Shiba Inu’s price fell toward $0.00016 on July 31; on-chain data reveals that short-term traders are exiting their SHIB positions, raising concerns of a potential breakdown below the $.000015 level.

Shiba Inu Bulls Retreat toward $0.000016

Donald Trump’s recent appearance at the Bitcoin Nashville conference was expected to trigger bullish sentiment across the crypto market. However, recent market trends suggest that investors’ attention has been mainly focused on the mega-cap assets this week, while the memecoin sector appears to be struggling for traction.

Since the sell-the-news cycle that greeted the launch of the Ethereum ETFs on July 22, bearish traders have dominated the Shiba Inu short-term market momentum.

This heightened volatility associated with the ETF launch has led crypto investors to adopt a more cautious trading outlook toward Ethereum-hosted assets, including Shiba Inu.

Bears Have Mounted another $100 Million Sell-Wall

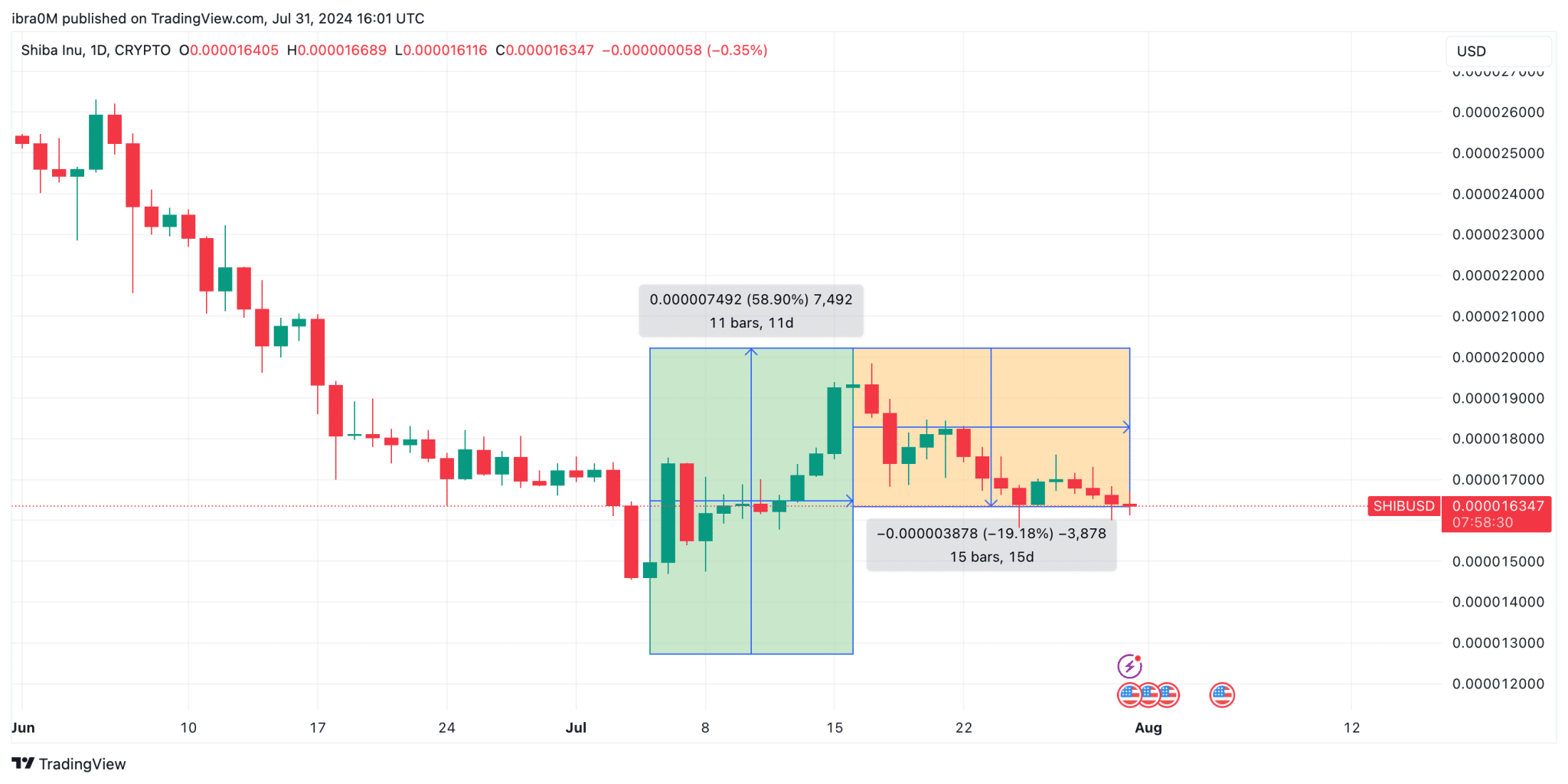

As of July 31, the price of SHIB had decreased by 19.18% from its monthly timeframe peak of $0.000018 recorded on July 22. Markets data now shows short-term traders appear to be preparing to abandon the token in favour of better performing assets.

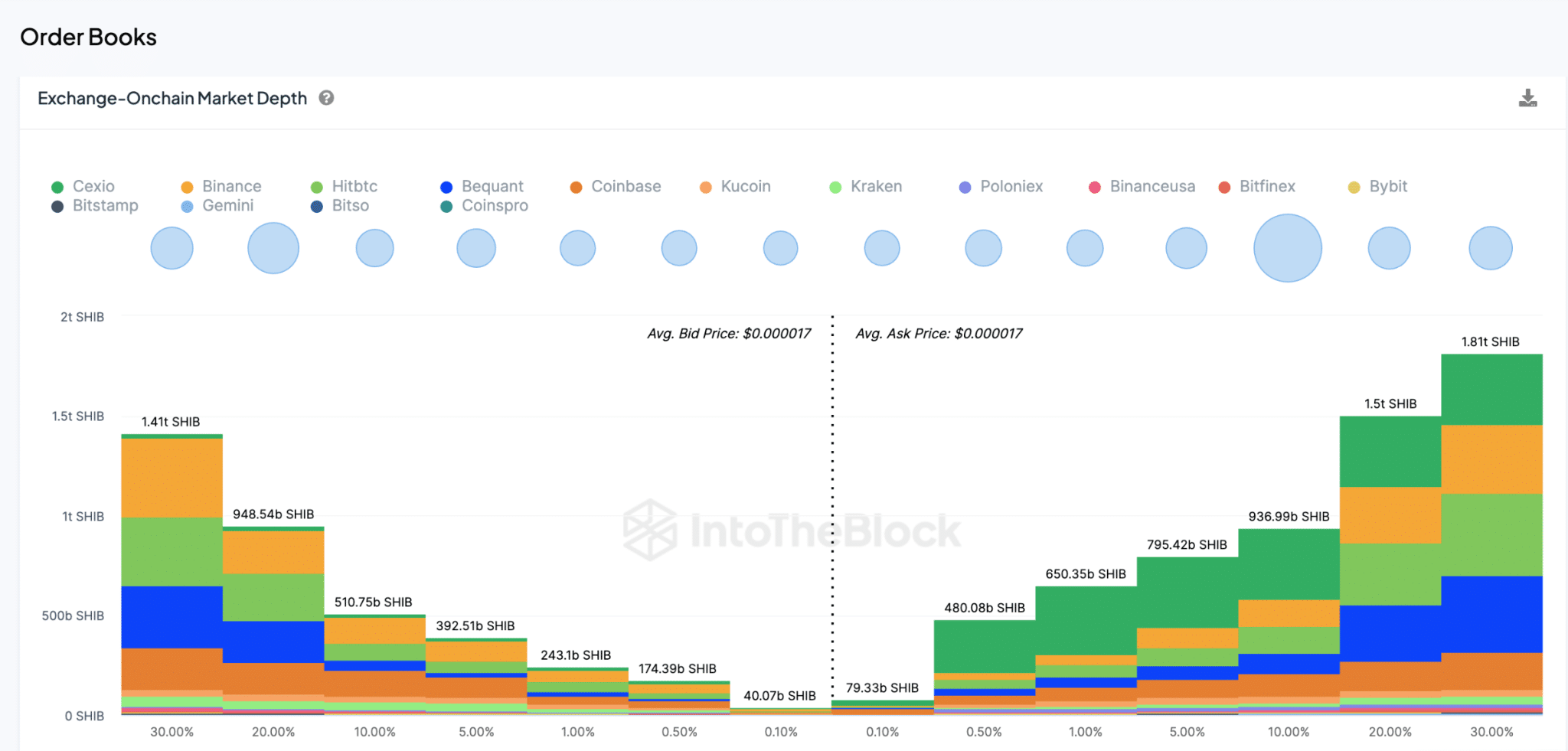

Data from IntoTheBlock’s Exchange Order books provides a clearer picture of this bearish outlook for Shiba Inu.

The Exchange Order Books, which assess the flow of buy and sell orders, reveal a substantial sell-wall forming. Traders have placed orders to sell over 5.9 trillion SHIB at an average price of $0.000017, representing a potential sell-off worth over $100 million. In contrast, prospective buyers have placed orders for only 3.4 trillion SHIB. This discrepancy indicates an excess supply of approximately 2.5 trillion SHIB in the market.

Based on the fundamental laws of market supply and demand, an oversupply typically exerts downward pressure on the asset’s prices. Additionally, rival top 20-ranked cryptocurrencies including XRP, BCH and ETH have all outperformed Shiba Inu in the past week.

This performance disparity suggests short-term SHIB traders may be inclined to sell off their holdings quicker to re-invest in assets that have performed better within the monthly time frame.

SHIB Price Forecast: Bulls to Defend $0.000015 Support

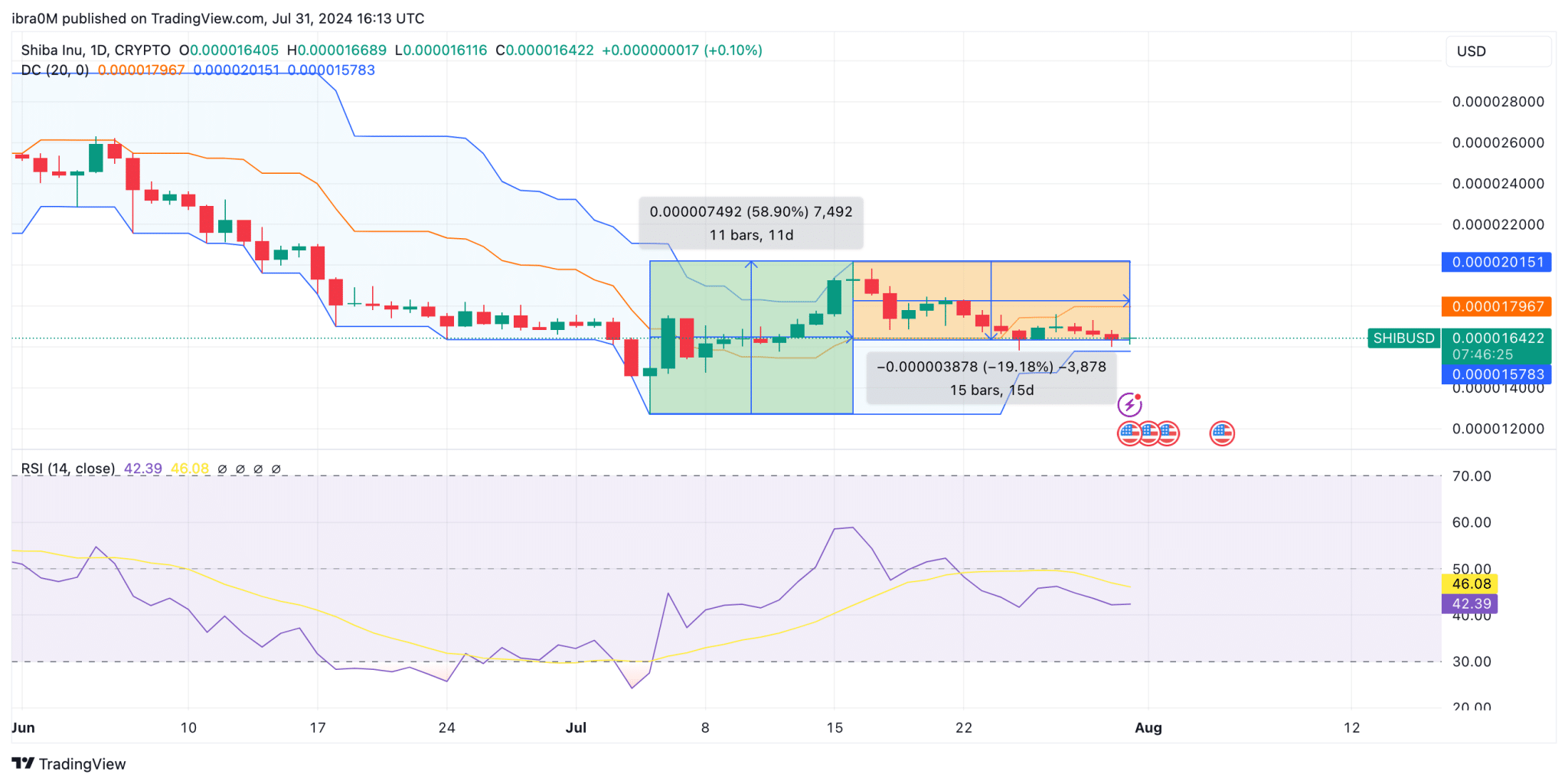

Shiba Inu’s (SHIB) price performance in July 2024 shows a 19% downtrend in the second half of the month. Bulls attempted a recovery in mid-July, rallying by 58.90% within 11 days, but faced strong resistance around $0.00002151. This resistance level remains a critical barrier for any upward movement.

The Donchian Channel (DC) indicates a current upper limit of $0.00002151 and a lower limit of $0.000015783, highlighting a tight trading range that SHIB is currently confined to. The price is hovering around the $0.000016 level, with immediate resistance at $0.000017967. If the bulls manage to break above this resistance, the next target would be the upper DC limit at $0.00002151.

The Relative Strength Index (RSI) is at 42.39, suggesting that the market is currently in bearish territory but not yet oversold. This implies that there is still room for a further decline before reaching oversold conditions. The RSI’s recent movement below the 50 level confirms the bearish momentum, indicating that the price may continue to face downward pressure in the near term.

Key support lies at $0.000015783, which coincides with the lower limit of the Donchian Channel. Bulls need to defend this support level to prevent further downside. A break below this support could lead to a steeper decline, potentially towards the $0.00001400 level.

thecryptobasic.com

thecryptobasic.com