Arweave (AR) price surged 9% in 24 hours, likely influenced by Bitcoin’s advancement, and it grew nearly 65% in 24 days. $BTC has surpassed the $69,500 mark amid a positive crypto market. With $BTC surpassing $69500, the entire crypto market cap has surged to $2.48 Trillion, a 3.09% intraday rise.

AR’s growth corresponded to a 7% market cap surge intraday. It ranked 4th in the global crypto list. Meanwhile, in the past 24 hours, the token’s market cap also surged by 7% to $2.155 Billion.

Similarly, its 24-hour volume on the spot has also experienced growth by 4.62% on all tradeable platforms, which amounted to $45.301 Million. Despite the surge, its liquidity status is weak as of writing, where the volume-to-market cap ratio of 24 hours stands at 2.11%.

Tokenomics shows that 65.65 Million ARs (99.47%) are circulating in people’s hands from a total supply of 66 Million ARs.

Analyst Perspective for AR Price Growth

AR is expected to grow, suggests chatter on X (formerly Twitter).

$AR Gearing Up https://t.co/a2XYLahxfL pic.twitter.com/0fyu1qPltu

— VeLLa Crypto (@VellaCryptoX) July 29, 2024

As per the analyst @VeLLa Crypto. He illustrated with a drawing that the target $42.50.

What Does Arweave (AR) Derivatives Data Analysis Highlights?

As per the derivatives, the derivatives volume has reached $78.43 Million, and Open Interest showed more open contracts opened for the current trend. The OI surged by 9.88%, where it amounted to $77.78 Million.

Similarly, the AR’s 24-hour data liquidation highlights that the shorts that have been liquidated amounts greater than longs liquidation. Thus signifying the bullish potential for Arweave’s (AR) price. Likewise, the shorts that have been liquidated are $112.41K, and longs stayed at $14.92K.

What is the Lowest AR’s Price & the Highest?

As per the TradingView platform, the Arweave built an all-time low (ATL) price of $0.4870 on May 1st, 2020. From this low, the current price has traded 6000% higher. Likewise, on the daily chart, the all-time high (ATH) of $91.11 was recorded on November 1st, 2021. Comparitive to that CMP has traded nearly 60% down.

Reading the Arweave Chart

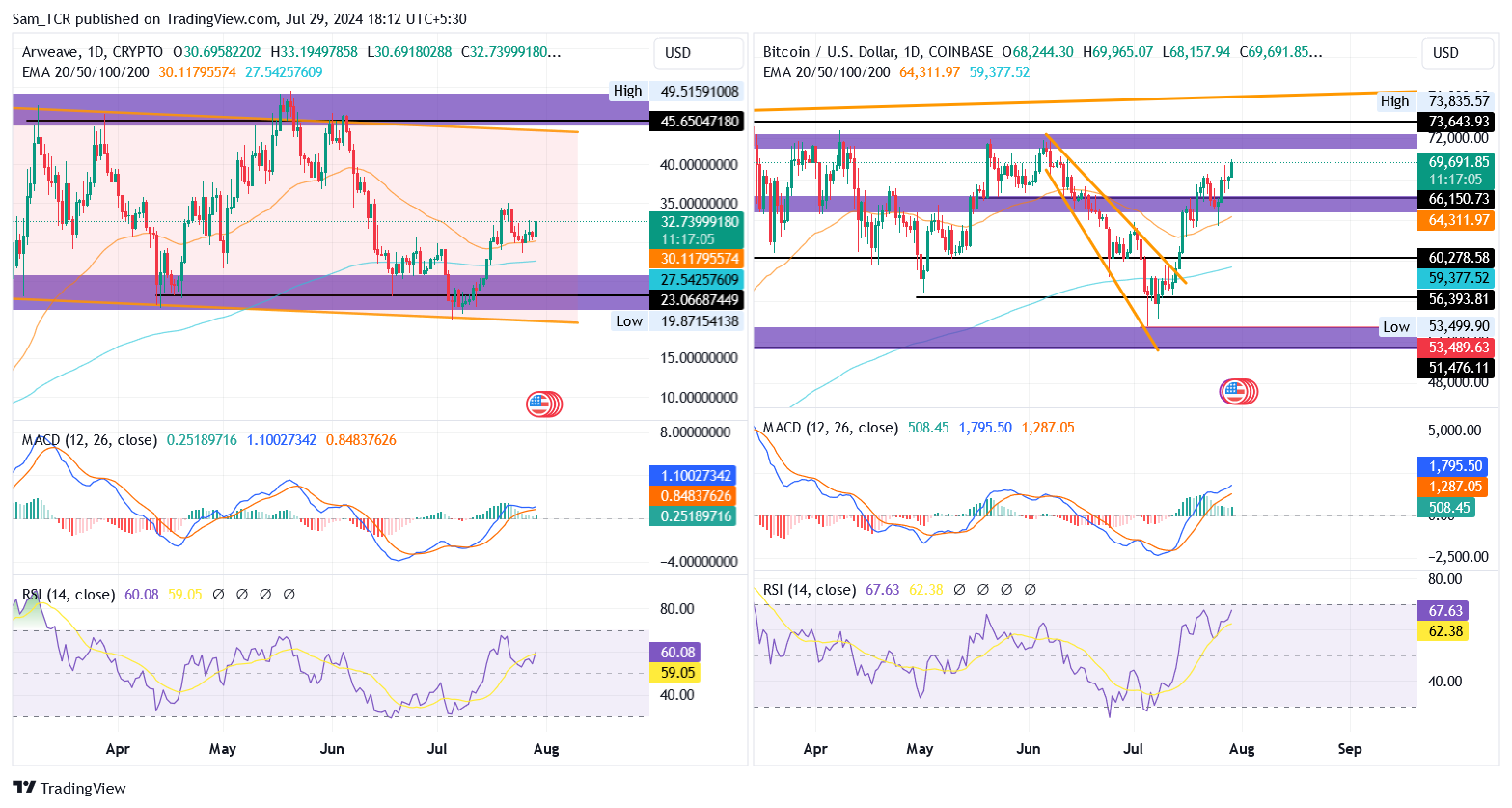

Arweave (AR) price has been in a wedge for nearly 152 days. The price had attempted 4 times to move past the channel’s upper boundary and the resistance zone of $46.10-$49.10. However, it failed and dropped to the lower border of the channel, at the $25.10-$20.10 support zone.

However, a bullish spell was induced in resonance with the broader market, and from July 5th onwards, AR advanced once again for the channels’ upper border.

Indicators-wise, the EMA bands support the price, MACD was at 0.2528, and the RSI was at 60.11.

Therefore, if the momentum continues, the price could Advance higher, while hurdles could be present at $35.10 and $39.10, respectively.

However, the slippage of gains would change the tides, and the price could drive towards supports at $25.10 and $20.10, respectively.

thecoinrepublic.com

thecoinrepublic.com