The crypto analytics firm Santiment outlined potentially bullish altcoins as digital asset markets ticked upwards on Friday.

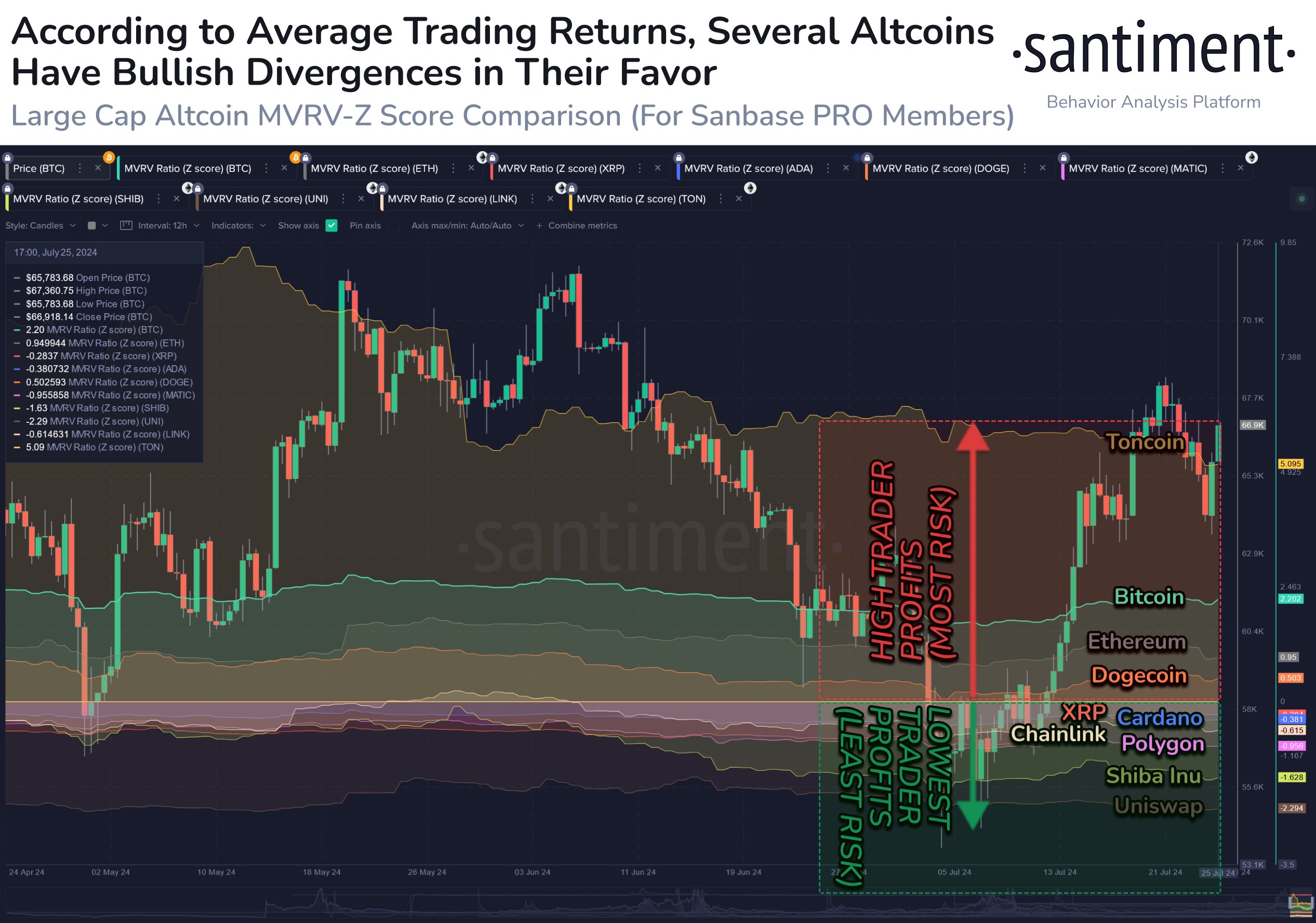

Santiment analyzes assets by their market value-to-realized-value (MVRV) Z-score, which aims to measure whether they are undervalued or overvalued.

Meanwhile, realized value records the price of each asset when it last moved and aims to gauge how many holders are in profit or at a loss.

Explains Santiment,

“If you believe markets are about to surge, history says that buying into assets that traders have experienced the most pain in have a greater probability of netting high returns for you.”

Santiment notes that high-pain assets with low MVRV Z-scores include the decentralized exchange (DEX) Uniswap (UNI), the memecoin Shiba Inu (SHIB), the blockchain scaling solution Polygon (MATIC), the decentralized oracle network Chainlink (LINK), the smart contract platform Cardano (ADA) and the payments altcoin XRP.

High-gain assets that are currently riskier buys include the layer-1 blockchain Toncoin (TON), Bitcoin (BTC), Ethereum (ETH) and top meme asset Dogecoin (DOGE).

Santiment doesn’t have MVRV data on Stellar (XLM), but the analytics firm also notes that the XRP competitor’s social volume and sentiment have been on the negative side, a “mildly bullish” sign for the asset.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com