Bitcoin’s price finally touched the coveted $70,000 level yesterday but experienced a massive rejection that pushed it south by over four grand.

The altcoins have also turned red on a daily scale, propelling a $100 billion decline in the total crypto market cap.

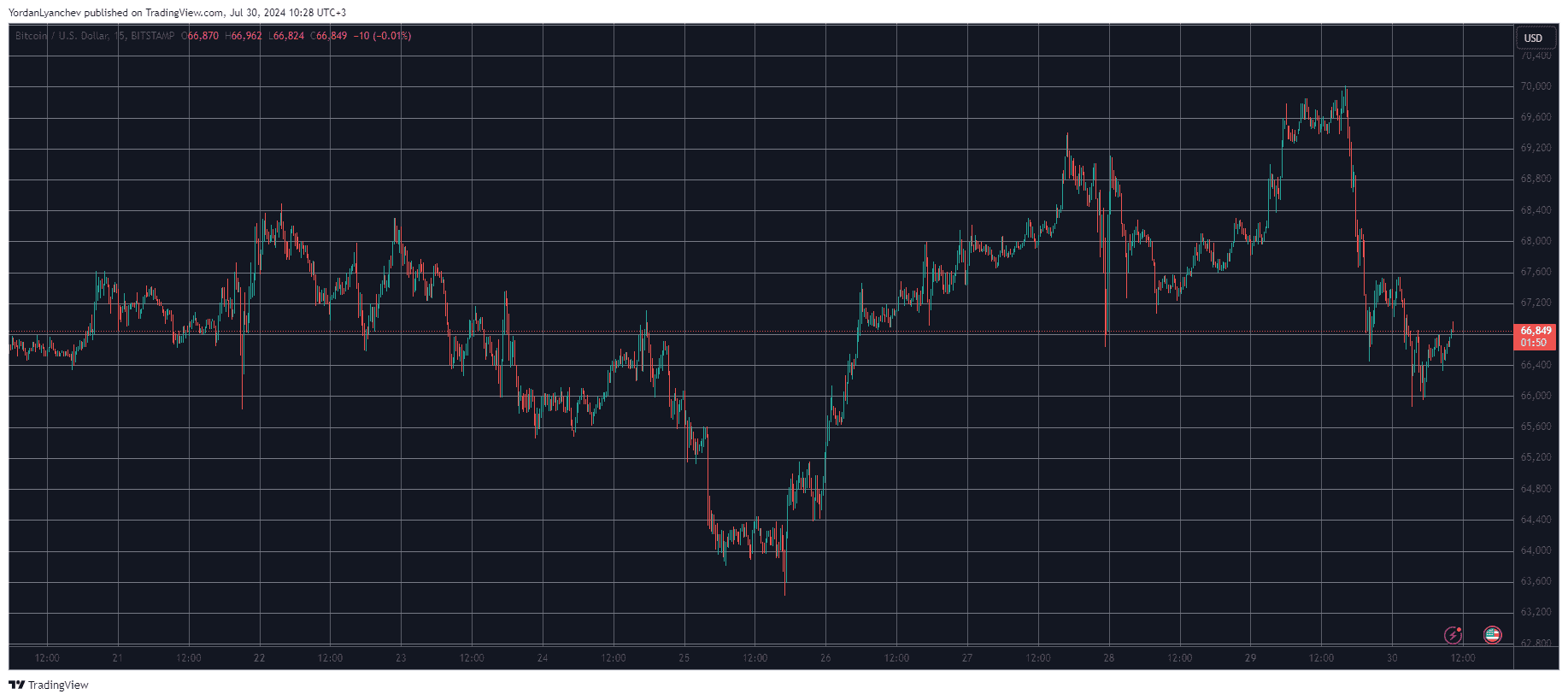

BTC Rejected at $70K

It was last Thursday when the bears seemed in complete control of the market as they drove bitcoin south hard from over $67,000 to a multi-day peak of under $63,500.

However, the bulls came out of the woods at that point and didn’t allow any further declines. In fact, BTC reversed its trajectory and started to gain traction, which culminated in a price surge to over $69,000 on Saturday as the community was preparing for the Bitcoin Conference in Nashville and Donald Trump’s speech.

Once he took the stage, volatility ensued and BTC fell by $3,000, bounced off to its starting position, and returned to $67,200. The bulls stepped up on the gas pedal once again on Monday and they pushed the cryptocurrency to its highest price tag in almost seven weeks of $70,000.

This is where the momentum was halted, perhaps driven by the actions of the US government, and bitcoin dumped hard by over four grand. Despite recovering about $1,000 since its low, BTC is still 4% down on the day. Its market cap has declined to $1.320 trillion, and its dominance over the alts has been reduced to 52.5%.

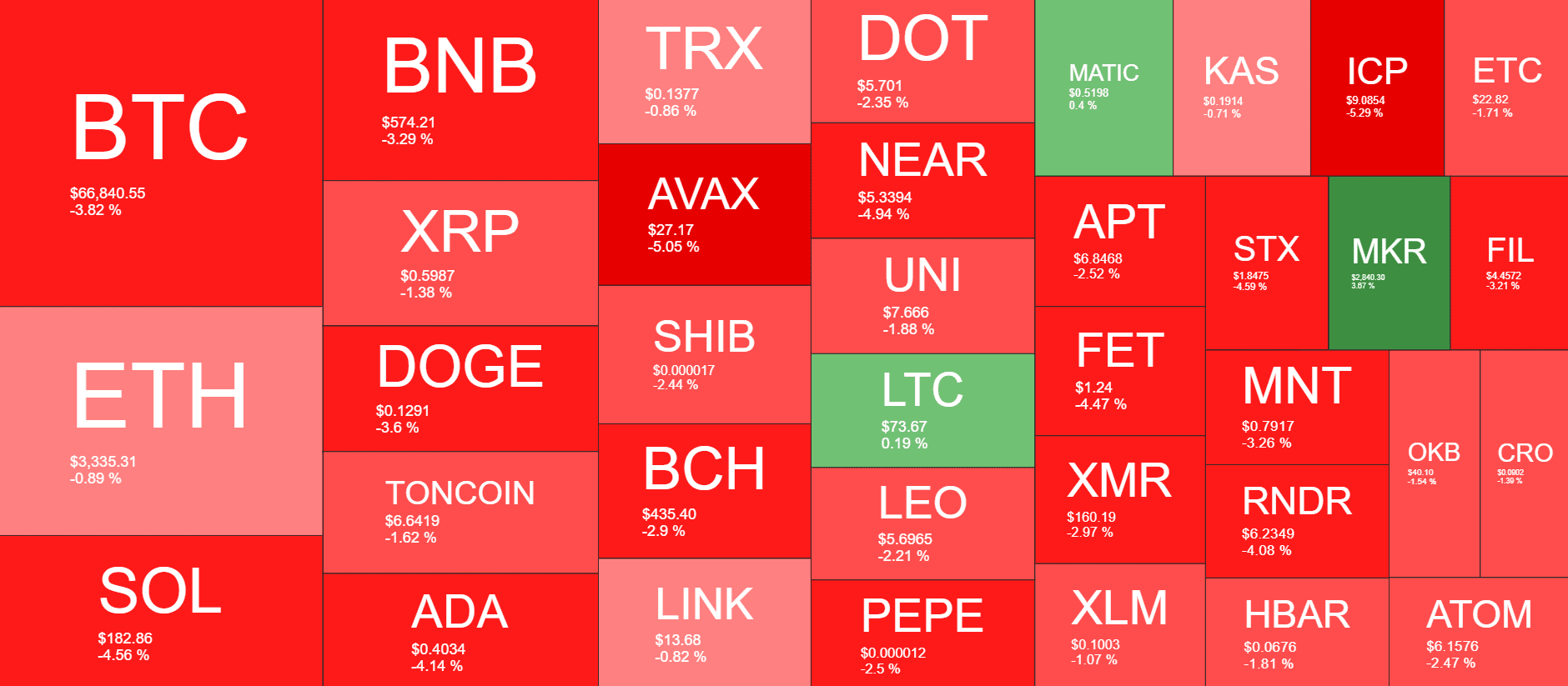

Alts Turn Red

As it typically happens when BTC heads in either direction, so do most alts. The biggest losers from the larger caps include SO (-4.5%), AVAX (-5%), ADA (-4%), DOGE (-3.6%), and others.

ETH XRP, TON, TRX, SHIB, and LINK are also in the red, but in a less painful manner. JUP, TAO, WIF, BONK, AR, and ICP have lost more than 5% in the past day.

The total crypto market cap tapped $2.6 trillion yesterday but dumped by over $100 billion to its local low today.

cryptopotato.com

cryptopotato.com