The bears are still in control in today’s session, as seen from the increase in the global market cap. The total cap stood at $2.32T as of press time, representing a 3.39% decrease over the last 24 hours, while the trading volume jumped by 23.6% over the same period to stand at $78.7B as of press time.

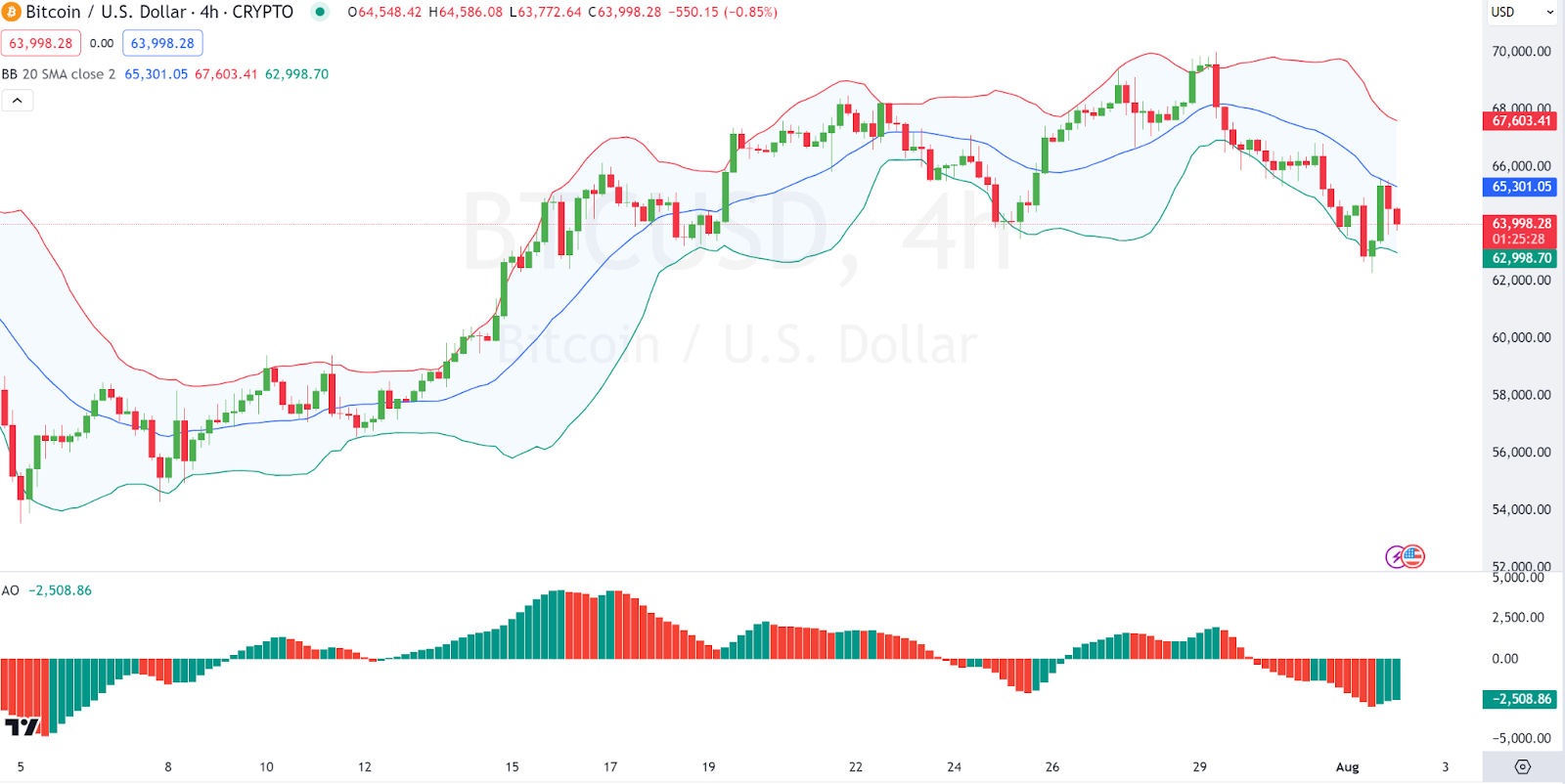

Bitcoin Price Review

Bitcoin, $BTC, has posted slight gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, we see that Bitcoin has recently touched the lower Bollinger Band, indicating it might be oversold and could potentially rebound towards the middle band around 65,301.05. The bands are widening, suggesting increased volatility.

On the other hand, the Awesome Oscillator (AO) is currently negative. Still, it shows a slight increase in green bars, which could indicate a potential bullish momentum shift if this trend continues. Bitcoin traded at $64,324 as of press time, representing a 0.03% increase over the last 24 hours.

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 2">

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 2">

Ethereum Price Review

Ethereum, $ETH, has failed to post gains in today’s session, as seen from the price movements. An in-depth analysis shows that the Alligator’s lines are converging, indicating a period of low volatility and potential consolidation. If the lips cross above the teeth and jaw, it could signal a bullish trend.

On the other hand, the Woodies CCI is currently at -79.63, below the -100 level, which typically indicates an oversold condition. Ethereum traded at $3,155 as of press time, representing a 0.45% decrease over the last 24 hours.

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 3">

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 3">

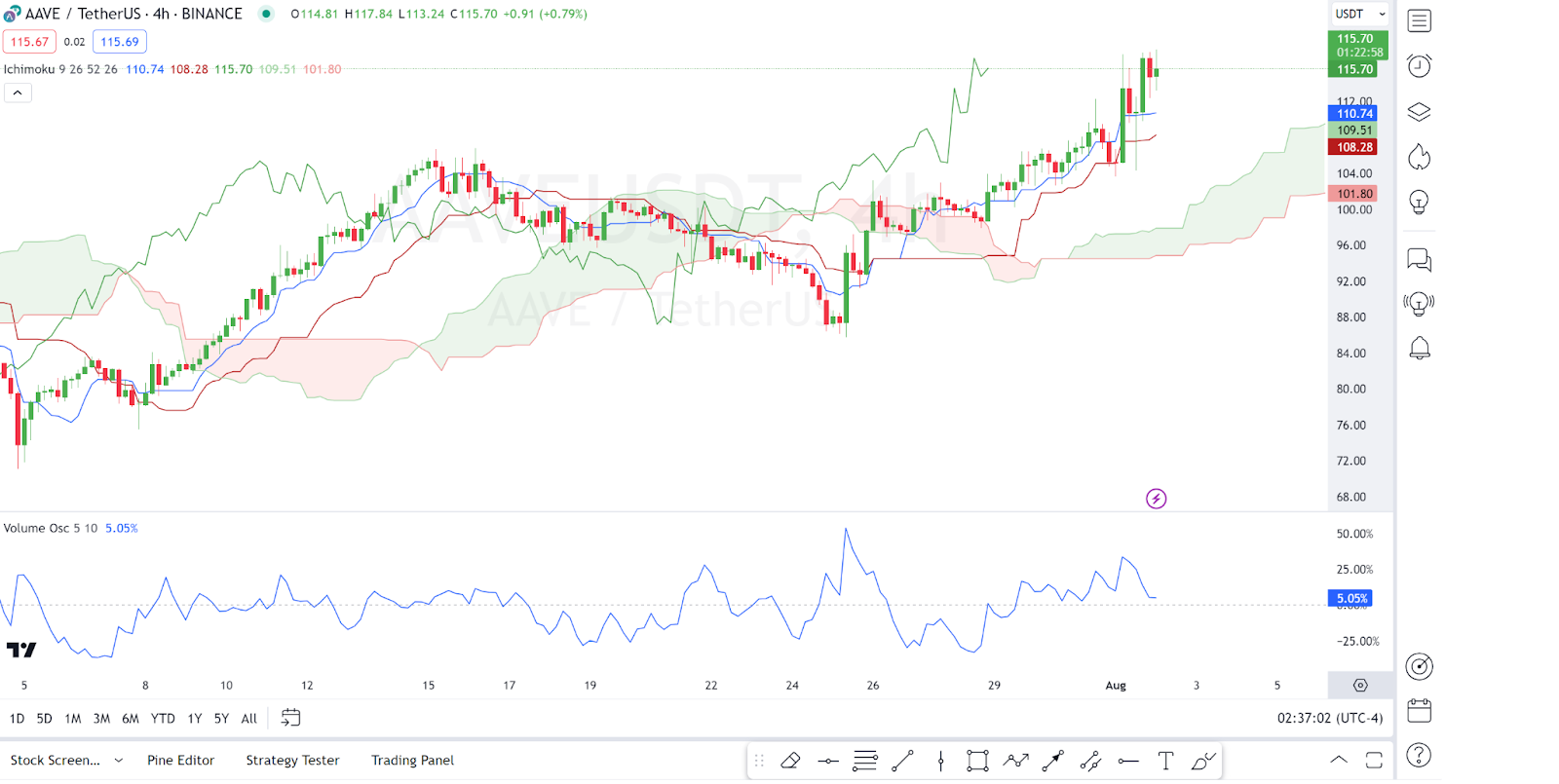

Aave Price Review

Aave, $AAVE, is also among the gainers in today’s session, as seen from its price movements. An in-depth analysis shows that $AAVE is currently above the Ichimoku cloud, indicating a bullish trend. The cloud is thick, suggesting strong support between 101.80 and 108.28.

On the other hand, the Volume Oscillator is at 5.05%, indicating that the buying volume is stronger than the selling volume, supporting the bullish trend. Aave traded at $115.92 as of press time, representing a 10.08% increase over the last 24 hours.

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 4">

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 4">

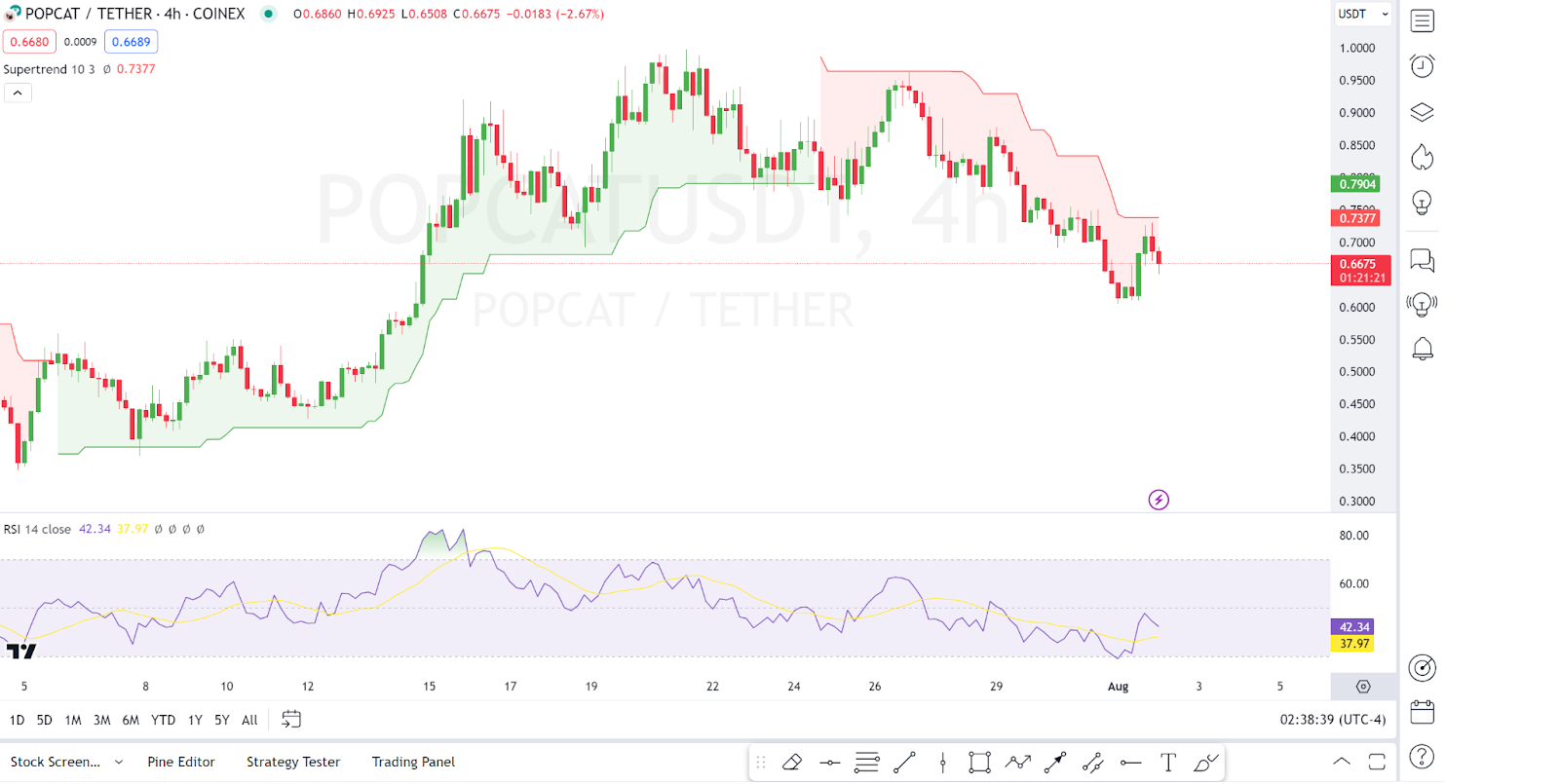

Popcat ($SOL) Price Review

Popcat ($SOL), $POPCAT, is also among the gainers in today’s session, as seen from its price movements. Looking at in-depth analysis, we see that the current Supertrend indicator is bearish as the Popcat ($SOL) price is below the red line at 0.7377. A break above this level could reverse the trend to bullish.

On the other hand, we see that the RSI (Relative Strength Index) is at 42.34, below the 50 mark, indicating a bearish momentum. However, it is approaching the oversold territory (below 30), suggesting a potential rebound. Popcat ($SOL) traded at $0.6697 as of press time, representing an 8.7% increase over the last 24 hours.

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 5">

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 5">

Aioz Network Price Review

Aioz Network $AIOZ is also among the gainers in today’s session, as seen from its price movements. An in-depth analysis shows that the Pitchfork lines show that $AIOZ is trading within an upward-sloping channel, indicating an overall bullish trend. The Aioz Network price is currently near the lower band of the pitchfork, which could act as support.

On the other hand, the MFI (Money Flow Index) is at 47.07, close to the 50 level, indicating a neutral stance. A move above 50 would indicate buying pressure, while a move below 50 would indicate selling pressure. Aioz Network, $AIOZ, traded at $0.5976 as of press time, representing a 6.58% increase over the last 24 hours.

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 6">

$BTC, $ETH, $AAVE, $POPCAT, $AIOZ 6">