$NEO displayed bullish presence over the past two weeks, when BTC sustained, and the crypto-verse turned green. It continued its upward trajectory from a pre-marked, historically proven strong demand zone of $9.0. It is up 37% from the demand zone.

$NEO ">

$NEO ">

Meanwhile, this growth has placed $NEO in the top 100 global crypto-list at 85th position in terms of market cap. Its market cap reached $821.95 Million by July 5th, 2024, from $605.74 Million.

As per Messari website, the market dominance of $NEO stands at 0.03. Likewise, the 24-hour volume has also grown by 56.99%, where the total volume on all tradeable platforms amounted to $47.515 Million.

Additionally, the liquidity in $NEO is weak; as of writing, the 24-hour volume-to-market cap ratio stands at 5.63%.

Thus, with a low ratio, assets appear less liquid and most likely present less stable markets. So, investors and traders must proceed with caution (DYOR).

Moreover, per the coin cap website, the top 10 holders’ addresses hold most of the supply in circulation, 70.53 Million. At the same time, the capped total supply stands at 100 Million $NEO.

As per the rich list, the total $NEO holders are 135.35K, and the top 10 holders’ addresses hold 88.77% of the circulation.

What Was the Highest and Lowest $NEO Ever Reached?

According to Tradingview, $NEO was 2250% higher than its all-time low price. The low was at $0.0739, registered on February 1st, 2017.

Likewise, the all-time high was registered on January 1st, 2018, when the price peaked at $194.91. Comparatively, from the A-T-H level, the price as of writing is nearly 94% down.

Digging Deeper On-Chain Analysis of $NEO

The social volume of $NEO displayed a positive trajectory, but there was also an uptick in active users on the social platforms. This reflected how much it is talked about, valued, and sought after by the communities.

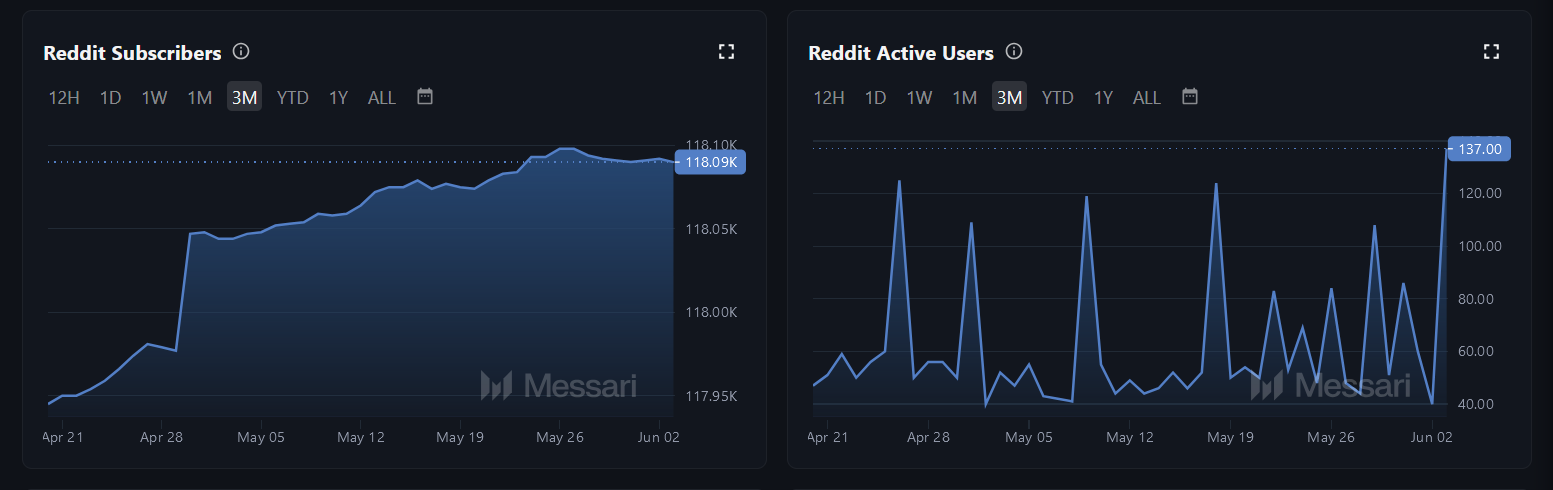

As per Messari, Reddit subscribers on the $NEO asset have drastically surged in the past three months. The Reddit subscribers have reached a number of 118.09K. Meanwhile, the number of Reddit active users for $NEO is also up (137).

$NEO ">

$NEO ">

Generally, a rise in these social metrics highlights the increasing user participation that portrays demand for the crypto, and it leaves an optimistic impact on the price.

Moreover, the total fees paid to miners in the past two weeks have also increased, while the active addresses in the network were at 60.

Per its network activity, the transaction volume peaked at $2.0 Million this week. The adjusted transaction volume after cutting down noise peaked at $1.88 Million. The transaction volume was $400K, and the adjusted transaction volume was $333K.

Finding What $NEO Price Structure Could Display Next?

$NEO, over the monthly chart, formed a seamless structure from 2017 to 2024 (present). It showed that the price had peaked 2 times majorly. The first main peak was January 1st, 2018, when the price gained 122K% to $194.91.

Thereon, the abrupt selling pressure took the price lower. The price consolidated for the next 792 days, shot up 800% to $136.98 (second peak). The second peak also failed to stabilize, and the price went sideways again, and it has already been 761 days as of writing.

In the broader picture, a declining trendline resistance has been playing. If a rally breaks out over the month, the price could reach the $80 mark, registering a third peak (almost 8x the current price).

The daily chart shows that the price could rise out of a falling wedge. Indicators have been bullish, and the nearest resistance are at $14 and $17. However, breaking $10 would open up $NEO’s path to $8.

$NEO surged 37% over the past two weeks. Its market cap reached $821.95 Million. Social volume and network activity are on the rise. The price could reach $80 if it breaks out of monthly resistance.

thecoinrepublic.com

thecoinrepublic.com