse these trends to look for long-term growth, which having the “Holy Grail” crypto technology can not guarantee will happen. Cryptocurrencies are highly volatile and unpredictable assets, even when backed by solid fundamentals.

Still, different experts acknowledge MultiversX’s potential to deliver a decentralized, secure, and efficient infrastructure for decentralized apps (DApps), decentralized finance (DeFi), and Web3, which may earn the market’s attention in the long run.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com