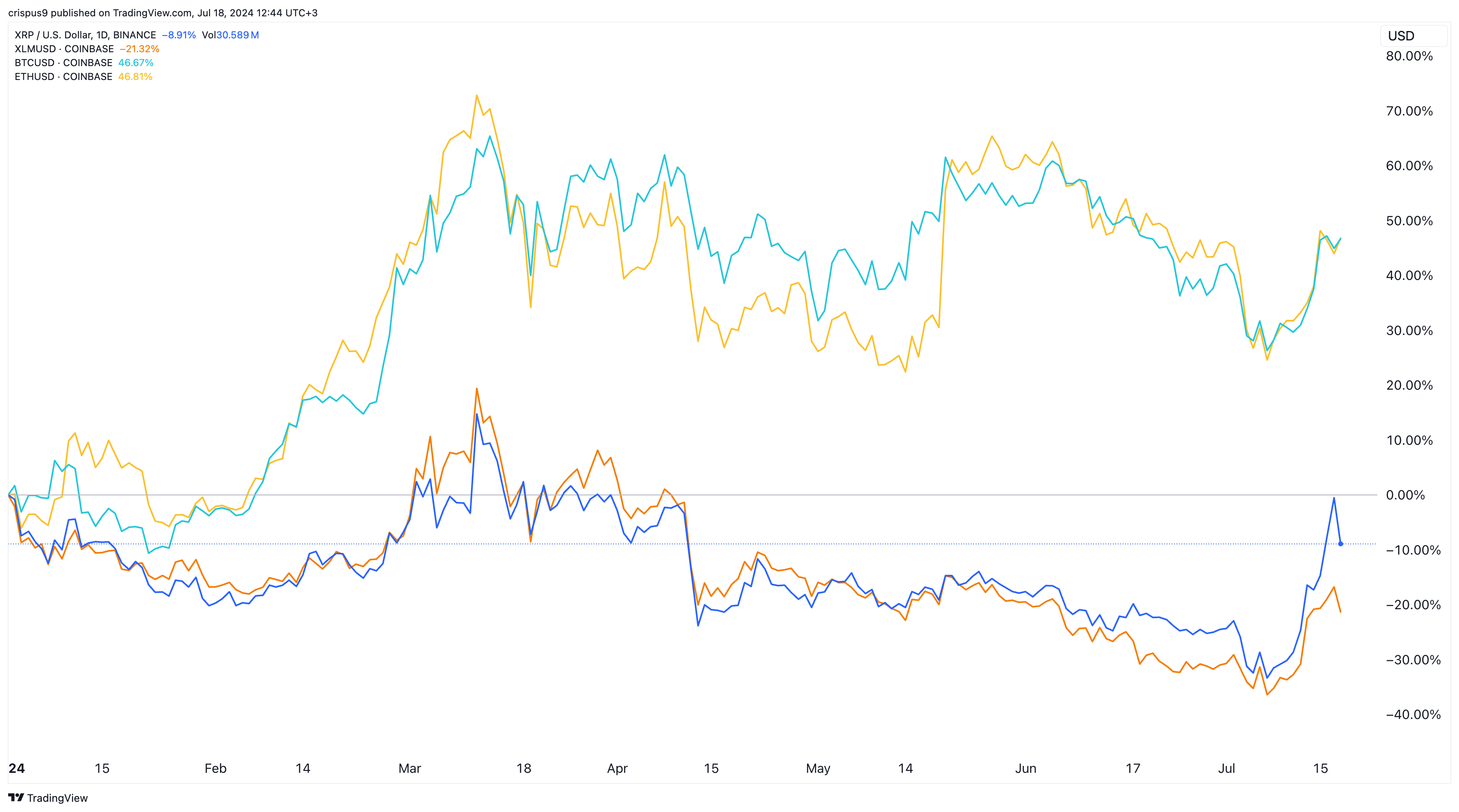

Stellar Lumens (XLM) and Ripple (XRP) prices have underperformed Bitcoin and Ethereum this year. They have all dropped in 2024 while BTC and ETH have risen by almost 50%. Stellar has been the worst-performing tokens of the four as it dropped by over 20%.

XRP vs XLM vs BTC vs ETH

Ripple and Stellar are facing headwinds

Stellar and Ripple are the two biggest blockchain companies that focus on the cross-border payment industry.

They were both formed to make it easier and cheaper for people to send and receive funds internationally. Indeed, Stellar was established by Jed McCaleb, who was a founding member of Ripple Labs.

The two companies use two key approaches to simplify the remittances industry. Ripple partners with banks and other technology companies and payment companies to help them handle remittances well.

It uses the RippleNet, which is based on the concept of on-demand liquidity (ODL). In this, a sender initiates a payment on the network and the funds are converted into XRP using a crypto exchange.

After this, the XRP is sent across the XRP ledger, a process that takes less than 5 seconds and is then converted to the local currency. The funds are then delivered to the customer.

Ripple’s benefit is that its transactions are often fast and eliminate pre-funded accounts in local currencies.

Over the years, Ripple has established relationships with several companies in the financial industry like IndusInd Bank, Banco Rendimento, Palau, and Tranglo. However, it has struggled to reach agreements with big banks and remittance companies.

Stellar focuses on stablecoins

Stellar, on the other hand, is useful in the payments industry because of its relationship with Circle, the creator of USD Coin (USDC), the second-biggest stablecoin in the world.

USDC on Stellar is known for its low transaction costs and fast speed. Data on Circle’s website shows that the network has over $220 million in USDC tokens. The other top blockchains in terms of USDC are Ethereum, Arbitrum, Base, Near, Noble, and Polygon.

Stellar has worked to build its USDC ecosystem in the payments industry. The most important collaboration is with MoneyGram, one of the oldest companies in the industry.

This collaboration ensures that users can send USDC tokens and withdraw them in thousands of MoneyGram’s locations. This is a highly useful solution that is at the intersection of fiat and crypto.

Stellar has also collaborated with other large companies. In 2023, it partnered with Franklin Templeton to create the Franklin OnChain US Government Money Fund which has almost $500 million in funds. Stellar is used as the transfer agent for this fund.

Stellar has also partnered with WisdomTree, a leading company with over $100 billion in assets under management. It has been used to tokenize 13 digital funds run by the company.

Plans for the future

Stellar and Ripple have pivoted their businesses in the past few months. Ripple has launched its blockchain, which it hopes will become a leading player in the development of development of decentralized applications (dApps).

Also, the company is working on a stablecoin that will be backed 1:1 by the US dollar. Ripple hopes that this stablecoin will help it to grow its payment infrastructure. A stablecoin is also one of the easiest ways to make money. In addition to transaction costs, issuers make money by investing the fiat currencies in safe assets like bonds.

The challenge that Ripple faces is that the stablecoin industry is now saturated and achieving success will be tough. For example, while PayPal is one of the biggest fintech companies in the world, PYPL, its stablecoin, has only attracted $586 million in assets.

Stellar is also seeing to grow its ecosystem. It recently launched Soroban, a blockchain it hopes will become the best platform for developers.

Like Ripple, the challenge is that the blockchain industry is now dominated by many layer-1 and layer-2 networks like Ethereum, Arbitrum, Base, and Tron.

Better buy between XRP and XLM?

So, which is the better buy between XRP and XLM tokens? As described above, the two cryptocurrencies have strong utilities in the financial services industry.

However, they are all facing substantial challenges as the tokenization and use of stablecoins in payments rise. While Stellar focuses on USD Coin, evidence is that Tether is the most popular stablecoin in the industry with billions of dollars in assets.

As also mentioned, it is still unclear whether their new initiatives will do well in the future. For example, Stellar’s Soroban has less than $11 million in assets. Including Franklin Templeton, Stellar has over $450 million in assets.

Therefore, I suspect that the two cryptocurrencies will continue to underperform Bitcoin and Ethereum in the near term. Given a chance to select between Stellar and Ripple, I would select Stellar because of the growing interest by developers as evidenced by the rising commits.

The post Stellar Lumens (XLM) vs Ripple (XRP): better crypto to buy? appeared first on Invezz

invezz.com

invezz.com