- $AAVE held steady during the crypto market sell-off and secured $21 billion in value across various Layer 1 and Layer 2 chains.

- $AAVE Treasury earned $6 million in revenue from liquidations and the marketwide bloodbath.

- The DeFi token is primed for 15% gains, daily chart shows W formation and potential bullish breakout in $AAVE.

- $AAVE trades just below $100 on Tuesday.

$AAVE generated over $6 million in revenue in Monday’s crypto market sell-off. The decentralized protocol held steady even as the price of cryptocurrencies in the top 30 plummeted.

Stani Kulechov, founder of $AAVE, notes that the project secured over $21 billion in value during the carnage in the crypto markets on Monday.

$AAVE trades above $99 at the time of writing on Tuesday and secures $10.905 billion, according to DeFi Llama data.

$AAVE generates $6 million in revenue

On Monday, Stani Kulechov commented on $AAVE’s performance in the recent crypto market correction that served as a stress test for the DeFi protocol. The project withstood the stress across 14 active markets in Layer 1 and Layer 2 chains while securing over $21 billion in value.

The $AAVE Treasury earned $6 million in revenue overnight, facilitating decentralized liquidations.

Aave Protocol withstood market stress across 14 active markets on various L1s and L2s, securing $21B worth of value.

— Stani (@StaniKulechov) August 5, 2024

Aave Treasury was rewarded with $6M in revenue overnight from decentralized liquidations for keeping the markets safe.

This is why building DeFi is FTW.

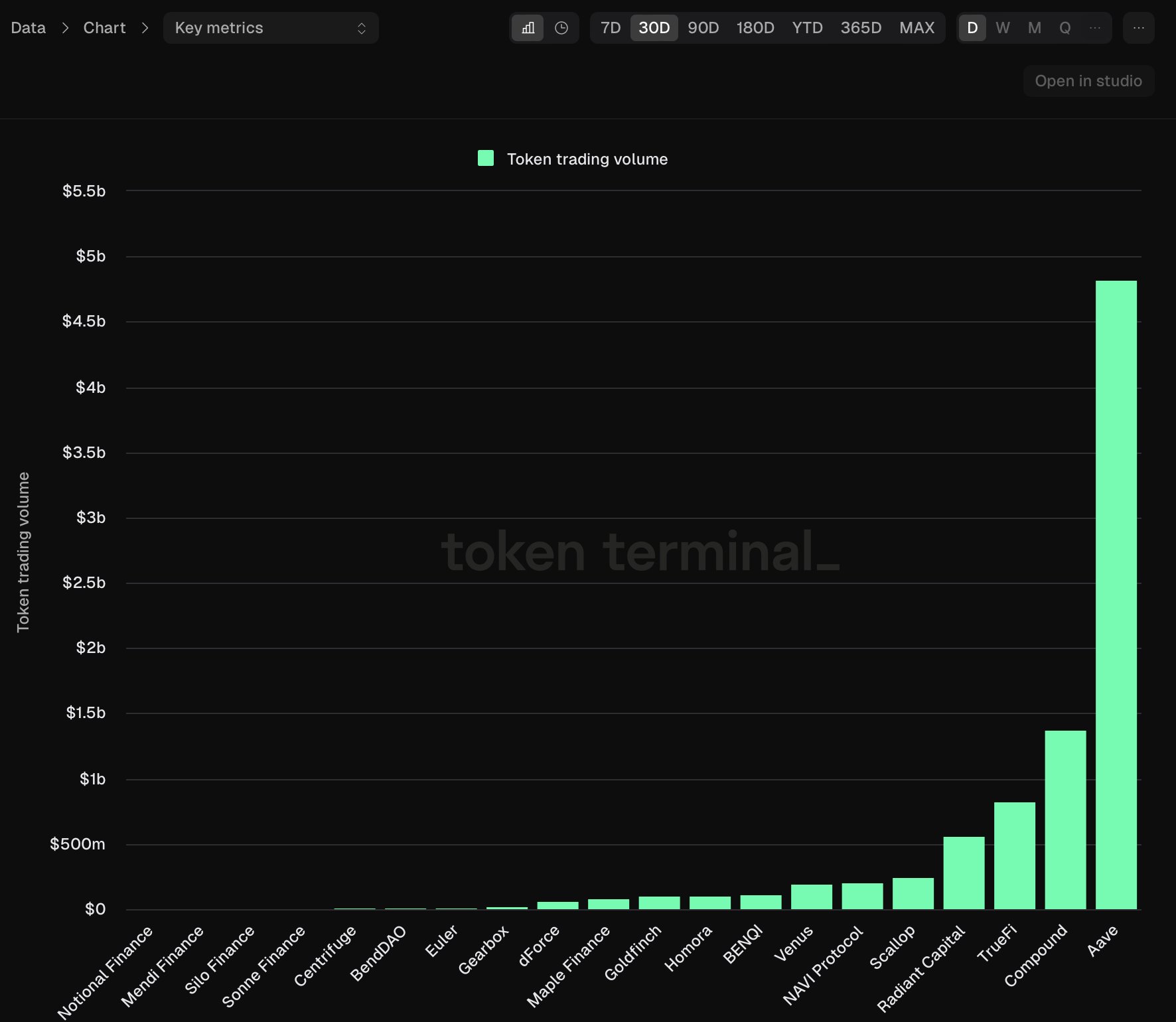

Recent data shows that the project has found higher utility and relevance among traders. Token Terminal data shows that $AAVE has generated the most interest among traders. The chart below compares the monthly governance token trading volume for projects in the lending market sector.

Token trading volume in the lending sector

$AAVE could extend gains by 15%

The $AAVE/$USDT daily chart shows a W formation. $AAVE trades at $99.41 at the time of writing, and the DeFi token is likely to extend gains and rally toward $114.74, a key resistance level. This would mark 154% gains for $AAVE.

The token faces resistance at the upper boundary of the Fair Value Gap (FVG) at $103. The Relative Strength Index (RSI) indicator is back at 50, the neutral level, meaning $AAVE lacks any directional momentum.

$AAVE" src="https://cnews24.ru/uploads/08a/08ad2542b1797447a25b8aaaab005dde4ec2a083.png" size="2168x1542">

$AAVE/$USDT daily chart

On the other hand, $AAVE could find support at the imbalance zone between $86.17 and $88.20 in the event of a correction in the DeFi token price.

Failure to see a daily close above $95 could invalidate the bullish thesis for $AAVE.

fxstreet.com

fxstreet.com