From Bitcoin to Dogecoin, there are thousands of crypto assets, with various catalysts driving their prices. Some altcoins surged with use-case-based development theories, and some are driven by community sentiment or a joke, which are meme coins.

The right choice from these cryptocurrencies could delight investors or traders with overwhelming returns. However, the major catch in the crypto market is the play of sentiment, which plays a vital role in this realm.

What & How Market Leaders Influence Broader Markets?

As the market leaders with the biggest market cap drag the larger market, it creates a ripple effect. As a result, traders and investors either enjoy the gains or suffer losses in their holdings, per the market sentiment.

According to CoinMarketCap, the Bitcoin Dominance was 56.4% at press time. It landed more than 25% in the past 7 days. The $BTC has put the red blanket on the crypto landscape. Its global market cap has dipped below $2 trillion. It has reached $1.89 Trillion with an intraday fall of 12.14%.

The $BTC coin on the daily chart has broken down from an ascending wedge a week ago and has slipped two critical supports of $60278 and $56393. It hung over a historical demand zone at the time of writing, trading at $53256 with an intraday dip of 9% on the daily chart.

Over the monthly TF, the $BTC price activity majorly happened in an upward wedge. In the broader picture, the price has been deflected from the upper border of the channel, causing the plunge. Previously witnessed channels’ middle line has shown previous comebacks in price, and recently, it has reached near this dynamic trendline.

Depending on buyers’ interest, this trendline could hold and bounce back. However, if the seller’s dominance continues, deterioration would lead to a severe crash, making it a resonating crash globally in the crypto realm.

What Are the Best Buy-The-Dip Crypto Assets Today?

So, hooking on to the optimism from channel middle dynamic trendline support, that has historically proved its worth. A few crypto assets could be worth watching that are at an accumulation level and have managed to sustain at least the past 7 days’ declines.

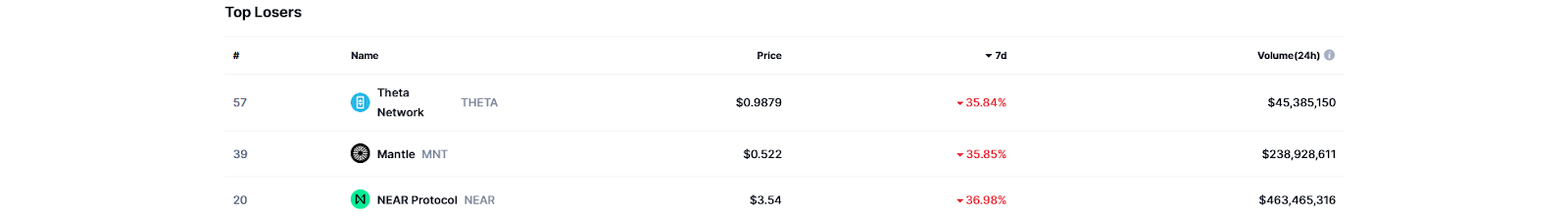

Those cryptocurrencies among the top 100 global cryptos are Theta Network ($THETA), Mantle ($MNT), and Near Protocol ($NEAR).

Can Theta Network ($THETA) Show 400% Return?

Historically, $THETA had a run of more than 300% earlier in the first quarter of 2024, which peaked at $3.82. In the second quarter, it followed a downtrend by profit bookers, which extended in the third quarter with a recent $BTC decline. Its price dropped to the $0.90 demand zone at the time of writing.

Despite massive declines in most other cryptos, with $BTC impacting, the $THETA token had the lowest drop amid the $BTC crash landing. The $THETA price in the past week dropped 35.84%. It has been at a promising accumulation level, which has been a historically proven level.

If the token shows a bullish price action, accumulation could be promising for the investors for an upthrust to the $4.5 mark. The probable interruption could be at $1.80, $2.50, and $3.50, respectively.

Can Mantle ($MNT) Make Upto $2 Mark?

$MNT, positioned second in the list, was affected 35.86% in the past 7 days and has been at a critical zone. This level could be a deciding level. If it’s breached, the lows are evident.

However, the level has shown the power of bulls in the past. The $MNT price could ignite for $2 if major buying activity occurs. The resistance to watch would be at $0.88 and $1.24 levels, respectively.

Can $NEAR Protocol ($NEAR) Set a New $ATH?

The third on the list is $NEAR. This crypto has aped more than 750% gains in the past from October 2023 lows near the $1 mark, where the $3 demand zone had played a key role earlier.

During the current broader market dip, the $NEAR price has slipped back to the same demand zone at $3, with a 36.98% fall over the past 7 days. The price slipped after a brief rally from $4.35, but bulls failed.

Therefore, the recent situation highlights that contingent on the buyer’s interest, $NEAR could aim for $10 to build a new $ATH from the demand zone. It may encounter resistance at $5.0 and $6.80, respectively.

thecoinrepublic.com

thecoinrepublic.com