In connection with the Bitcoin Ordinal, the cryptocurrency token ORDI has gained momentum and recovered by over 45% this month. This rise was realized when the general market sentiment increased, although the market itself recently declined.

At press time, the ORDI was trading at $38.44 with an intraday gain of 9.87%, signifying a bullish wave on the chart. It was ranked at 96 and has a market cap of $809.91 Million.

For the past few weeks, the ORDI was under bearish pressure as it retraced inside a falling channel. However, the correction wave ended, and signs of accumulation were noted on the chart.

Now near the $40 cluster, ORDI could breach the $45 soon. Still, the token was caged in a range and was poised for a breakout.

ORDI Token Traders Anticipate a Breakout

Amidst the market’s improved sentiments, the ORDI token has gained momentum could mark a big breakout. Its holders were anticipating a rise and eyeing it closely.

Price action shows that the token is on the brink of the 50-day EMA hurdle as it attempted to breach it. A short covering move would be triggered once it crosses the $42 mark, and the token could rally ahead.

The Relative Strength Index (RSI) curve is near 53. It is near the midline region, and conveyed a bullish stance on the chart.

ORDIUSDT gained %10.193 in 4 hour time frame!

— thegoldencrosser (@goldencrossertw) July 26, 2024

Signal: STRONG_BUY

Visit https://t.co/u74IHRk0bb for more info

#ORDI $ORDI pic.twitter.com/DIhTkMx7z7

Similarly, the CMF and MFI index guided a beginning of accumulation, and the token could trigger a short-term reversal ahead.

ORDI token Social Dominance Shows a Spike

On the social front, following the price rise, the speculative move was noted in the social dominance data. Also, a notable spike of over 23% was noted.

The value rose to 0.112%, implying an increase in the media buzz and chatter for ORDI in the recent hours.

Notably, the percentage of stablecoin total supply held by whales’ activity noted a consistent rise. The rise was noted at 55.68, signifying a steady bullish belief among the holders.

Funding Rate Shifted Positive

Evidence for this could be gleaned from inspection of its Future market activity readings. The funding rate across several exchanges noted a promising change and looks.

Funding rates are applied in perpetual futures contracts to ensure the future price is always near the spot price. A positive funding rate means that the asset stays in demand, especially for those in a long position.

At press time, the token’s funding rate was 0.0064%, conveying a bullish stance that buyers could dominate ahead.

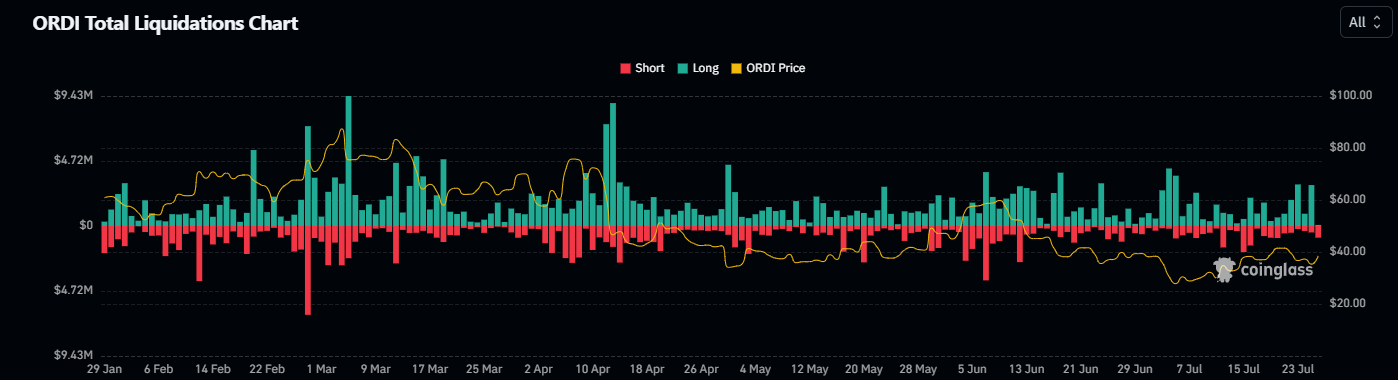

Sharp Surge In Short Liquidations

At the time of writing, the short liquidations were at $844.20k, whereas the long liquidations were at $77k.

The long traders have witnessed a decline in liquidations, and the token’s price triggered a rise. This signified a bullish conviction that buyers have outpaced the sellers.

Notably, its Open Interest data rose over 10.68% to $160.51 Million, signifying fresh long buildup activity in the past 24 hours. The immediate support levels for ORDI are $33 and $28, whereas the key upside hurdles are $43 and $50.

ORDI is trading near the cluster of $40 could break out with momentum. Once it escapes the channel’s trajectory hurdle of $43, it may reach the $50 mark and can go toward the $60 mark quickly.

thecoinrepublic.com

thecoinrepublic.com