At Bitcoin Market Journal, we invest in crypto tokens as if they were stocks. While there are important differences between the two, we analyze crypto “companies” like traditional companies, and diversify our investments with a mix of both. More on our approach here.

Key Takeaways:

- BNB’s strong market cap continues to reflect investor confidence and underscores the platform’s pivotal role as the leading crypto exchange.

- Despite regulatory challenges, BNB maintains a solid user base, and Binance has actively strengthened its compliance measures to mitigate future regulatory risks.

- BNB’s central role in Binance’s expanding ecosystem positions it to capitalize on the company’s ongoing success.

Origin Story

Stories matter. They’re how investors remember the details of a crypto company.

Binance was launched in 2017, but its story begins earlier with its creator, Changpeng Zhao, also known as CZ. CZ was born in China and moved to Canada at the age of 12. His interest in technology began during his teenage years, and after studying computer science, he worked at Bloomberg starting in 2001. In 2005, CZ ventured into entrepreneurship, founding an IT startup that developed trading systems for stock brokers.

CZ’s journey into cryptocurrency began in 2013 when he discovered bitcoin during a poker game. His involvement in blockchain and cryptocurrencies deepened, even leading him to sell his apartment and invest the proceeds in bitcoin. Fast forward to 2017: CZ founded Binance and launched BNB through an initial coin offering (ICO). The coin was initially designed for discounted trading fees on the exchange, but BNB quickly became integral to various aspects of the Binance platform and ecosystem.

By 2018, just six months after its launch, Binance had become the world’s largest cryptocurrency exchange by trading volume.

Binance continued its global expansion, which attracted scrutiny and regulatory actions from authorities worldwide. Several countries issued warnings or imposed restrictions on Binance’s operations.

In 2023, Binance encountered its most significant regulatory hurdle when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the company and CZ. The SEC’s allegations included engaging in unregistered securities sales, mishandling investor funds, artificially inflating trading volumes, failing to restrict U.S. customers, and misleading investors about market surveillance controls.

As a result of these challenges, CZ stepped down as CEO of Binance, replaced with Richard Teng (see our guide on The Future of Binance under Richard Teng). The company responded by enhancing its compliance programs, collaborating with U.S. agencies, and implementing robust AML/KYC measures.

Key Fundamental Data

Metrics matter. We focus on returning users and real revenues of a crypto company.

- Daily Active Users (DAU): According to TokenTerminal, BNB currently has an average of about 830k daily active users, a 39% decrease year over year. Despite this decline, its DAU remains far ahead of major cryptocurrencies like bitcoin (380k DAU) and Ethereum (432k DAU).

BNB user numbers can see significant spikes during bull markets.

- Fees and Revenues: Binance has a steady and sustainable revenue model whereby most of its income comes from transaction fees. Former Binance CEO Changpeng Zhao revealed in 2022 that transaction fees account for 90% of the company’s earnings. These transaction fees include purchase fees (which vary depending on the method of payment), trading fees, and withdrawal fees.

Just as users jump during bull markets, so do revenues.

Market Cap: BNB stands as the largest exchange token by market capitalization, with over $77 billion invested in the token. This places it behind only BTC, ETH, and USDT in terms of overall market cap. Since 2023, its market cap has more than doubled, significantly outpacing other exchange tokens like LEO ($5.2 billion), CRO ($2.3 billion), and OKB ($2.2 billion).

BNBs market cap has grown significantly in 2024, making it the 4th largest crypto by market cap.

Market Analysis

The market matters: how big is it, how fast is it growing, and who are the customers?

Problem that it solves: Binance addresses key crypto market needs such as liquidity, access to diverse cryptocurrencies, user-friendly interfaces, and innovative financial products. It offers products catering to everyone from beginning investors and experienced traders, including futures trading, staking, and savings accounts.

Customers: Binance serves over 200 million users, with users that are primarily between the ages of 25 and 34 years old. Over half are college educated, and the overwhelming majority (95%) are male. The majority are also institutional investors, with Binance reporting that 100 million of its 130 million user base were institutional users as of late 2022. According to Binance Research in 2021, 48% of users were hobbyists, while 15% said trading was their main source of income. Binance covers over 180 countries, with Russia and Turkey being the largest.

Value creation: Adopting Binance provides users with high liquidity and access to a wide range of cryptocurrencies. Additionally, participation in financial products like futures trading, staking, and DeFi opportunities offers potential additional income streams.

Market structure: The crypto exchange space is already relatively mature, with Binance establishing itself as the clear leader, boasting the highest trading volumes and global popularity. Binance’s annual revenue in 2022 was $12 billion, compared to $3 billion for its rival Coinbase.

Market size: The potential market for centralized crypto exchanges like Binance is considered significant, as they serve as an entry point for many users into the crypto industry. As adoption of cryptocurrencies continues to grow globally, Binance stands to benefit from its established popularity and widespread user base.

Regulatory risks: Binance, as a leading player with substantial market influence, is particularly susceptible to regulatory scrutiny. The U.S. SEC has filed a lawsuit against Binance, alleging regulatory violations and raising concerns about whether BNB could be considered a security.

Our analysts rated BNB a 3.8 out of 5 for its market position. Download the complete scorecard here.

Competitive Advantage

How big is the company moat? Can they defend against competitors?

Technology/blockchain platform: BNB was originally built on Ethereum but now runs on Binance’s own blockchain, BNB Smart Chain (BSC), which was launched in 2018. The chain is now the third largest by Total Value Locked (TVL) with $4.4 billion locked.

Lead time advantage: As a crypto exchange, Binance is not the first; in fact, it was launched almost eight years after bitcoin was created. Still, Binance quickly grew to be the biggest exchange and has held that position ever since.

Contacts and networks: As one of the biggest crypto companies in the world, it's safe to say that Binance has access to key players in the industry. The company has been making notable appointments and landed massive partnerships.

Our analysts rated BNB a 4.3 out of 5 for competitive advantage. Download the complete scorecard here.

Management Team

Does the team have the experience, intelligence, and integrity to make the company great?

Entrepreneurial team: Binance has an excellent leadership and entrepreneurial team. The team is currently led by Richard Teng, who contributed to Binance’s success as the CEO of Binance Singapore and in other roles within the company. Prior to Binance, he held positions as a regulator in various financial companies.

Industry/technical experience: It’s fair to say that the team has the required industrial experience. They quickly helped grow Binance to become the largest crypto exchange and have maintained that position over the years.

Integrity: The SEC's lawsuit against Binance has raised concerns about the company's compliance with regulatory standards and the integrity of its business practices.

Our analysts rated BNB a 4 out of 5 for the management team. Download the complete scorecard here.

Token Mechanics

Is the token design favorable to long-term investors?

Is a token necessary? BNB is essential to the Binance ecosystem. In addition to providing discounts and incentives to exchange users, it has been integrated into Binance’s chain ecosystem (BSC chain) where it serves as the utility token.

Value added: BNB offers more utility than a typical exchange token, as it has been integrated into the broader Binance ecosystem.

Decentralized: Binance is a centralized company, though some of its products (like Binance Smart Chain) have some level of decentralization. However, its financial products are centralized.

Token supply: BNB had an initial token supply of 200 million tokens, which now sits at 147,583,017 as Binance burns BNB tokens quarterly.

Public exchange: BNB is listed on major exchanges such as Binance, KuCoin, and OKX.

MVP: Binance, along with its BNB token, has been operational since 2017.

Our analysts rated BNB a 4 out of 5 for token mechanics. Download the complete scorecard here.

User Adoption

How easy will it be for the company to grow users?

Technical Difficulty: Binance is very user-friendly and accessible in many countries. This has positioned it as the go-to platform for both beginners and experienced crypto users worldwide. Additionally, Binance attracts more users by running massive marketing campaigns and partnering with celebrities with millions of followers.

Halo Effect: BNB has a strong halo effect as it is closely associated with its creator, Binance. The coin is now an integral part of Binance’s ecosystem.

Buzz: BNB generates a significant amount of buzz and has an impressive social media following with over 11.8 million Twitter followers (almost double that of its rival Coinbase). It’s also doing well on Reddit with over 960k members on its subreddit.

Our analysts rated BNB a 4.3 out of 5 for buzz. Download the complete scorecard here.

Potential Risks

What risk factors might cause intelligent investors to stay away?

Team: In terms of industry experience, there’s no question that Binance has a capable team that will continue to contribute to its success. However, the team’s integrity has been questioned after the SEC in 2023 accused Binance and its former CEO Changpeng Zhao of mishandling customer funds to “enrich themselves while placing investors’ assets at significant risk.”

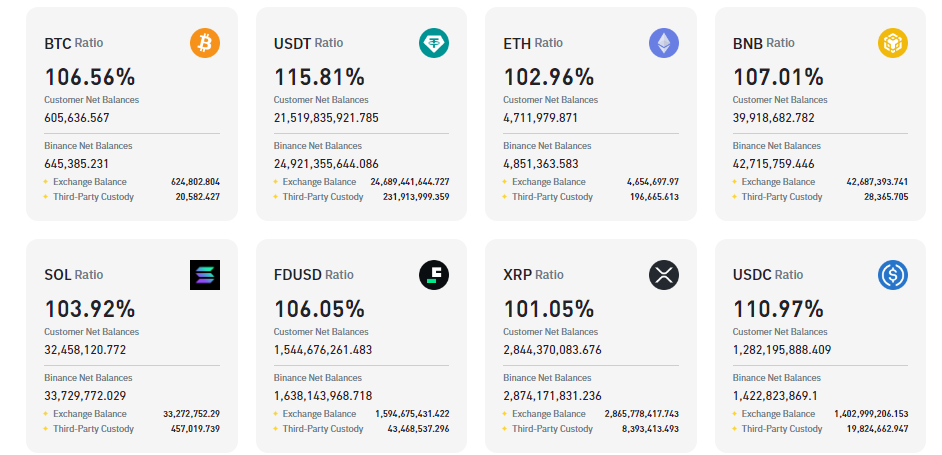

Financial: According to Binance’s proof of reserves reports, customer assets held in the exchange are fully backed, allowing the exchange to operate comfortably.

Regulatory: Binance’s regulatory risk has always been high, particularly due to its size. As mentioned, the company has already been sued by the SEC, which alleged that its token, BNB, is a security.

Smart Contract: Binance smart contracts have been audited by reputable firms like Hacken and Certik. Additionally, the company maintains a bug bounty that offers up to $100k for reporting bugs and vulnerabilities. The company and its products are battle-tested, having been around for roughly 7 years and having withstood hacks, crises (like exchange collapses), and its own regulatory issues.

Traction: Binance is doing very well in attracting users. Its blockchain, for one, records an impressive 800k users daily. The same goes for its platform and even its social media pages, as it holds the place as the most followed crypto project in the industry.

Behavioral: Binance has grown to be one of the most influential crypto projects in the world. Many investors choose to invest in BNB likely because they believe that the project will continue to be a significant part of the crypto industry in the future and not out of greed.

Our analysts rated BNB a 2 out of 5 for risk. (Note: for our risk ratings, lower = better.) Download the risk scorecard here.

Investor Takeaway

Binance enjoys a substantial user base and has developed a diverse ecosystem. Plus, its reliance on transaction fees provides a steady and scalable revenue stream that grows with increased trading volume. BNB, integral to Binance's ecosystem, will likely continue to benefit from the company's growth.

However, Binance continues to face significant regulatory scrutiny from authorities worldwide. Such regulatory challenges pose substantial risks, as they can lead to operational restrictions, financial penalties, reputational damage, and ultimately affect BNB's value.

Overall, our analysts rate BNB 4 out of 5, based on its robust market presence and proven experience in the industry, despite the hurdles it has faced. Download the complete scorecard here.

This analysis is to help make you a better-informed investor; it is not financial advice. Please use this as inspiration to do your own research, because the future may look different than the past. All investing involves risk; see our investing approach for how we manage risk through diversification. Never invest more than you’re willing to lose, and see losses as learning.

bitcoinmarketjournal.com

bitcoinmarketjournal.com