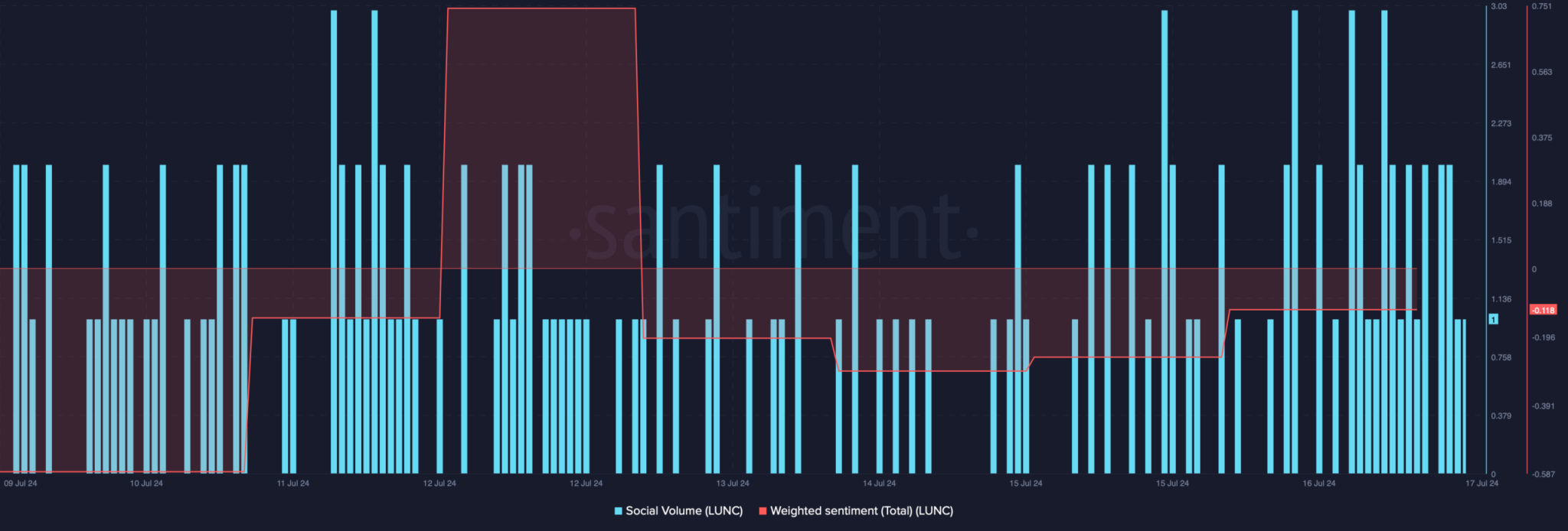

- Despite increased social volume indicating growing popularity for Terra classic LUNC, on-chain data revealed that the weighted sentiment remained negative, reflecting bearish market sentiment.

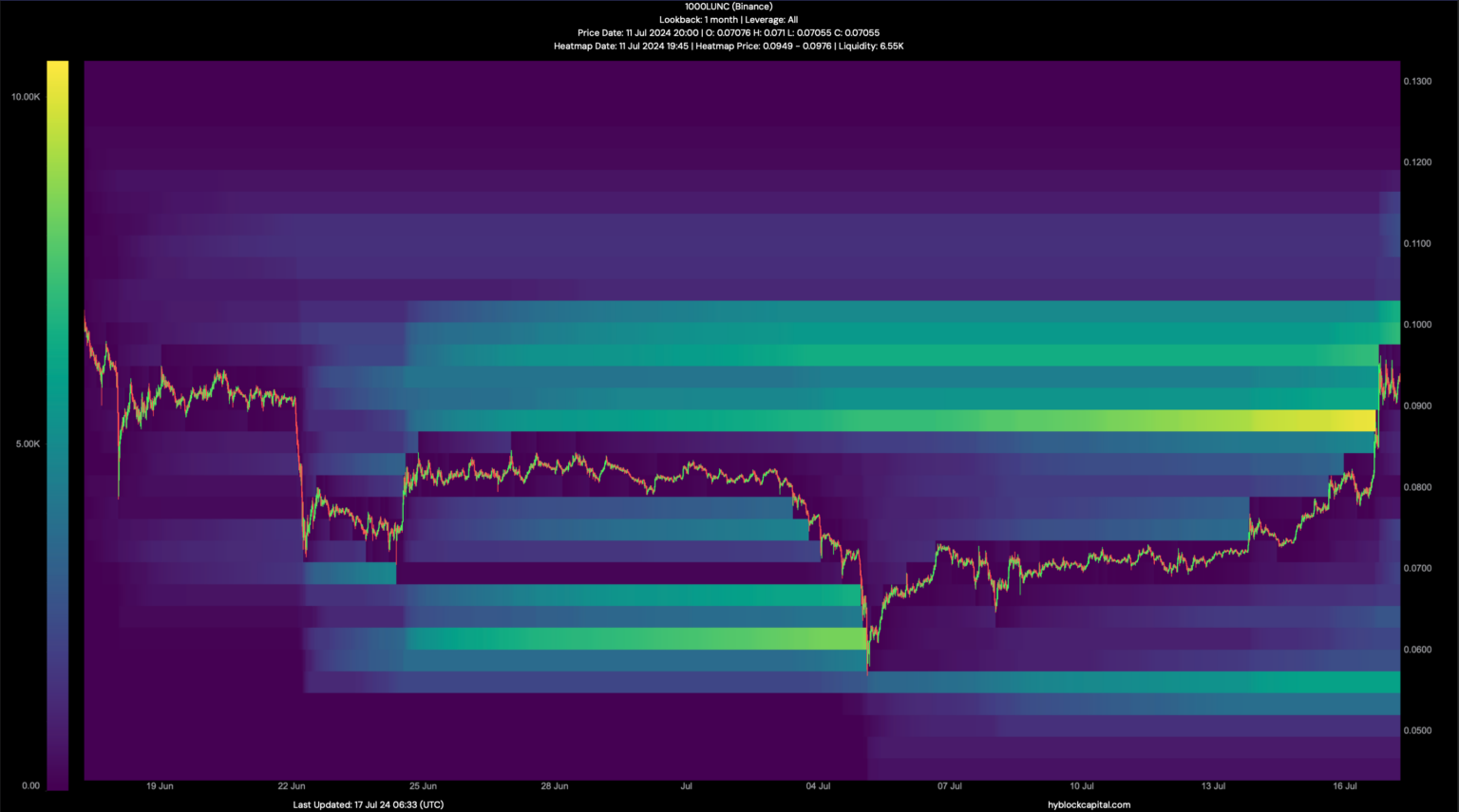

- Technical indicators like MACD showed a bullish advantage, while the RSI’s slight downtick and significant liquidations at $0.000086 indicated a possible price correction.

LUNC, the native cryptocurrency of the Terra Classic ecosystem, has been in the limelight with 30% gains over the past week. However, after facing rejection at $0.000095 earlier on Wednesday, the LUNC price has been showing sideways movement. As of press time, LUNC is trading 3.7% down at $0.00008713 with a market cap of $474 million.

The derivatives market appeared optimistic. According to Coinglass’ data, LUNC’s Long/Short Ratio improved, indicating more long positions than short at press time. This suggested that investors were anticipating a price increase for the token in the coming days.

How Long Will Terra Classic (LUNC) Rally Last?

Terra Classic’s daily chart shows that LUNC was testing a crucial resistance level at press time. For Terra Classic to sustain its bull rally, it must surpass this mark. The MACD technical indicator showed a clear bullish advantage in the market. However, the Relative Strength Index (RSI) registered a slight downtick, which could pose potential challenges.

Furthermore, the liquidation heatmap also shows that a large number of LUNC got liquidated when its price touched $0.000086. This suggested a potential price correction in the coming days. If this occurs, LUNC may enter a consolidation phase.

Last week, CNF reported that Terra Classic is preparing for a split login update. This might bring hope to investors going ahead.

Terra Luna Shows Bullish Action

Over the last week, LUNC’s sister token Terra LUNA has also shown bullish movement gaining more than 18%. As of press time, Terra LUNA is trading at $0.4389 with a market cap of $350 million and daily trading volumes skyrocketing by 100%.

In a major development for Terra Luna, the bankruptcy court has issued a new order authorizing several key actions for Terraform Lab (TFL). These include reopening the Shuttle Bridge for wrapped asset redemptions and implementing a plan to transfer and burn a significant amount of LUNA tokens.

1/ Dear Terra community,

We would like to inform you about a recent bankruptcy court order in TFL’s chapter 11 case authorizing TFL to do the following: 1) Reopen the Shuttle bridge for the redemption of wrapped assets on Terra Classic; 2) Undelegate & burn the 150M LUNA…

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) July 19, 2024

The court’s order allows TFL to reopen the Shuttle Bridge, a platform used for redeeming wrapped assets on Terra Classic. This will enable users to access their assets through a new, more secure interface. However, in the latest development, Terral Classic had denied any merger plans with LUNA, per the CNF update.

The Shuttle Bridge will remain operational for up to 30 days after TFL’s Chapter 11 plan becomes effective. After this period, the bridge will be permanently shut down, and any remaining assets will be burned. The Chapter 11 plan has not yet been approved and is expected to take effect no earlier than late September 2024.