Toncoin (TON), a top ten cryptocurrency by market capitalization, is navigating a challenging period as it attempts to recover from recent market corrections. Despite a promising outlook earlier in the year, TON has experienced a notable decline, raising questions about its short-term prospects.

The recent price action has seen Toncoin struggling to maintain its position above the crucial $7 mark. The failure to do so has led to a significant price drop, with TON now trading around $6.65 and potentially further dropping to $5. This decline represents a loss of over 13%, reflecting broader market weaknesses and specific issues within TON’s trading dynamics. The decline in TON’s value is attributed to a breakdown below a long-standing support trendline, which has exacerbated bearish sentiment among investors.

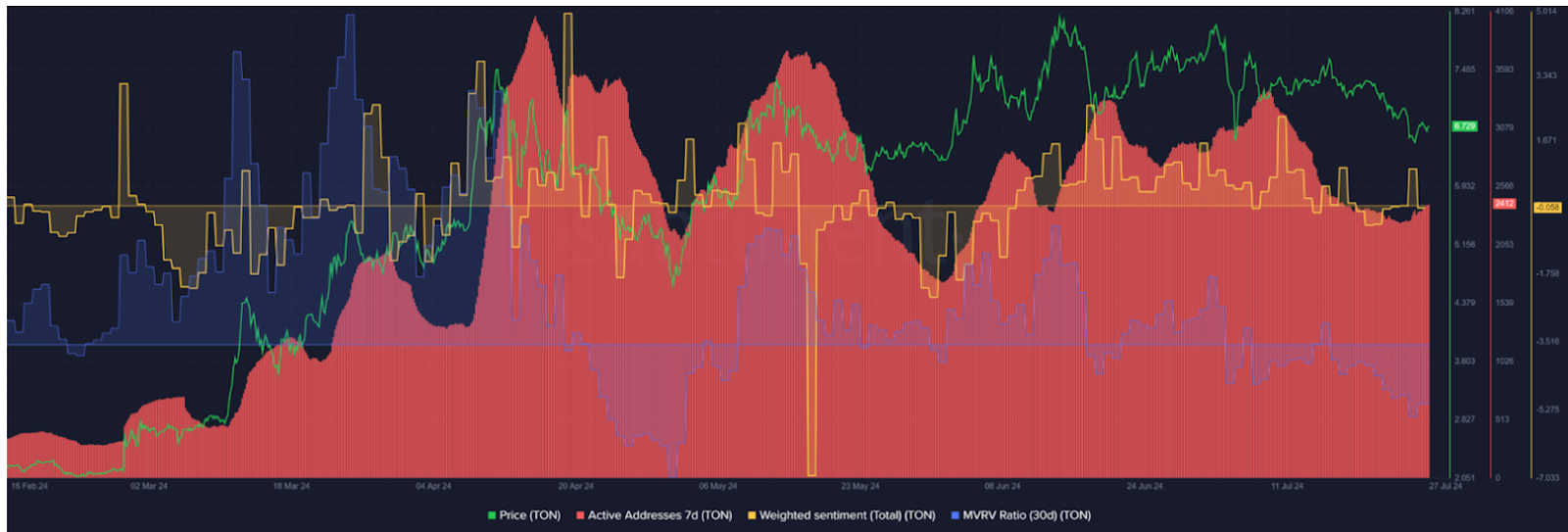

Technical indicators paint a challenging picture for TON. The Relative Strength Index (RSI) and On-Balance Volume (OBV) suggest a bearish outlook, indicating that selling pressure remains prevalent. Additionally, Toncoin’s market value has fallen below its realized value, as suggested by Santiment’s Market Value to Realized Value (MVRV) ratio. This undervaluation may signal potential buying opportunities for speculative investors looking to capitalize on discounted prices.

Source: Santiment

However, the overall market sentiment remains neutral, with no clear signs of a strong bullish reversal. This uncertainty is compounded by the lack of significant body formations in recent daily candles, which suggests a continued supply inflow and a possible further decline in TON’s price. The recent double top formation at the $8 level has created a new resistance line, further complicating the outlook for a recovery.

Despite these challenges, there are glimmers of hope for a bullish turnaround. The Stochastic RSI lines and the daily RSI line are showing an uptick near the oversold boundary, which could indicate a potential for a rebound. Additionally, the Fibonacci retracement level at $6.10 serves as a critical support point. Should the market sentiment improve, there is a possibility for TON to reclaim the $8 level and potentially reach a new all-time high (ATH) of $10.

Nevertheless, caution is advised as the market could still see a bearish candle formation, risking a drop to $5. This scenario underscores the importance of the $6.10 support level, which, if breached, could lead to a significant decline. Investors and market watchers are advised to monitor these key levels closely, as they will likely play a pivotal role in determining TON’s trajectory in the coming weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com