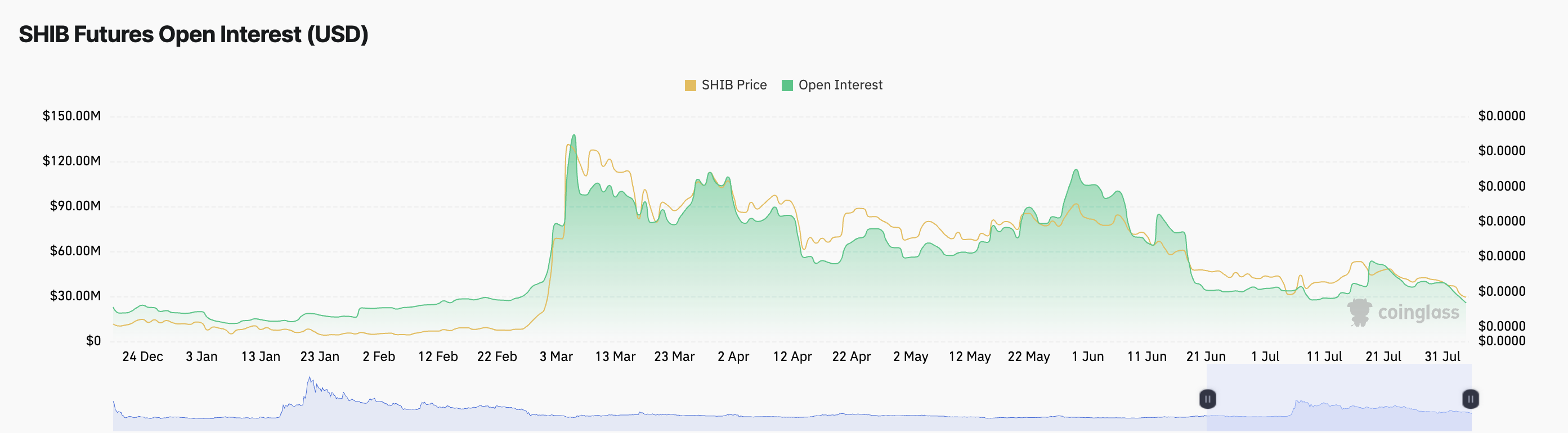

Shiba Inu’s ($SHIB) derivatives market has seen a decline in activity in the past few weeks. This is reflected in its falling futures open interest, which now sits at its lowest level since February 14.

This decline is due to the fall in the meme coin’s price. As of this writing, $SHIB trades at $0.000014, a price level it last reached on March 1.

Shiba Inu Traders Stay Away From Betting on the Coin’s Future Price Movements

According to Coinglass, $SHIB’s futures open interest is $26 million. It has declined consistently since July 19, dropping by 51% in the past 16 days.

An asset’s futures open interest refers to the total number of outstanding futures contracts that have not been settled. When it declines, it indicates a decrease in market activity and interest in the underlying asset. It is generally interpreted as a bearish signal which implies that traders are becoming less confident in the future price of the asset.

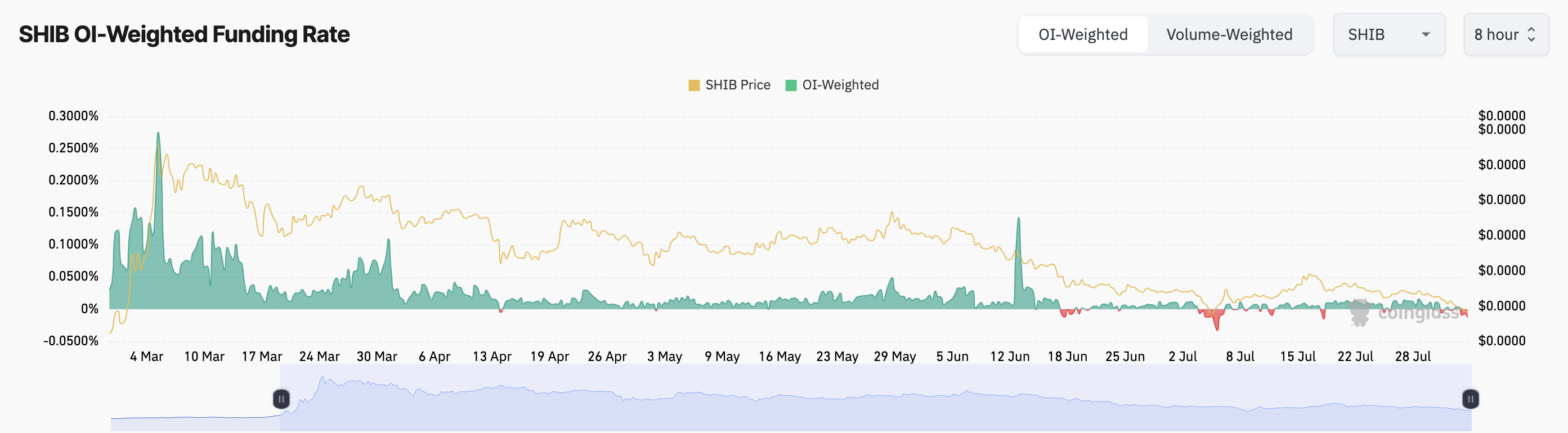

However, $SHIB’s predominantly positive funding rate across cryptocurrency exchanges suggests that this might not be true for the meme coin.

For context, since it climbed to a year-to-date peak of $0.000035 on March 6, $SHIB’s price has maintained a downtrend. However, its weighted funding rate has remained primarily positive since then, highlighting the constant demand for long positions among futures traders.

Read more: Shiba Inu — A Beginner’s Guide

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are positive, it means more traders are buying the asset and expecting a price rally than those buying and hoping for a decline, which is a bullish signal.

$SHIB Price Prediction: Is Rebound Underway?

$SHIB’s Relative Strength Index (RSI), assessed on a one-day chart, suggests a possible price rebound. At press time, the indicator’s value is 29.03.

An asset’s RSI indicator measures its oversold and overbought market conditions. At 29.03, $SHIB’s RSI suggests that the meme coin might be oversold and due for an upward correction.

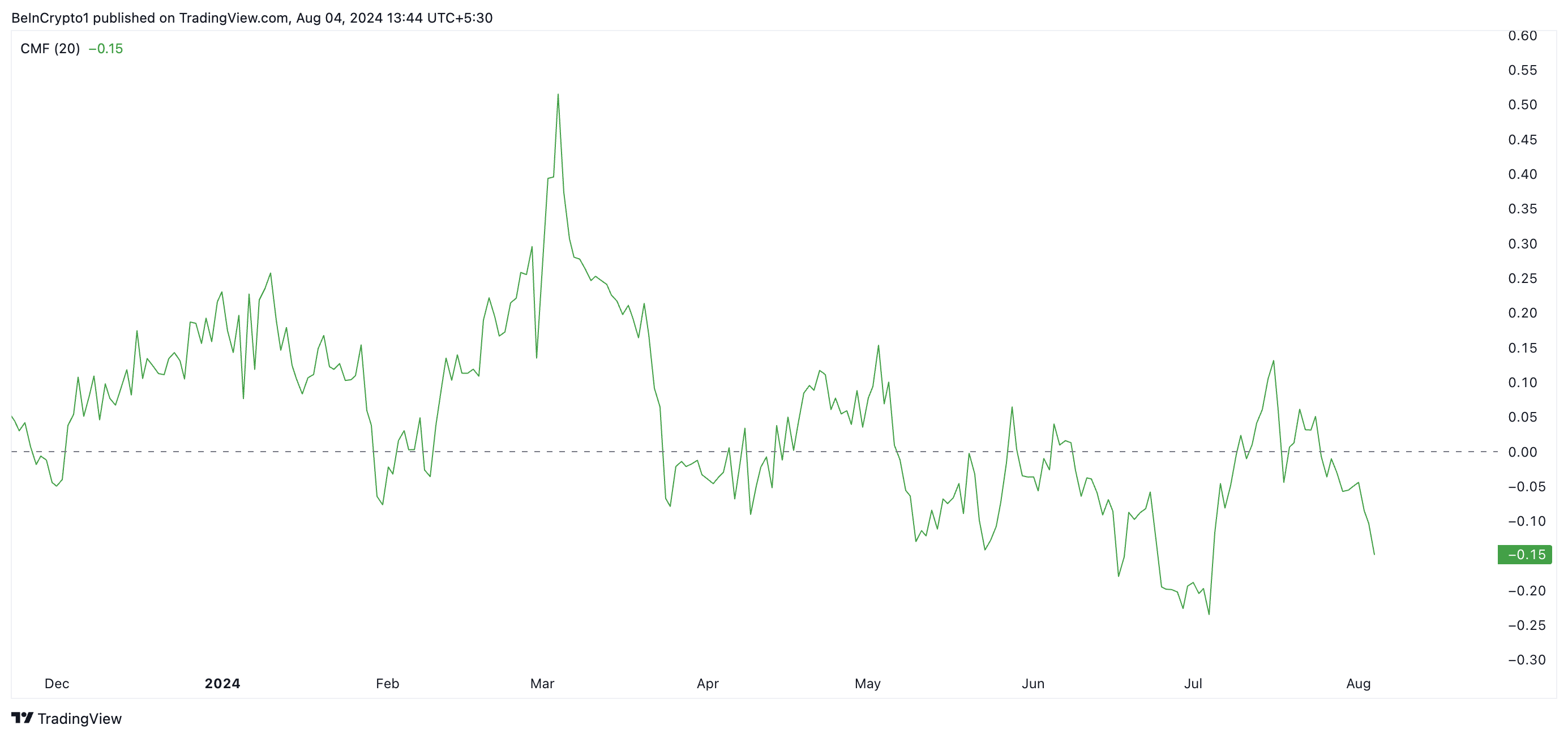

However, readings from its other indicators signal that the rebound might not happen in the near term. For example, $SHIB’s price decline has been accompanied by a falling Chaikin Money Flow (CMF). At press time, $SHIB’s CMF is below zero at -0.15 and in a downtrend.

This indicator tracks the flow of money into and out of an asset. A CMF value below zero is a sign of market weakness.

A falling price coupled with a declining and negative CMF suggests a strong bearish trend. The falling CMF implies more money is flowing out of the asset than into it, reinforcing the bearish trend and making it clear that selling pressure significantly outweighs buying pressure.

If this trend continues, $SHIB’s price will fall to $0.000012. It last traded at this price level on July 5.

Read more: 12 Best Shiba Inu ($SHIB) Wallets in 2024

However, if the market trend reverses and more liquidity begins to flow into $SHIB than out of it, it may witness a rally, pushing its price to $0.000020.

beincrypto.com

beincrypto.com