Arbitrum’s (ARB) price has plummeted by over 30% in the past 24 hours. This is due to its significantly positive correlation with leading assets such as Bitcoin (BTC) and Ethereum (ETH), whose values have plunged to multi-month lows within that period.

As of the writing, the Layer 2 (L2) token trades at $0.44, its lowest price ever.

Arbitrum Falls by Double Digits, Long Traders Count Their Losses

While ARB trends downward, its daily trading volume has spiked. Totaling $589 million at press time, it has risen 151% over the past 24 hours. The opposite movements of ARB’s price and its trading volume create a negative divergence, indicating a significant bearish bias toward the L2 token.

A surge in volume during a price decline means many investors are selling the asset, potentially due to negative news or broader market downturns. A decrease in trading volume suggests that the downtrend is not a fluke but is backed by substantial selling activity.

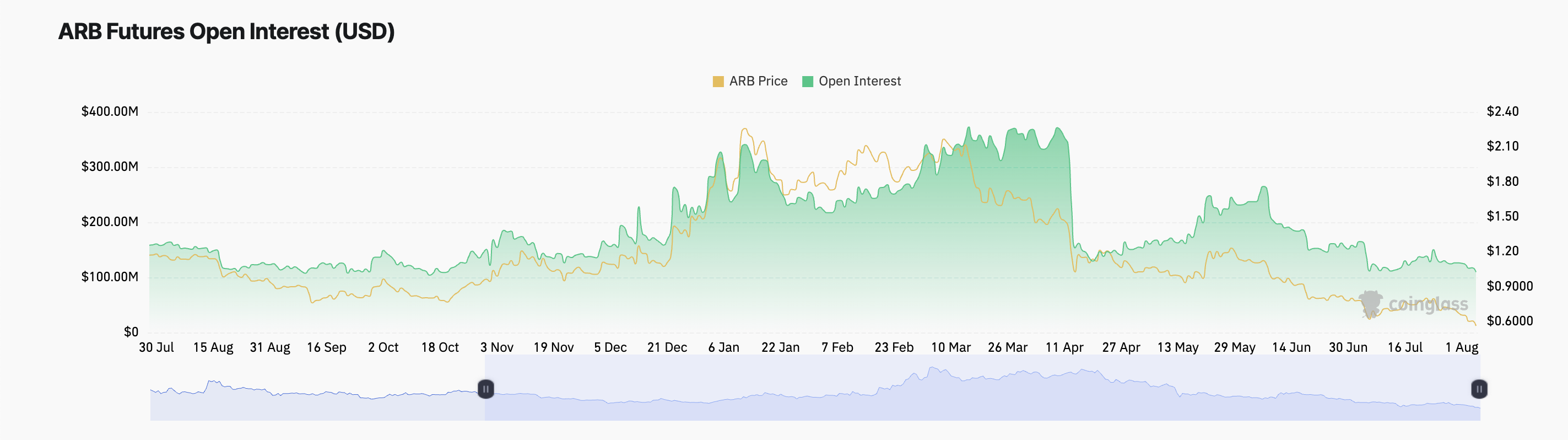

ARB’s double-digit price fall in the past 24 hours has also impacted activity across its derivatives market. While its derivatives trading volume has skyrocketed by over 200% during the period in review, the 30% drop in open interest confirms that many market participants are exiting the ARB’s futures and options market to prevent further losses.

According to Coinglass, the altcoin’s futures open interest is $109 million as of this writing, its lowest since October 2023.

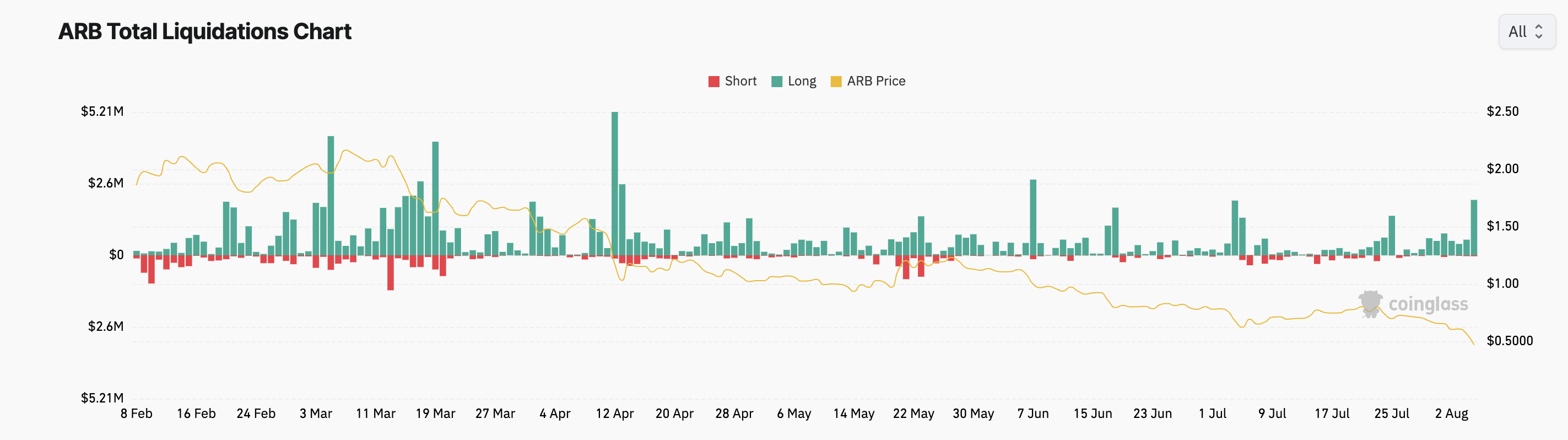

Additionally, the price decline has triggered a surge in long liquidations, as traders on the wrong side of the market have been forced to close their positions. According to Coinglass data, ARB long liquidations have reached $2.01 million at the time of writing. The last time daily long liquidations were this high was on June 7.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

Long liquidations happen when traders with long positions are forced to sell their assets at a lower price to cover their losses as the price falls. This usually occurs when the asset’s price drops below a certain threshold, forcing traders who had bet on a price increase to exit the market.

ARB Price Prediction: A Rebound in Sight?

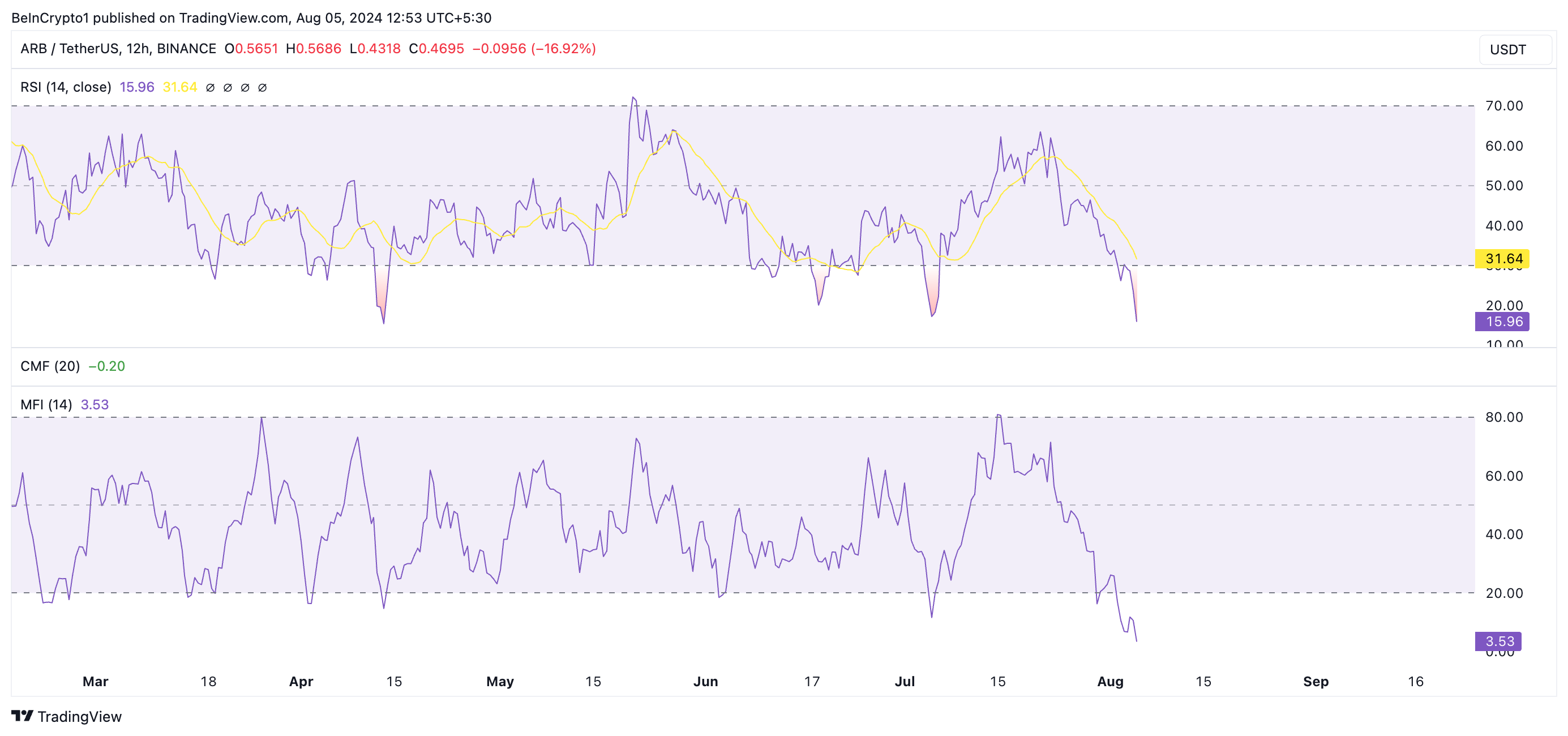

Readings from ARB’s key momentum indicators, the Relative Strength Index (RSI) and the Money Flow Index (MFI) suggest that a rebound might be on the horizon.

At press time, ARB’s RSI is 15.96, while its MFI is 3.53. These values suggest that ARB is oversold and may soon experience a positive correction.

While this may be possible, the bearish bias toward the L2 token remains significant, as evidenced by the large volume of liquidity traders continue to remove from the ARB market.

According to ARB’s Chaikin Money Flow (CMF), which measures how money flows in and out of its market, the market is currently weak. Below zero at -0.20, the token’s CMF signals a high capital exit. This is a known precursor to a further price decline.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

This may push the token’s price further downward. However, ARB’s price may head toward $0.99 if a rebound occurs.

beincrypto.com

beincrypto.com