The Aptos (APT) price exhibited signs of recovery and surged over 38% in the last two weeks. Moreover, it reached the vital trendline hurdle of $8 and eyed a breakout.

It has traded inside a falling channel for the past few weeks and engaged in a downtrend. Still, the trend reversal confirmation was awaited, and the bulls were trying their best to retain the dominance.

Following the recovery in the crypto market, the APT price recovered from its 52-week low. Moreover, it crossed the 20-day and 50-day EMA and showed signs of a potential breakout ahead.

Aptos Price Action Update

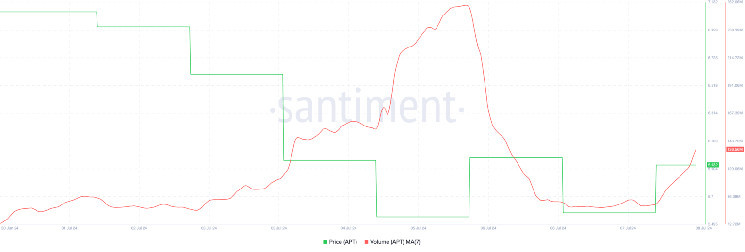

At press time, the Aptos price was trading at $7.27 with an intraday surge of 6.36%, reflecting accumulation on the chart. Its trading volume observed over

16% increase to $44.85 Million in the last 24 hours.

The APT token’s ranking was 32 in terms of market, which was $3.42 Billion at press time. Its total supply was noted at 1.11 Billion.

Aptos Gained Momentum: Is A Breakout Imminent?

The price action signified follow-on lower-low swings, and the token was on the edge of a trend reversal. A fresh higher high above the $8 mark would confirm the signs of reversal.

However, the buyers triggered the accumulation from its lower mark of $5, and the token has exhibited a significant bounce in the last two weeks.

Notably, it traded near the crucial pivot of $8, aiming to breach the trendline hurdle. A breakout could be confirmed once the $8 mark is flipped into a support.

To such probability, signs can be seen from the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI).

The RSI measures the momentum and velocity of price fluctuations and can indicate overbought/oversold conditions in a particular market.

MACD, on the other hand, checks the level of conjunction and isolation between the two SMA lines to identify changes in the momentum.

On both of these indicators, bullish tendencies were close to observable, and a significant crossover was imminent.

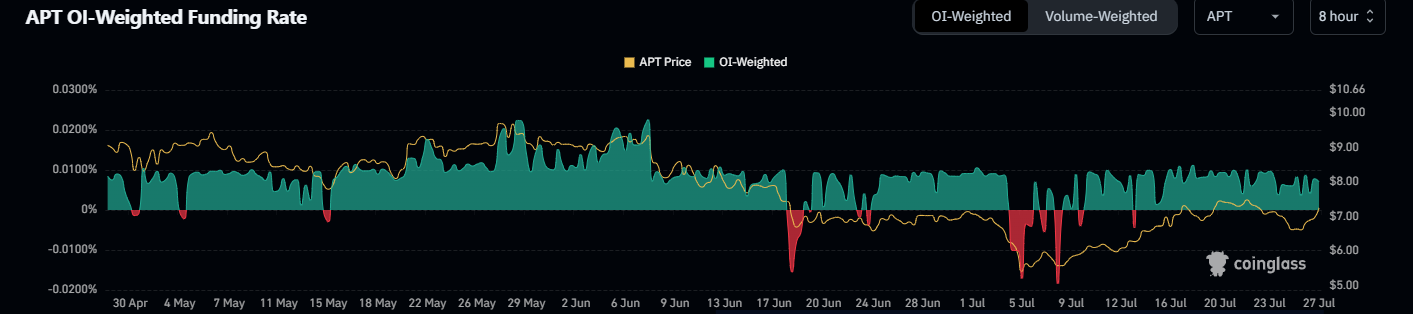

Funding Rate is on a Positive Note

Since 9 July, the funding rates have remained in green, directing a sustained buying pressure.

If the funding rate remained positive, it implied that buyers had outpaced the bears and that the uptrend was imminent.

The token’s funding rate was noted at 0.0078%, revealing a bullish stance.

@CryptoJules, in his X post, said that the APT has a strong potential to outperform ahead.

$APT macro potential pic.twitter.com/F6CcBhSev0

— Crypto Jules (@CryptoJules1) July 26, 2024

Decline In Popularity

Amidst the significant price recovery, the social dominance data witnessed an unfavorable move and dropped to the downside region.

It was around 0.013%, replicating the severe drop in online discussions among investors on media platforms.

Its development activity data observed a positive outlook, as the value stayed above the midline region. It pointed to a continuous development in the ecosystem.

If the token faced any rejection from the 100-day EMA, $7.0 and $6.20 would act as immediate support levels. However, if the token crosses the $8 mark on a closing basis, it may face the upside hurdle of $8.40, followed by $9 ahead.

Can the Aptos Price Reach the $10 Mark?

Aptos price climbed above the 20-day and 50-day EMAs and was poised for a significant breakout.

Once the token breaks and closes above the $8 mark, it might deliver a massive upside movement toward the $10 mark in the short term.

thecoinrepublic.com

thecoinrepublic.com