MANTRA, the second largest Real-World Asset (RWA) in market cap, witnessed a notable pullback of over 4% in yesterday’s session.

Recently, it broke out of a major range and rallied by over 70% in the past two weeks. After the intense surge, slight profit booking was noticed. The token has retested the 20-day EMA mark this week.

Buyers are dominating. The price chart shows a vertical rally comprising higher high swings.

Undoubtedly, the trend is bullish, and the investors bought dips heavily, which signified a sustained uptrend.

Notably, the OM token breached the three-month consolidation phase and gained a sharp bullish momentum. This led to an upward price move. It has made a new ATH of $1.42, but significant profit booking from the highs was spotted.

MANTRA at Press Time

At press time, the MANTRA was trading at $1.22 with an intraday surge of 3.86%, reflecting a pullback on the chart. Its trading volume rose over 17%, and the token has noted a monthly surge of 71%, reflecting a short-term uptrend.

The pair of OM/BTC is at 0.0000183 BTC, and the market cap is $1.11 Billion. The total supply is 965.71 Million, and the volume-to-market cap ratio is 0.00972.

MANTRA Daily Chart Analysis

The daily chart of the token projected a sustained uptrend. The token has comfortably held gains above the 61.8% Fib cluster. Amidst the market’s mixed cues, the OM token looks bullish.

Despite the recent volatility, the token was still above the key moving averages. It looks like a strong contender for further accumulation. Once it crosses its previous ATH mark, it can go toward the $2 mark in the short term.

Notably, the momentum indicator, the RSI curve, was in the overbought zone. However, a negative crossover was still exhibited. This indicated that the confirmed reversal was not yet spotted, and buyers are still in a dilemma.

The short term is still favoring the buy on dips. The rebound from the 20-day EMA has given a strong conviction that buyers have bought the dip and are eyeing a significant rally ahead.

Social Dominance and Weighted Sentiment Data Overview

The dominance curve saw a spike of over 6% on the social front and jumped to 0.17%.

Conversely, the weighted sentiment value was still below the zero line, noted at -0.615, indicating a negative stance.

@CryptoSavingExp, in his tweet, mentioned that MANTRA has reached new highs in July. It has escaped the consolidation phase, setting a target of $2 to catch in the short term.

$OM reached new highs in July after it rallied 81% to reach $1.41 📈

— CryptoSavingExpert ® (@CryptoSavingExp) July 29, 2024

It is currently undergoing a retrace following the strong upside move. This could potentially see OM fall into the consolidation zone between $1.09 and $1.01

From there, could OM restart the bullish momentum… pic.twitter.com/0zRDp8U8iE

Until the token slipped below the $1.10 mark, the uptrend was intact. Further bullish swings could be seen ahead.

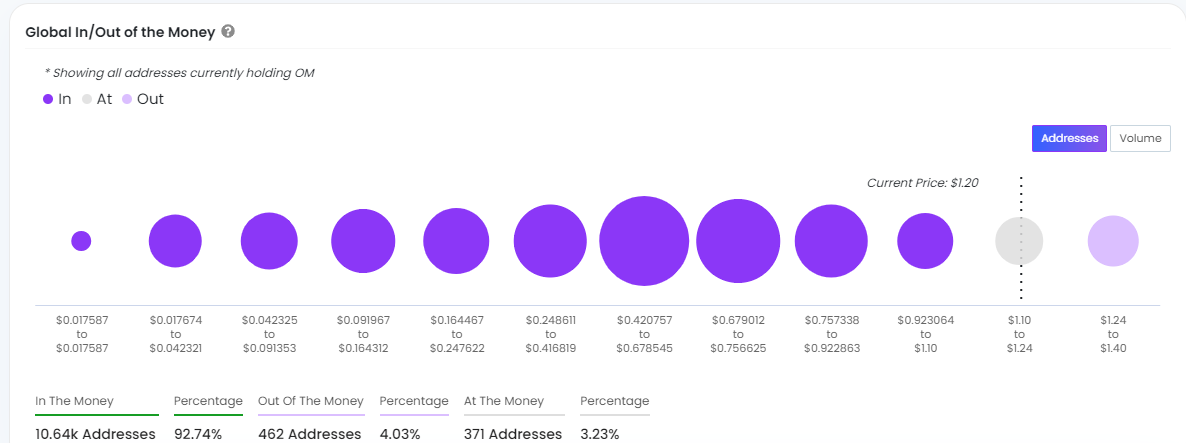

Per the IntoTheBlock, the Global In/Out of the Money indicator conveyed that 92% of OM addresses are making profits at the current price level. In contrast, only 8% of the holders lost their money and faced unrealized losses.

This significant data implied that many profitable holders protected the token from any unwanted selloff. It could continue to accumulate ahead. It shows the bulls’ confidence to hold on to their gains and guide their bullish sentiments.

Notably, its Open Interest has increased over 10.11% to $26.16 Million. This signified fresh long buildup activity in the last 24 hours.

If the token slips below the 20-day EMA mark, it may take support around $1.15 and $1.00. Conversely, if it extends the pullback, it may face the cluster of $1.32 followed by $1.40 ahead.

Nonetheless, the token’s trend is positive, and it could revisit the blue sky zone of $1.40 and $1.50 soon.

thecoinrepublic.com

thecoinrepublic.com