Layer 1 (L1) blockchain Injective (INJ) will implement its highly anticipated Altaris mainnet upgrade in less than 24 hours.

While the upgrade is expected to increase the network’s efficiency, the market has yet to show substantial enthusiasm. Its INJ token is on the cusp of an extended decline.

Injective Mainnet Upgrade Fails to Impress Coin Holders

Described as a “transformative step for Injective,” the upcoming Altaris Upgrade is designed as a comprehensive overhaul of the platform to improve its performance and overall user experience.

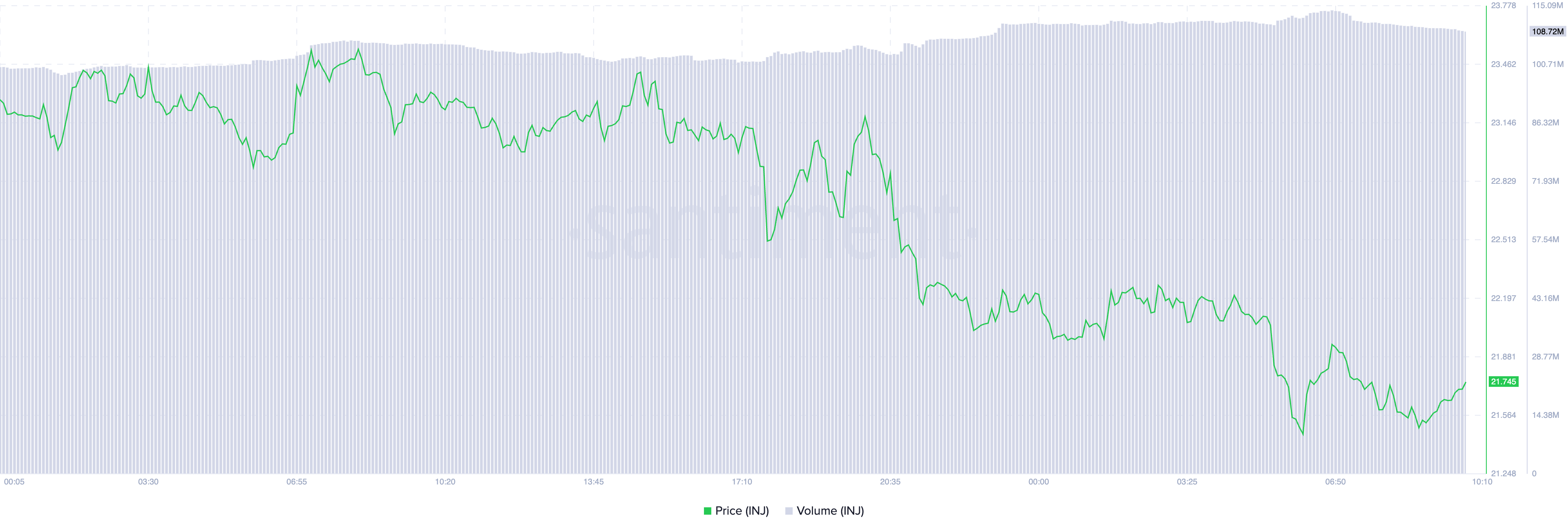

Even though the upgrade is less than 24 hours away and promises to introduce and enhance several core features, INJ’s price has failed to react positively. In fact, in the past 24 hours, the coin’s price has dropped by 6%. However, its daily trading volume spiked by 3% during that period, creating a negative volume-price divergence.

When an asset’s price and trading volume trend this way, it means that selling pressure is increasing, and more participants are getting involved in the coin distribution. This often indicates a stronger bearish trend, as the increased volume confirms the downtrend.

Further, INJ’s weighted sentiment flipped from positive to negative during the early trading hours on Thursday, highlighting the surge in bearish bias toward the altcoin. At press time, INJ’s weighted sentiment is below the zero line at -0.58.

Read More: What is a Layer-1 Blockchain?

An asset’s weighted sentiment tracks the overall mood of the market regarding it. The metric considers the sentiment trailing the asset and the volume of social media discussions.

When it returns a negative value, the asset’s market is overwhelmed by negative sentiment, and its price is expected to fall. Conversely, when the value is positive, the bulls are in control.

INJ Price Prediction: Price Falls Below Key Moving Average

INJ’s price movements, as assessed on a 12-hour chart, show that it trades below its 20-day exponential moving average (EMA), which measures its average price over the past 20 trading days.

When an asset trades below this key moving average, it signals a short-term bearish trend. It indicates that the asset’s recent prices are lower than average over the last 20 days, suggesting weakening momentum.

If buying activity weakens further, INJ’s price could trade further away from this crucial moving average. It might even decline to $16.83, a level it has approached only once since December 2023.

However, if sentiment shifts from bearish to bullish once the Altaris Mainnet upgrade goes live, the coin’s price may climb to $25.35.

beincrypto.com

beincrypto.com