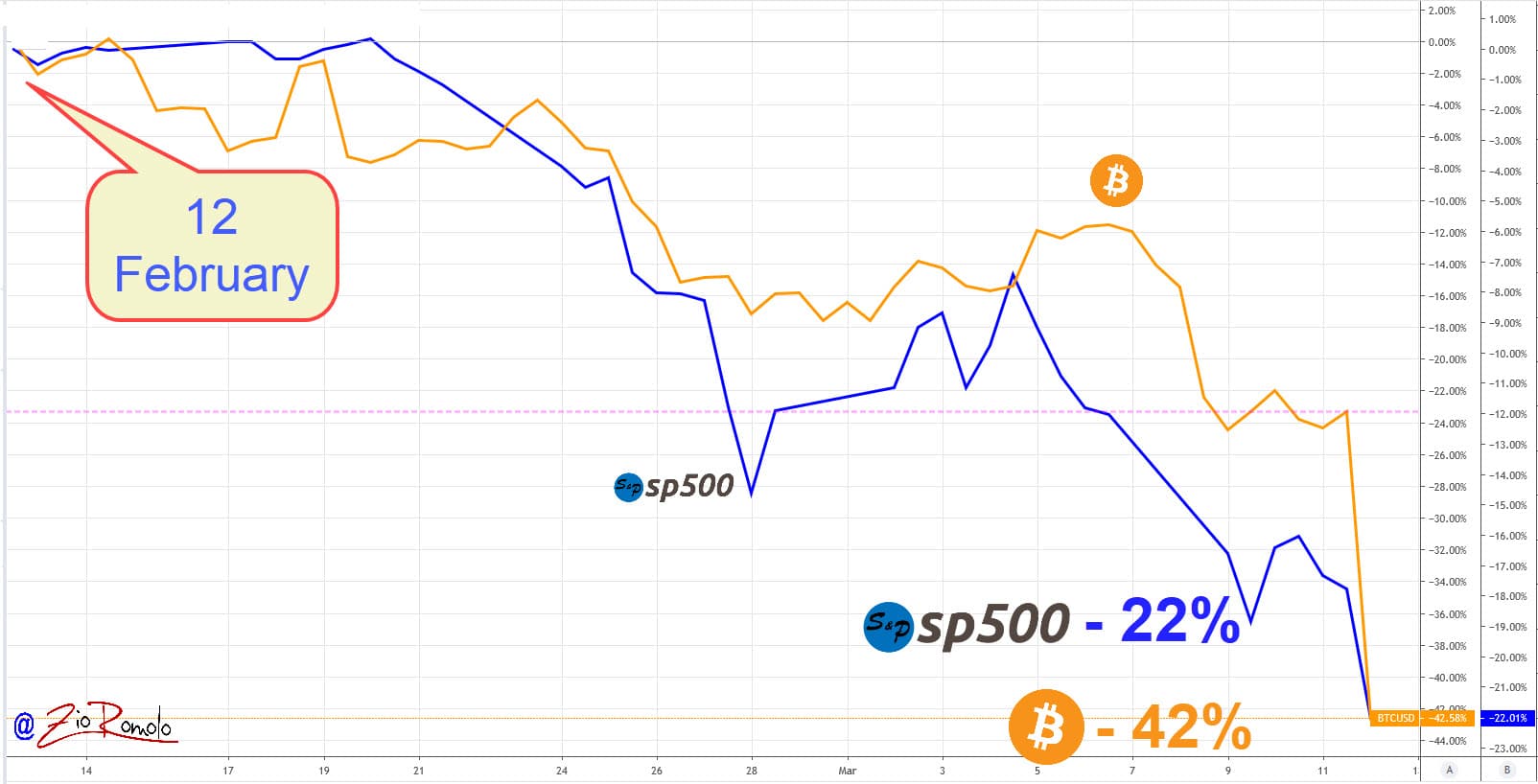

When comparing the graph of Bitcoin and the S&P 500 since mid-February it looks like a specular graph. A similar trend was characterizing Bitcoin and gold from mid-December until a few weeks ago.

However, looking now at the chart of Bitcoin and S&P 500 it can be seen that in this last month the two markets are highly correlated.

This is an indication that does not look good in the coming weeks but, as Bitcoin has accustomed us in the past, it is very likely that this correlation will be lacking.

At such a difficult time, with the tensions in the financial markets and from a psychological point of view, the expectation of the halving that is getting closer and closer seems to be overshadowed.

In the case of cryptocurrencies, the work done in recent months has been totally cancelled out and doubts are beginning to arise about the sector, which is in an equally delicate phase as the world’s stock markets, where further lows and sinkings are currently being recorded.

On the European markets, the Dax, Eurostoxx and Ftsi Mib indices continue to show double-digit declines of 10%.

The fall in the US stock indices today is blocking trading, which will most likely be suspended tomorrow for an indefinite period to deal with a pandemic crisis that has now reached the United States.

This will necessitate actions such as those taken in Europe leading to the freezing of US stock market indices such as the CME, the CBOE and most likely the NASDAQ.

The only asset that is proving to be an anticoronavirus is gold, which, although shrinking, continues to remain at the highs of recent years, highs recently updated.

Bitcoin and cryptocurrencies were expected to behave differently. What is certain is that this movement has definitely cancelled all the rises that have accompanied us until a few days ago and for much of the quarter that is about to end so excitingly.

All is not lost, but we will have to reckon with a global market where all indices are set downwards.

en.cryptonomist.ch

en.cryptonomist.ch