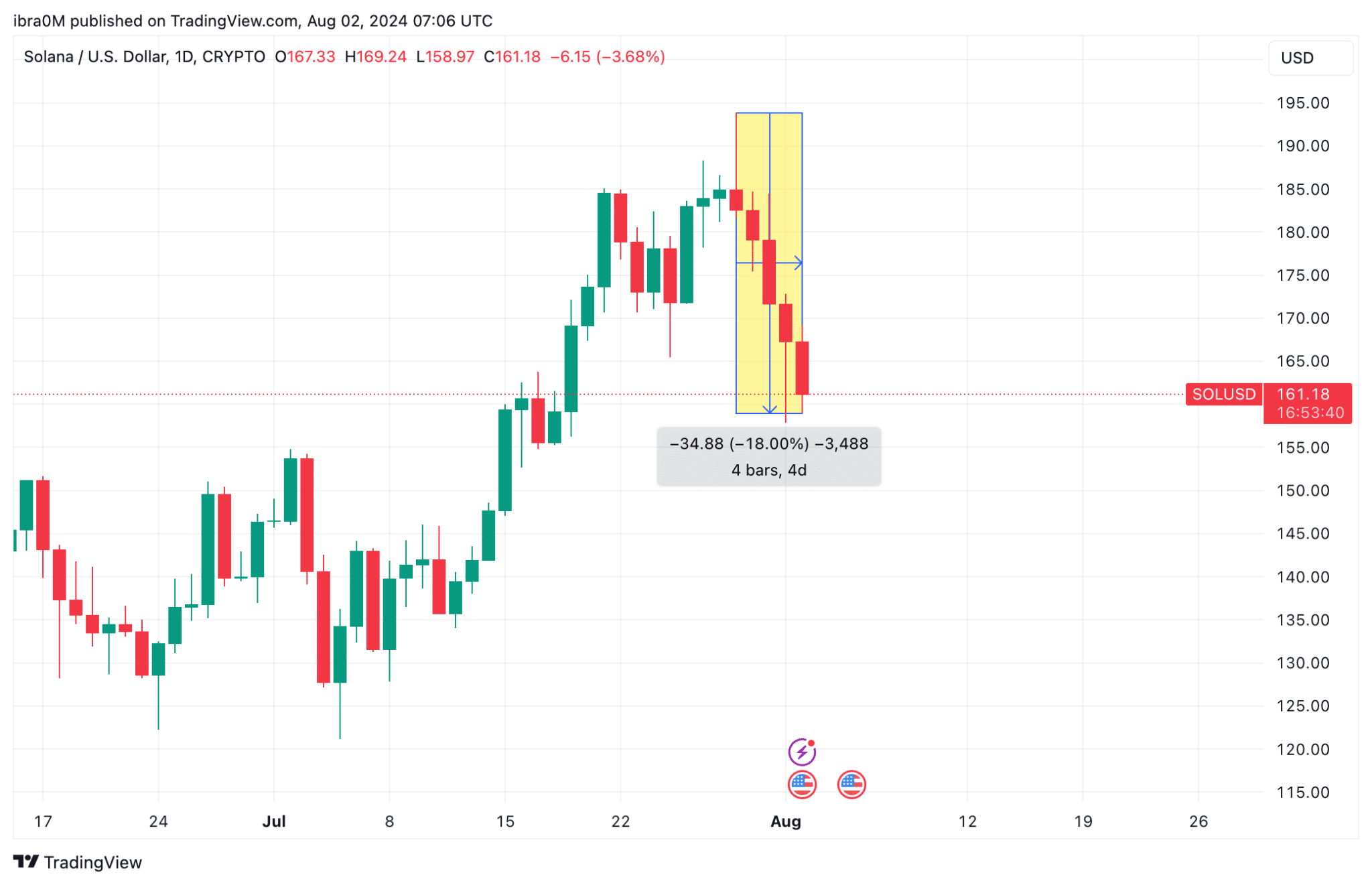

Solana price fell below $160 on Aug 2, extending it weekly timeframe losses to the 18% mark, as panic sellers forced derivatives traders to close out over $360 million worth of SOL contracts within 48-hours.

Solana Price Plunges Below $160 after Fed Rate Pause

Solana price registered 5th consecutive losing day on Friday, Aug 2, as bears further tightened their on the broader crypto markets.

On July 31, the US Fed announced a decision to hold interest rates unchanged for the 3rd consecutive month. This has sparked a major bearish reaction in Solana markets and across the cryptocurrency sector this week.

That announcement effectively dashed the hopes of investors who had anticipated the dovish NFP and CPI figures posted on July 5 would move the needle for a rate cut in August.

The chart above shows how SOL price had started the week positively, racing above the $193 for the first time in 4 months dating back to April 2024. But following a cascade of bearish catalysts Solana bulls have failed to build on the momentum and push for a $200 breakout.

Solana price dipped as low as $158 in the early hours of Friday Aug 2, reflecting a staggering 18% decline from the local top recorded on Monday July 29.

Largely, the latest phase of Solana’s ongoing downtrend appears to be driven by dampened investor sentiment. Following Van Eck’s application for SOL ETF in June 2024, many had anticipated that the Ethereum ETF launch would boost Solana’s prospects.

However, that narrative now seems to have a negative impact on SOL price action. After a fairly positive first week of trading, Ethereum ETFs have struggled for traction this week, recording over 165,000 ETH outflows in 4 consecutive trading days between July 24 and July 30.

This has sparked fears that a Proof-of-Stake (PoS) ETF may not be as attractive to investors as Bitcoin ETFs, therefore discounting the potential positive impacts of Solana ETF prospects.

In reaction to this, derivatives traders betting on spot Solana price action have closed a significant amount of their positions this week.

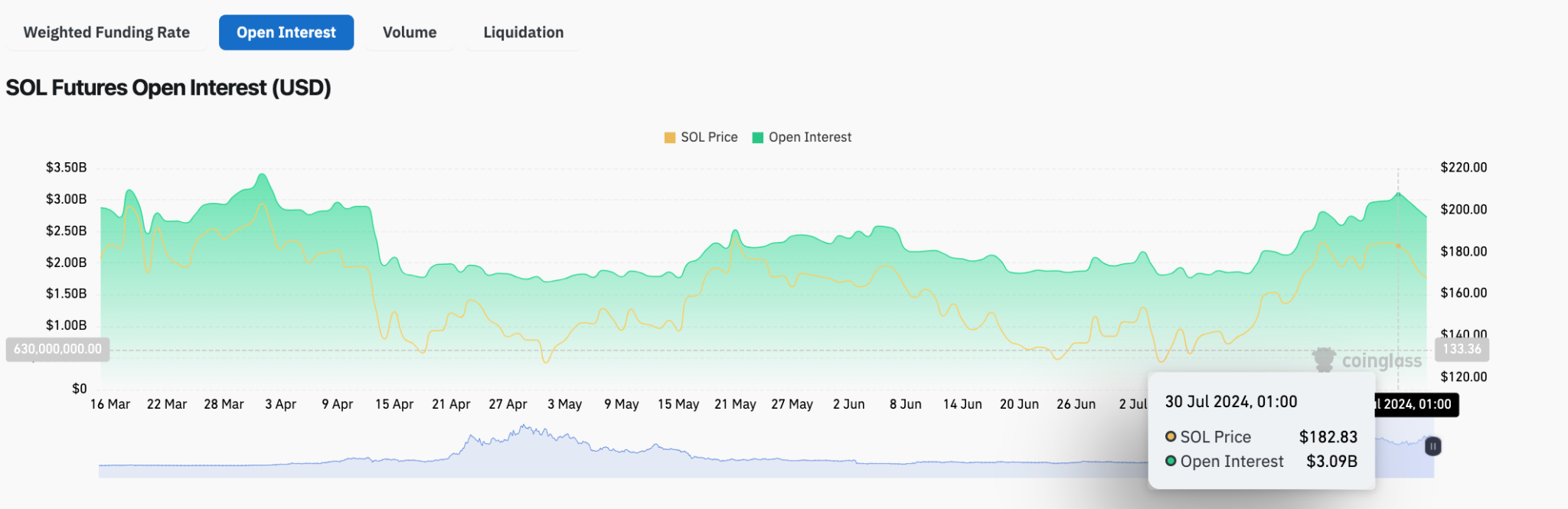

The Coinglass Open Interest chart monitors the dollar value of capital invested in the SOL/USDT derivatives markets across various exchanges and trading platforms.

Solana traders held over $3.09 billion in action SOL/USDT perpetual futures contracts as of July 30. But just as SOL prices began to retrace, traders responded by closing out their positions rather than make covering trades, which further accelerated the decline.

Solana open interest has since dropped by 11% to hit $2.73 billion at the time of writing on Aug 2. This clearly shows that Solana traders have closed out positions worth $370 million in the 5 trading days between July 29 and Aug 2.

More so, it is important to note that the 18% SOL price decline recorded during this period far exceeds the 11% drop-off in open interest.

When prices fall faster than open interest, it signals that there is a significant amount of selling pressure in the market, often driven by long positions being liquidated or a reduction in speculative interest.

This discrepancy suggests that Solana traders are exiting positions more aggressively than usual, which can amplify further downward price movements in the days ahead.

Solana Price Forecast: Panic Sellers Could Trigger $150 Retest

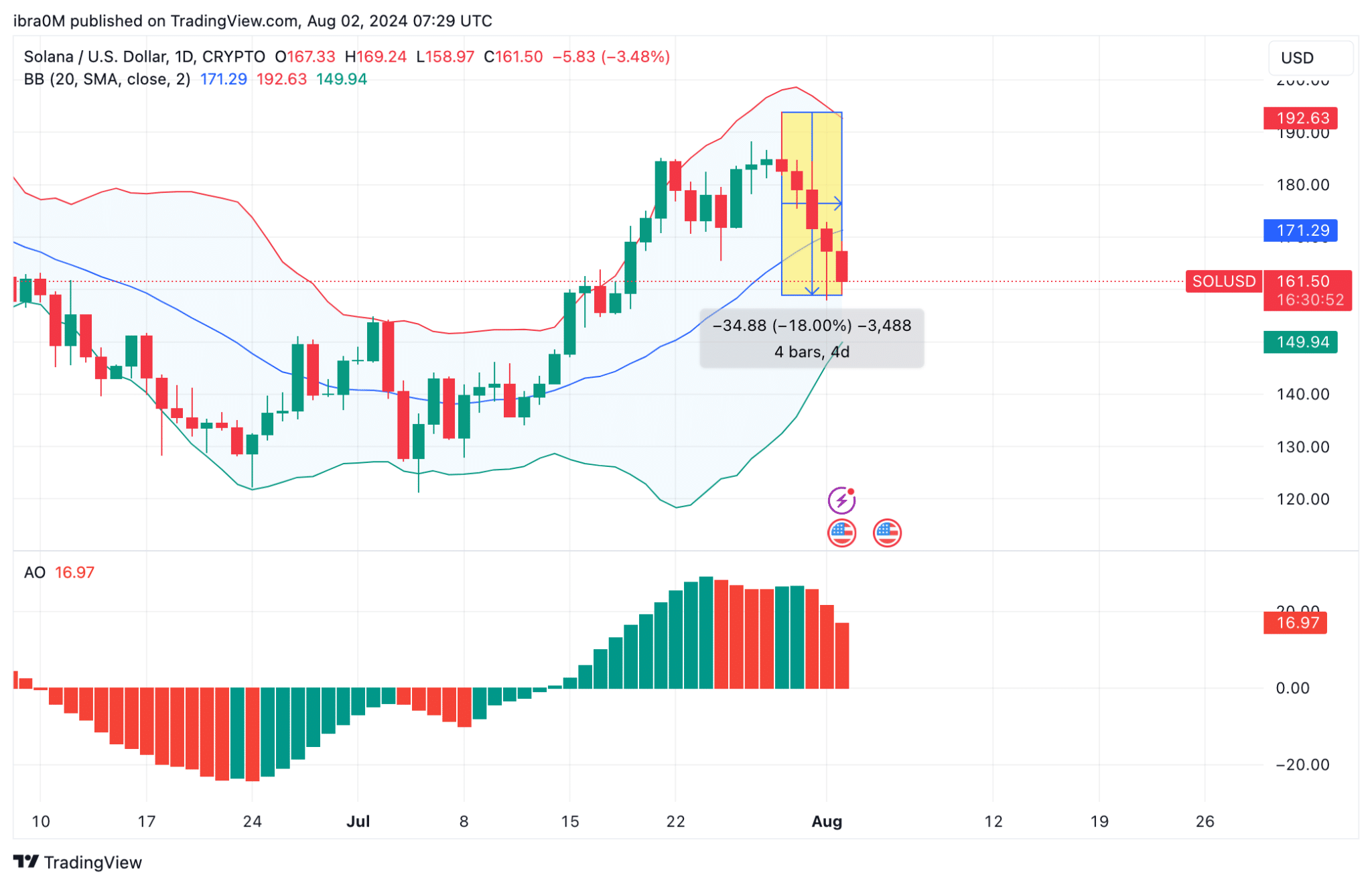

The recent 18% decline in Solana (SOL) price, as depicted in the chart, indicates a significant pullback from its recent highs. This sharp decline has caused SOL to break below the middle Bollinger Band, which is currently acting as a dynamic resistance around $171.29.

The immediate support to watch is at $149.94, aligning with the lower Bollinger Band. This level is crucial as a break below it could lead to further downside pressure, potentially triggering a retest of the $150 support zone.

The Awesome Oscillator (AO) is currently showing a bearish momentum, with red bars appearing after a prolonged period of green bars. This shift suggests that the bears are gaining strength, and further downside could be expected if the bearish momentum continues.

However, it’s important to note that the AO is still above the zero line, indicating that the overall trend remains positive in the longer term.

Despite the recent bearish sentiment, there is a silver lining for SOL. The price is approaching a key support level at $149.94, which has historically acted as a strong rebound zone.

If SOL manages to hold above this level, it could attract buying interest from investors looking to capitalize on the lower prices.

thecryptobasic.com

thecryptobasic.com