Cryptocurrency payments and utility are again getting the spotlight as cryptocurrencies get mainstream attention with Bitcoin ($BTC) and Ethereum ($ETH) exchange-traded funds (ETFs) and growing political relevance in the U.S. presidential elections.

According to CoinGate‘s crypto payments report published on July 25, three cryptocurrencies gained prominence in 2024 Q2. Notably, Solana (SOL) has seen “immediate popularity” since integration, while Litecoin ($LTC) and Shiba Inu ($SHIB) have experienced remarkable growth.

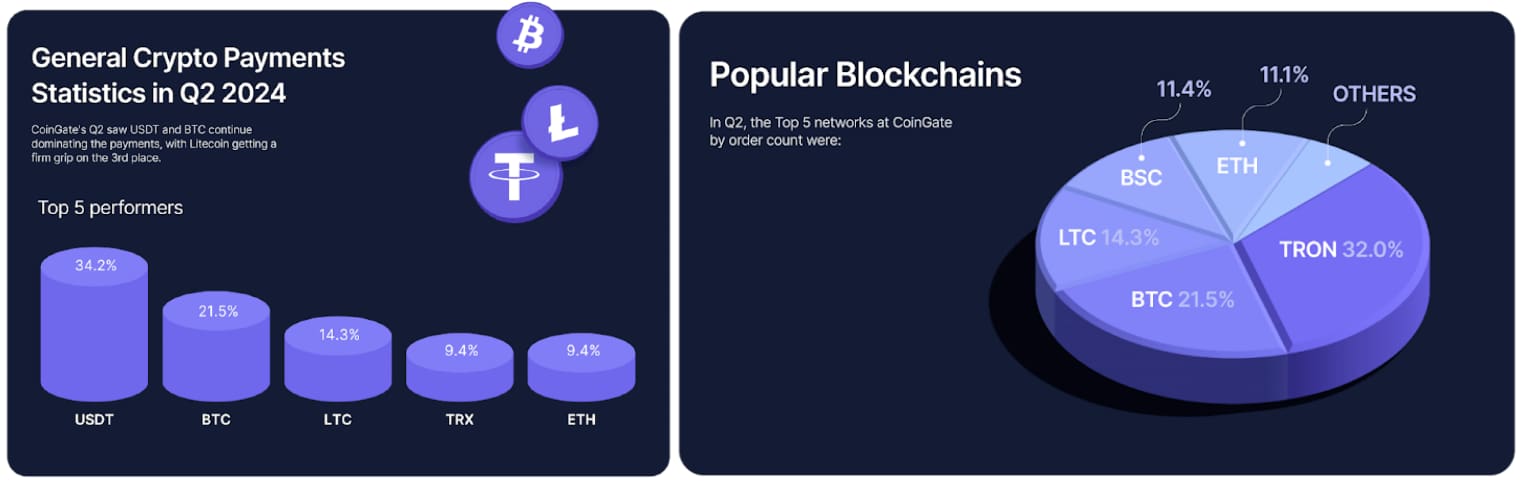

Nevertheless, Tether USD stablecoin ($USDT) continues to lead payment preferences, primarily on the Tron (TRX) network. Bitcoin is the second-most-used cryptocurrency on CoinGate, with significant growth for payments using the Lightning Network.

As reported, users seem to favor the most efficient payment methods, given the rising popularity of faster and cheaper networks. For this study, CoinGate considered 404,674 orders made in 2024’s second quarter – a 25% increase from last year.

Solana, Litecoin, and $SHIB payments growth on CoinGate

CoinGate’s report explained that Solana saw an “immediate popularity” since its recent integration in May. Since then, the Solana network has processed two times more Circle USD stablecoin ($USDC) payments than the $BNB Chain ($BNB).

Moreover, payments using $LTC grew by 67% year-over-year, with Alan Austin attributing the growth to Litecoin’s transaction experience.

Similar to the two others, $SHIB payments started surging after CoinGate added support to Shiba Inu on the BSC and Polygon (MATIC) networks—again, users favoring chains with faster finality and lower transaction fees. Overall, $SHIB payments grew 76% following the integration.

Lightning Network $BTC payments have increased over Bitcoin’s mainnet payments for the same reason, according to CoinGate.

$USDT leads the pack: Stablecoins in infrastructure blockchains

However, users seem to favor using U.S. dollar-pegged stablecoins instead of sovereign currencies like $BTC, $LTC, and $ETH.

$USDT still “leads the pack,” as reported, but CoinGate expects $USDC to increase its market share following regulatory developments. Interestingly, Circle’s stablecoin grew by 24% from 2024 Q1, accumulating an “impressive” 94% surge year over year (YoY).

Additionally, the decentralized stablecoin DAI has seen a 9% increase quarter-over-quarter and 37% since 2023 Q2.

Tron is by far the most used network for stablecoins, especially $USDT, dominating 70.46% of all Tether payments.

As things develop, the cryptocurrency market turns its eyes to projects that shine through utility, meeting real-world demands. Data payments can act as leading indicators of this utility but could also be influenced by the lack of better integrations, as evidenced by the “immediate popularity” of efficient networks after implementation.

Therefore, services like CoinGate must closely follow technological innovations to meet their customer needs. For that, they must adopt cryptocurrencies with better scalability, lower transaction fees, faster finality, and higher security.

In the meantime, these leading cryptocurrencies can attract investors’ attention with promising results as demand grows, potentially driving prices upward.

finbold.com

finbold.com